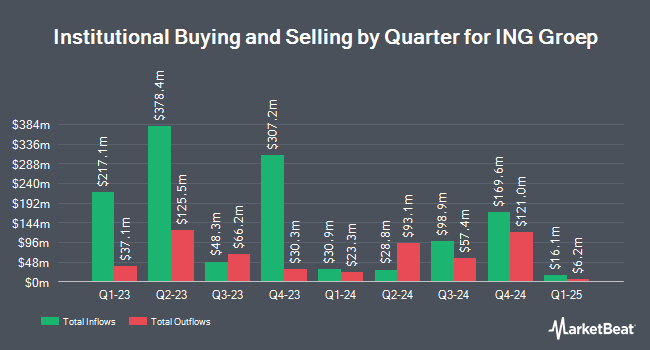

BNP Paribas Financial Markets decreased its stake in shares of ING Groep (NYSE:ING - Free Report) by 81.2% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 50,124 shares of the financial services provider's stock after selling 215,812 shares during the quarter. BNP Paribas Financial Markets' holdings in ING Groep were worth $910,000 as of its most recent SEC filing.

Several other large investors also recently added to or reduced their stakes in the stock. Natixis Advisors LLC increased its stake in shares of ING Groep by 71.3% during the third quarter. Natixis Advisors LLC now owns 3,306,798 shares of the financial services provider's stock valued at $60,051,000 after buying an additional 1,376,713 shares during the period. Mediolanum International Funds Ltd bought a new stake in shares of ING Groep in the 3rd quarter valued at about $7,972,000. Fisher Asset Management LLC lifted its position in shares of ING Groep by 0.6% in the 3rd quarter. Fisher Asset Management LLC now owns 68,451,083 shares of the financial services provider's stock worth $1,243,072,000 after purchasing an additional 429,562 shares during the period. Bank of New York Mellon Corp boosted its stake in shares of ING Groep by 150.1% during the second quarter. Bank of New York Mellon Corp now owns 599,012 shares of the financial services provider's stock valued at $10,267,000 after purchasing an additional 359,535 shares in the last quarter. Finally, Benson Investment Management Company Inc. purchased a new position in ING Groep during the third quarter valued at approximately $5,204,000. 4.49% of the stock is owned by hedge funds and other institutional investors.

ING Groep Stock Down 3.1 %

ING traded down $0.49 during trading on Thursday, hitting $15.28. The stock had a trading volume of 2,562,361 shares, compared to its average volume of 2,312,353. The stock has a 50 day simple moving average of $16.38 and a two-hundred day simple moving average of $17.24. The company has a market capitalization of $53.43 billion, a PE ratio of 7.07, a PEG ratio of 6.09 and a beta of 1.48. The company has a debt-to-equity ratio of 2.89, a quick ratio of 1.13 and a current ratio of 1.13. ING Groep has a twelve month low of $12.77 and a twelve month high of $18.72.

Wall Street Analysts Forecast Growth

A number of analysts have weighed in on ING shares. Barclays lowered ING Groep from an "overweight" rating to an "equal weight" rating in a report on Tuesday, October 22nd. Citigroup upgraded ING Groep to a "strong-buy" rating in a research note on Thursday, October 17th. Deutsche Bank Aktiengesellschaft downgraded ING Groep from a "buy" rating to a "hold" rating in a research report on Wednesday, October 9th. Finally, Morgan Stanley downgraded shares of ING Groep from an "overweight" rating to an "equal weight" rating in a report on Tuesday, November 26th.

View Our Latest Stock Report on ING Groep

ING Groep Profile

(

Free Report)

ING Groep N.V. provides various banking products and services in the Netherlands, Belgium, Germany, rest of Europe, and internationally. It operates through five segments: Retail Netherlands, Retail Belgium, Retail Germany, Retail Other, and Wholesale Banking. The company accepts current and savings accounts.

See Also

Before you consider ING Groep, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ING Groep wasn't on the list.

While ING Groep currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.