BNP Paribas Financial Markets trimmed its position in shares of Iovance Biotherapeutics, Inc. (NASDAQ:IOVA - Free Report) by 75.5% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 113,724 shares of the biotechnology company's stock after selling 350,328 shares during the period. BNP Paribas Financial Markets' holdings in Iovance Biotherapeutics were worth $1,068,000 at the end of the most recent reporting period.

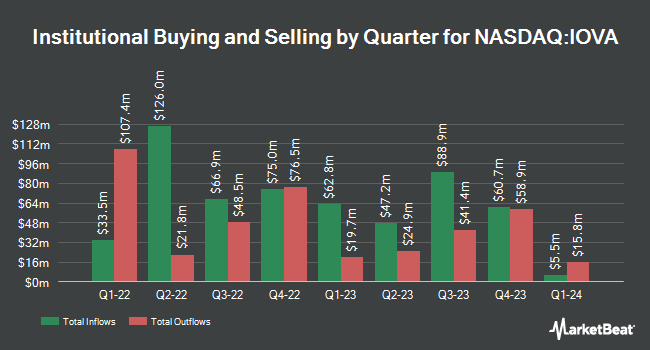

A number of other large investors also recently modified their holdings of the company. ORG Partners LLC purchased a new position in shares of Iovance Biotherapeutics in the second quarter valued at about $32,000. Quest Partners LLC lifted its position in shares of Iovance Biotherapeutics by 1,237.7% in the second quarter. Quest Partners LLC now owns 5,003 shares of the biotechnology company's stock valued at $40,000 after acquiring an additional 4,629 shares in the last quarter. EverSource Wealth Advisors LLC purchased a new position in shares of Iovance Biotherapeutics in the second quarter valued at about $58,000. Daiwa Securities Group Inc. lifted its position in shares of Iovance Biotherapeutics by 754.0% in the second quarter. Daiwa Securities Group Inc. now owns 8,813 shares of the biotechnology company's stock valued at $71,000 after acquiring an additional 7,781 shares in the last quarter. Finally, Abacus Planning Group Inc. purchased a new position in shares of Iovance Biotherapeutics in the second quarter valued at about $82,000. Hedge funds and other institutional investors own 77.03% of the company's stock.

Insider Buying and Selling

In other news, Director Ryan D. Maynard sold 50,000 shares of the stock in a transaction on Tuesday, November 12th. The stock was sold at an average price of $10.06, for a total transaction of $503,000.00. Following the completion of the sale, the director now owns 7,500 shares in the company, valued at approximately $75,450. This represents a 86.96 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. 12.10% of the stock is owned by insiders.

Iovance Biotherapeutics Stock Performance

IOVA stock traded down $0.01 during midday trading on Wednesday, reaching $8.58. 4,666,114 shares of the company traded hands, compared to its average volume of 7,197,723. The firm has a market capitalization of $2.62 billion, a price-to-earnings ratio of -5.77 and a beta of 0.55. The business has a 50 day moving average of $9.74 and a 200-day moving average of $9.38. Iovance Biotherapeutics, Inc. has a 52-week low of $6.00 and a 52-week high of $18.33.

Iovance Biotherapeutics (NASDAQ:IOVA - Get Free Report) last announced its quarterly earnings data on Thursday, November 7th. The biotechnology company reported ($0.28) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.31) by $0.03. Iovance Biotherapeutics had a negative return on equity of 58.43% and a negative net margin of 451.25%. The company had revenue of $58.56 million for the quarter, compared to analysts' expectations of $53.54 million. During the same quarter in the prior year, the firm earned ($0.46) earnings per share. Research analysts anticipate that Iovance Biotherapeutics, Inc. will post -1.23 earnings per share for the current year.

Analyst Ratings Changes

Several equities analysts have recently commented on IOVA shares. UBS Group started coverage on Iovance Biotherapeutics in a research report on Thursday, October 24th. They issued a "buy" rating and a $17.00 price objective on the stock. HC Wainwright restated a "buy" rating and issued a $32.00 price objective on shares of Iovance Biotherapeutics in a research report on Wednesday, November 6th. One research analyst has rated the stock with a sell rating, one has issued a hold rating and eight have assigned a buy rating to the company. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $22.33.

View Our Latest Research Report on Iovance Biotherapeutics

Iovance Biotherapeutics Company Profile

(

Free Report)

Iovance Biotherapeutics, Inc, a commercial-stage biotechnology company, develops and commercializes cell therapies using autologous tumor infiltrating lymphocyte for the treatment of metastatic melanoma and other solid tumor cancers in the United States. The company offers Amtagvi, a tumor-derived autologous T cell immunotherapy used to treat adult patients with unresectable or metastatic melanoma; and Proleukin, an interleukin-2 product for the treatment of patients with metastatic renal cell carcinoma.

Recommended Stories

Before you consider Iovance Biotherapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Iovance Biotherapeutics wasn't on the list.

While Iovance Biotherapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.