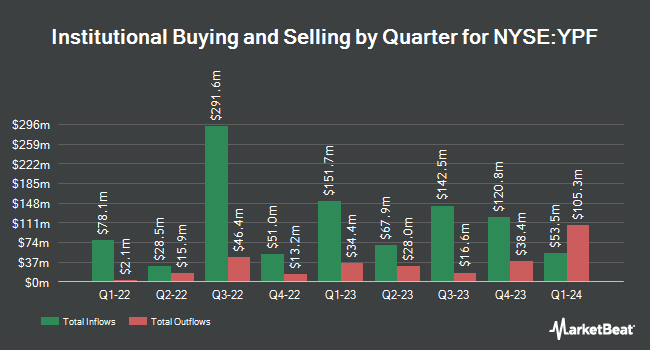

BNP Paribas Financial Markets trimmed its position in shares of YPF Sociedad Anónima (NYSE:YPF - Free Report) by 85.6% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 43,144 shares of the oil and gas exploration company's stock after selling 257,138 shares during the quarter. BNP Paribas Financial Markets' holdings in YPF Sociedad Anónima were worth $915,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other institutional investors have also recently made changes to their positions in the company. Banco Santander S.A. purchased a new position in YPF Sociedad Anónima during the second quarter worth about $270,000. Prospera Financial Services Inc lifted its position in shares of YPF Sociedad Anónima by 60.8% during the 3rd quarter. Prospera Financial Services Inc now owns 71,251 shares of the oil and gas exploration company's stock worth $1,511,000 after buying an additional 26,936 shares in the last quarter. Squarepoint Ops LLC purchased a new position in shares of YPF Sociedad Anónima in the 2nd quarter worth approximately $6,890,000. Mirabella Financial Services LLP grew its holdings in shares of YPF Sociedad Anónima by 59.7% in the third quarter. Mirabella Financial Services LLP now owns 128,483 shares of the oil and gas exploration company's stock valued at $2,725,000 after acquiring an additional 48,025 shares in the last quarter. Finally, Marshall Wace LLP increased its position in shares of YPF Sociedad Anónima by 6,194.9% during the second quarter. Marshall Wace LLP now owns 947,260 shares of the oil and gas exploration company's stock valued at $19,059,000 after acquiring an additional 932,212 shares during the last quarter. Institutional investors own 10.08% of the company's stock.

Analyst Ratings Changes

Several research analysts have weighed in on YPF shares. Bank of America raised YPF Sociedad Anónima from a "neutral" rating to a "buy" rating and boosted their price objective for the stock from $31.00 to $55.00 in a research report on Monday. Citigroup downgraded shares of YPF Sociedad Anónima from a "buy" rating to a "neutral" rating and boosted their price target for the stock from $33.00 to $44.00 in a report on Wednesday, November 27th. JPMorgan Chase & Co. increased their price target on shares of YPF Sociedad Anónima from $24.00 to $25.00 and gave the company a "neutral" rating in a research report on Wednesday, October 30th. UBS Group reaffirmed a "neutral" rating and issued a $38.00 price objective (up previously from $30.00) on shares of YPF Sociedad Anónima in a research report on Wednesday, December 4th. Finally, Jefferies Financial Group upgraded shares of YPF Sociedad Anónima from a "hold" rating to a "buy" rating and boosted their target price for the company from $23.50 to $30.00 in a research note on Friday, August 30th. Six equities research analysts have rated the stock with a hold rating and two have given a buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average price target of $34.23.

Check Out Our Latest Report on YPF Sociedad Anónima

YPF Sociedad Anónima Stock Performance

NYSE:YPF traded up $0.84 on Thursday, reaching $43.96. 3,774,369 shares of the company's stock were exchanged, compared to its average volume of 2,192,827. The firm has a market cap of $17.29 billion, a price-to-earnings ratio of 21.78, a P/E/G ratio of 0.12 and a beta of 1.94. The company has a debt-to-equity ratio of 0.59, a current ratio of 0.88 and a quick ratio of 0.68. The stock has a fifty day simple moving average of $30.74 and a 200-day simple moving average of $24.58. YPF Sociedad Anónima has a 52 week low of $14.53 and a 52 week high of $44.76.

About YPF Sociedad Anónima

(

Free Report)

YPF Sociedad Anónima, an energy company, engages in the oil and gas upstream and downstream activities in Argentina. Its upstream operations include the exploration, exploitation, and production of crude oil, and natural gas. The company's downstream operations include petrochemical production and crude oil refining; transportation and distribution refined and petrochemical products; commercialization of crude oil, petrochemical products, and specialties.

See Also

Before you consider YPF Sociedad Anónima, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and YPF Sociedad Anónima wasn't on the list.

While YPF Sociedad Anónima currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.