BNP Paribas Financial Markets lessened its stake in shares of BWX Technologies, Inc. (NYSE:BWXT - Free Report) by 8.7% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 46,604 shares of the technology company's stock after selling 4,415 shares during the quarter. BNP Paribas Financial Markets owned 0.05% of BWX Technologies worth $5,066,000 as of its most recent SEC filing.

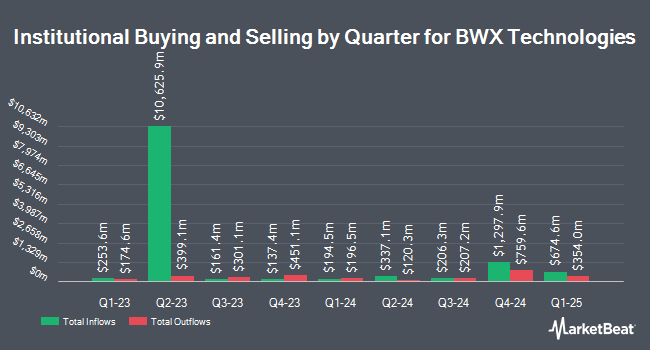

Several other hedge funds also recently bought and sold shares of BWXT. Thrivent Financial for Lutherans boosted its stake in BWX Technologies by 1,121.6% during the second quarter. Thrivent Financial for Lutherans now owns 578,068 shares of the technology company's stock worth $54,916,000 after buying an additional 530,749 shares during the period. FMR LLC lifted its position in shares of BWX Technologies by 22.3% during the third quarter. FMR LLC now owns 1,754,567 shares of the technology company's stock worth $190,721,000 after purchasing an additional 320,217 shares in the last quarter. Van ECK Associates Corp lifted its position in shares of BWX Technologies by 49.7% during the third quarter. Van ECK Associates Corp now owns 960,269 shares of the technology company's stock worth $104,381,000 after purchasing an additional 318,598 shares in the last quarter. Sapient Capital LLC acquired a new stake in shares of BWX Technologies during the second quarter worth about $29,408,000. Finally, American Century Companies Inc. lifted its position in shares of BWX Technologies by 37.9% during the second quarter. American Century Companies Inc. now owns 738,542 shares of the technology company's stock worth $70,161,000 after purchasing an additional 203,067 shares in the last quarter. Hedge funds and other institutional investors own 94.39% of the company's stock.

Wall Street Analyst Weigh In

BWXT has been the topic of several research reports. Alembic Global Advisors raised shares of BWX Technologies from a "neutral" rating to an "overweight" rating and set a $148.00 price target on the stock in a research report on Tuesday, November 12th. StockNews.com cut shares of BWX Technologies from a "buy" rating to a "hold" rating in a research report on Wednesday, November 6th. Truist Financial increased their price target on shares of BWX Technologies from $95.00 to $106.00 and gave the stock a "hold" rating in a research report on Tuesday, November 5th. Bank of America increased their price target on shares of BWX Technologies from $115.00 to $160.00 and gave the stock a "buy" rating in a research report on Thursday, November 14th. Finally, Deutsche Bank Aktiengesellschaft raised their target price on shares of BWX Technologies from $129.00 to $130.00 and gave the company a "buy" rating in a report on Wednesday, November 6th. One research analyst has rated the stock with a sell rating, two have issued a hold rating and six have assigned a buy rating to the company. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $122.43.

Check Out Our Latest Report on BWX Technologies

BWX Technologies Stock Up 0.8 %

BWXT traded up $1.04 on Wednesday, reaching $130.24. The company's stock had a trading volume of 301,052 shares, compared to its average volume of 645,105. The company has a market capitalization of $11.91 billion, a price-to-earnings ratio of 42.76, a P/E/G ratio of 4.33 and a beta of 0.70. BWX Technologies, Inc. has a fifty-two week low of $74.69 and a fifty-two week high of $136.31. The company has a quick ratio of 2.25, a current ratio of 2.25 and a debt-to-equity ratio of 1.15. The stock has a 50 day moving average of $122.66 and a two-hundred day moving average of $105.47.

BWX Technologies (NYSE:BWXT - Get Free Report) last posted its earnings results on Monday, November 4th. The technology company reported $0.83 EPS for the quarter, beating analysts' consensus estimates of $0.77 by $0.06. BWX Technologies had a net margin of 10.32% and a return on equity of 31.95%. The firm had revenue of $672.00 million for the quarter, compared to the consensus estimate of $658.84 million. During the same period last year, the firm posted $0.67 EPS. The company's revenue was up 13.9% on a year-over-year basis. As a group, analysts forecast that BWX Technologies, Inc. will post 3.23 EPS for the current fiscal year.

BWX Technologies Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Tuesday, December 10th. Stockholders of record on Tuesday, November 19th will be given a dividend of $0.24 per share. This represents a $0.96 dividend on an annualized basis and a dividend yield of 0.74%. The ex-dividend date of this dividend is Tuesday, November 19th. BWX Technologies's dividend payout ratio (DPR) is currently 31.79%.

BWX Technologies Company Profile

(

Free Report)

BWX Technologies, Inc, together with its subsidiaries, manufactures and sells nuclear components in the United States, Canada, and internationally. It operates through two segments, Government Operations and Commercial Operations. The Government Operations segment designs and manufactures naval nuclear components, reactors, and nuclear fuel; fabrication activities; and supplies proprietary and sole-source valves, manifolds, and fittings to naval and commercial shipping customers.

Recommended Stories

Before you consider BWX Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BWX Technologies wasn't on the list.

While BWX Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.