BNP Paribas Financial Markets cut its position in Taylor Morrison Home Co. (NYSE:TMHC - Free Report) by 38.9% during the third quarter, according to its most recent Form 13F filing with the SEC. The firm owned 107,038 shares of the construction company's stock after selling 68,177 shares during the period. BNP Paribas Financial Markets owned approximately 0.10% of Taylor Morrison Home worth $7,520,000 at the end of the most recent quarter.

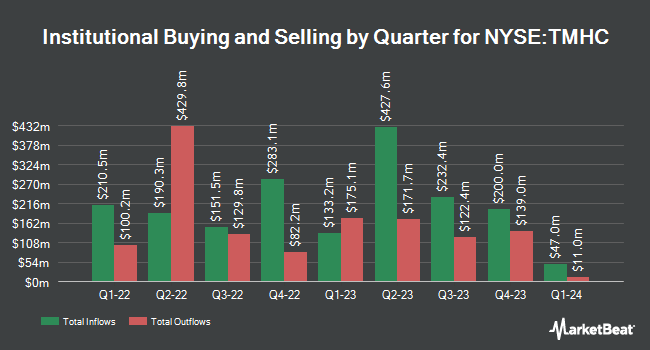

Several other institutional investors have also recently modified their holdings of TMHC. V Square Quantitative Management LLC purchased a new stake in shares of Taylor Morrison Home in the third quarter valued at approximately $29,000. Thurston Springer Miller Herd & Titak Inc. purchased a new stake in shares of Taylor Morrison Home during the second quarter worth $31,000. Harbor Capital Advisors Inc. acquired a new stake in shares of Taylor Morrison Home in the third quarter valued at about $34,000. UMB Bank n.a. lifted its stake in shares of Taylor Morrison Home by 263.9% in the third quarter. UMB Bank n.a. now owns 535 shares of the construction company's stock worth $38,000 after buying an additional 388 shares in the last quarter. Finally, Peterson Financial Group Inc. acquired a new position in Taylor Morrison Home during the third quarter worth about $62,000. 95.16% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of analysts recently issued reports on TMHC shares. BTIG Research raised their price objective on Taylor Morrison Home from $78.00 to $86.00 and gave the stock a "buy" rating in a research report on Thursday, October 24th. Raymond James reaffirmed an "outperform" rating and issued a $84.00 target price (up from $81.00) on shares of Taylor Morrison Home in a research report on Tuesday, October 29th. Wedbush raised Taylor Morrison Home from a "neutral" rating to an "outperform" rating and increased their price objective for the company from $65.00 to $85.00 in a report on Friday, October 25th. Zelman & Associates raised shares of Taylor Morrison Home from a "neutral" rating to an "outperform" rating in a report on Monday, August 12th. Finally, StockNews.com raised Taylor Morrison Home from a "hold" rating to a "buy" rating in a report on Thursday, October 24th. Two investment analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company's stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $77.33.

Read Our Latest Stock Analysis on TMHC

Taylor Morrison Home Stock Down 0.4 %

Shares of TMHC stock traded down $0.31 during mid-day trading on Tuesday, reaching $72.87. 184,807 shares of the company were exchanged, compared to its average volume of 792,588. The company has a market capitalization of $7.54 billion, a P/E ratio of 9.69 and a beta of 1.97. The company has a debt-to-equity ratio of 0.37, a quick ratio of 0.69 and a current ratio of 6.24. Taylor Morrison Home Co. has a fifty-two week low of $45.81 and a fifty-two week high of $75.49. The business's 50 day simple moving average is $69.92 and its 200 day simple moving average is $64.25.

Taylor Morrison Home (NYSE:TMHC - Get Free Report) last issued its quarterly earnings results on Wednesday, October 23rd. The construction company reported $2.37 EPS for the quarter, topping the consensus estimate of $2.06 by $0.31. The business had revenue of $2.12 billion for the quarter, compared to analysts' expectations of $1.96 billion. Taylor Morrison Home had a net margin of 10.39% and a return on equity of 15.91%. The company's quarterly revenue was up 26.6% compared to the same quarter last year. During the same quarter last year, the company posted $1.62 earnings per share. Research analysts predict that Taylor Morrison Home Co. will post 8.44 earnings per share for the current year.

Insider Buying and Selling at Taylor Morrison Home

In other Taylor Morrison Home news, Director William H. Lyon sold 24,284 shares of the stock in a transaction on Monday, November 25th. The shares were sold at an average price of $74.46, for a total transaction of $1,808,186.64. Following the transaction, the director now directly owns 2,045,316 shares of the company's stock, valued at $152,294,229.36. This represents a 1.17 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. Also, EVP Darrell Sherman sold 26,757 shares of the stock in a transaction dated Monday, October 28th. The shares were sold at an average price of $70.00, for a total value of $1,872,990.00. Following the transaction, the executive vice president now directly owns 109,217 shares in the company, valued at approximately $7,645,190. This represents a 19.68 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 128,621 shares of company stock valued at $9,164,869. Corporate insiders own 3.50% of the company's stock.

Taylor Morrison Home Profile

(

Free Report)

Taylor Morrison Home Corporation, together with its subsidiaries, operates as a public homebuilder in the United States. The company designs, builds, and sells single and multi-family detached and attached homes; and develops lifestyle and master-planned communities. It develops and constructs multi-use properties consisting of commercial space, retail, and multi-family properties under the Urban Form brand name.

Further Reading

Before you consider Taylor Morrison Home, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Taylor Morrison Home wasn't on the list.

While Taylor Morrison Home currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.