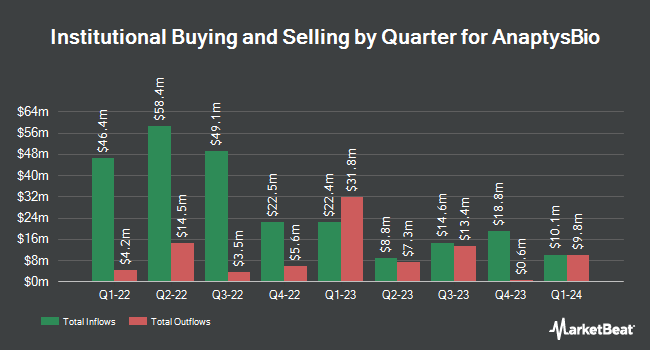

BNP Paribas Financial Markets lifted its holdings in shares of AnaptysBio, Inc. (NASDAQ:ANAB - Free Report) by 6,009.9% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 66,109 shares of the biotechnology company's stock after purchasing an additional 65,027 shares during the quarter. BNP Paribas Financial Markets owned approximately 0.22% of AnaptysBio worth $2,215,000 as of its most recent SEC filing.

A number of other hedge funds and other institutional investors have also modified their holdings of ANAB. Frazier Life Sciences Management L.P. increased its position in AnaptysBio by 140.7% during the second quarter. Frazier Life Sciences Management L.P. now owns 2,165,591 shares of the biotechnology company's stock worth $54,270,000 after buying an additional 1,265,891 shares during the last quarter. FMR LLC boosted its stake in shares of AnaptysBio by 15.3% during the 3rd quarter. FMR LLC now owns 3,309,175 shares of the biotechnology company's stock worth $110,857,000 after acquiring an additional 438,557 shares in the last quarter. Jennison Associates LLC acquired a new position in shares of AnaptysBio during the 3rd quarter valued at about $8,874,000. Victory Capital Management Inc. raised its stake in shares of AnaptysBio by 677.9% in the 3rd quarter. Victory Capital Management Inc. now owns 237,250 shares of the biotechnology company's stock valued at $7,948,000 after acquiring an additional 206,750 shares in the last quarter. Finally, Assenagon Asset Management S.A. lifted its holdings in AnaptysBio by 55.1% in the 3rd quarter. Assenagon Asset Management S.A. now owns 475,446 shares of the biotechnology company's stock worth $15,927,000 after purchasing an additional 168,813 shares during the last quarter.

Insider Activity

In related news, insider Paul F. Lizzul sold 1,500 shares of the stock in a transaction dated Monday, September 23rd. The shares were sold at an average price of $38.67, for a total transaction of $58,005.00. Following the completion of the sale, the insider now owns 15,398 shares in the company, valued at $595,440.66. This trade represents a 8.88 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Also, insider Eric J. Loumeau sold 8,720 shares of AnaptysBio stock in a transaction that occurred on Monday, September 16th. The shares were sold at an average price of $39.82, for a total transaction of $347,230.40. Following the completion of the transaction, the insider now owns 7,020 shares of the company's stock, valued at $279,536.40. This trade represents a 55.40 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 22,440 shares of company stock worth $892,936. Corporate insiders own 33.70% of the company's stock.

AnaptysBio Price Performance

Shares of NASDAQ:ANAB traded up $1.15 during trading on Friday, hitting $24.81. 660,214 shares of the stock were exchanged, compared to its average volume of 469,034. AnaptysBio, Inc. has a 1-year low of $15.78 and a 1-year high of $41.31. The company's fifty day simple moving average is $27.17 and its 200-day simple moving average is $29.63.

AnaptysBio (NASDAQ:ANAB - Get Free Report) last posted its quarterly earnings results on Tuesday, November 5th. The biotechnology company reported ($1.14) earnings per share for the quarter, topping analysts' consensus estimates of ($1.72) by $0.58. AnaptysBio had a negative net margin of 289.75% and a negative return on equity of 287.94%. The firm had revenue of $30.02 million for the quarter, compared to the consensus estimate of $7.92 million. Sell-side analysts predict that AnaptysBio, Inc. will post -6.02 earnings per share for the current year.

Analyst Ratings Changes

ANAB has been the topic of a number of recent analyst reports. BTIG Research lowered shares of AnaptysBio from a "buy" rating to a "neutral" rating in a research report on Monday, December 2nd. JPMorgan Chase & Co. cut their target price on shares of AnaptysBio from $75.00 to $66.00 and set an "overweight" rating for the company in a research report on Tuesday, November 12th. Wedbush reaffirmed an "outperform" rating and issued a $42.00 price target on shares of AnaptysBio in a research report on Thursday, November 14th. HC Wainwright cut their price objective on AnaptysBio from $55.00 to $52.00 and set a "buy" rating for the company in a research report on Wednesday, November 6th. Finally, Truist Financial increased their target price on AnaptysBio from $20.00 to $30.00 and gave the company a "hold" rating in a research note on Thursday, August 15th. Three investment analysts have rated the stock with a hold rating and nine have issued a buy rating to the stock. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $54.64.

Read Our Latest Stock Report on ANAB

AnaptysBio Profile

(

Free Report)

AnaptysBio, Inc, a clinical-stage biotechnology company, focuses in delivering immunology therapeutics. Its products include Rosnilimab, an IgG1 antibody that targets PD-1+ T cells, resulting in their agonism or depletion, broadly impacting pathogenic drivers of autoimmune and inflammatory diseases; and ANB032, a non-depleting antibody that binds to the BTLA checkpoint receptor and inhibits activated T cell proliferation; ANB033, a novel anti-CD122 antagonist antibody that targets the shared common beta subunit of the receptors for IL-15 and IL-2; ANB101, a BDCA2 modulator antibody that specifically targets plasmacytoid dendritic cells (pDCs); and Imsidolimab, an antibody that inhibits the interleukin-36 receptor, which is in the Phase 3 development for the treatment of generalized pustular psoriasis.

Featured Articles

Before you consider AnaptysBio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AnaptysBio wasn't on the list.

While AnaptysBio currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.