BNP Paribas Financial Markets boosted its position in shares of F5, Inc. (NASDAQ:FFIV - Free Report) by 2.7% during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 110,539 shares of the network technology company's stock after purchasing an additional 2,908 shares during the quarter. BNP Paribas Financial Markets owned approximately 0.19% of F5 worth $24,341,000 at the end of the most recent reporting period.

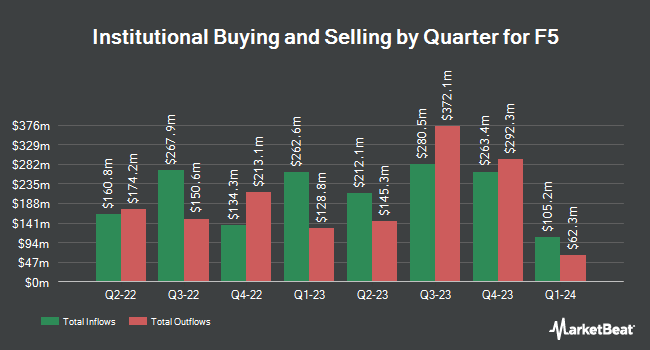

A number of other hedge funds have also made changes to their positions in FFIV. Price T Rowe Associates Inc. MD grew its holdings in shares of F5 by 1.0% during the first quarter. Price T Rowe Associates Inc. MD now owns 80,292 shares of the network technology company's stock worth $15,224,000 after buying an additional 811 shares in the last quarter. Janus Henderson Group PLC grew its stake in F5 by 195.1% in the 1st quarter. Janus Henderson Group PLC now owns 21,994 shares of the network technology company's stock worth $4,170,000 after acquiring an additional 14,541 shares during the period. Tidal Investments LLC raised its holdings in F5 by 130.6% in the 1st quarter. Tidal Investments LLC now owns 10,019 shares of the network technology company's stock valued at $1,899,000 after acquiring an additional 5,674 shares during the last quarter. Cetera Advisors LLC purchased a new position in shares of F5 during the 1st quarter worth $299,000. Finally, DekaBank Deutsche Girozentrale boosted its holdings in shares of F5 by 55.6% during the first quarter. DekaBank Deutsche Girozentrale now owns 57,361 shares of the network technology company's stock worth $10,775,000 after purchasing an additional 20,486 shares during the last quarter. Hedge funds and other institutional investors own 90.66% of the company's stock.

F5 Stock Up 0.1 %

Shares of FFIV traded up $0.28 during trading on Friday, reaching $250.35. The company's stock had a trading volume of 294,717 shares, compared to its average volume of 533,284. F5, Inc. has a twelve month low of $159.01 and a twelve month high of $252.30. The company has a market cap of $14.68 billion, a price-to-earnings ratio of 26.19, a P/E/G ratio of 3.38 and a beta of 1.05. The company has a fifty day moving average of $230.04 and a two-hundred day moving average of $199.47.

F5 (NASDAQ:FFIV - Get Free Report) last posted its quarterly earnings data on Monday, October 28th. The network technology company reported $3.67 EPS for the quarter, beating analysts' consensus estimates of $3.45 by $0.22. The firm had revenue of $747.00 million for the quarter, compared to the consensus estimate of $730.43 million. F5 had a net margin of 20.13% and a return on equity of 20.80%. The firm's revenue was up 5.7% compared to the same quarter last year. During the same period in the prior year, the firm posted $2.76 EPS. As a group, equities analysts forecast that F5, Inc. will post 11.01 EPS for the current fiscal year.

F5 declared that its Board of Directors has approved a share buyback plan on Monday, October 28th that authorizes the company to repurchase $1.00 billion in shares. This repurchase authorization authorizes the network technology company to purchase up to 7.9% of its stock through open market purchases. Stock repurchase plans are typically an indication that the company's leadership believes its stock is undervalued.

Insider Buying and Selling

In related news, Director Alan Higginson sold 825 shares of the firm's stock in a transaction on Tuesday, November 19th. The stock was sold at an average price of $239.77, for a total transaction of $197,810.25. Following the transaction, the director now directly owns 9,882 shares in the company, valued at $2,369,407.14. This trade represents a 7.71 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, CEO Francois Locoh-Donou sold 1,450 shares of the business's stock in a transaction on Thursday, October 3rd. The shares were sold at an average price of $218.26, for a total transaction of $316,477.00. Following the sale, the chief executive officer now owns 121,122 shares of the company's stock, valued at approximately $26,436,087.72. The trade was a 1.18 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders sold 4,475 shares of company stock worth $977,039. Corporate insiders own 0.58% of the company's stock.

Wall Street Analyst Weigh In

A number of analysts have issued reports on the company. JPMorgan Chase & Co. raised their price target on F5 from $225.00 to $250.00 and gave the stock a "neutral" rating in a research note on Tuesday, October 29th. StockNews.com upgraded shares of F5 from a "buy" rating to a "strong-buy" rating in a report on Tuesday, October 29th. Piper Sandler upped their price target on shares of F5 from $186.00 to $246.00 and gave the stock a "neutral" rating in a research report on Tuesday, October 29th. Morgan Stanley lifted their price target on shares of F5 from $215.00 to $230.00 and gave the company an "equal weight" rating in a report on Tuesday, October 29th. Finally, Barclays upped their price objective on F5 from $214.00 to $246.00 and gave the stock an "equal weight" rating in a report on Tuesday, October 29th. Seven equities research analysts have rated the stock with a hold rating, two have given a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus target price of $233.56.

Check Out Our Latest Stock Report on FFIV

F5 Company Profile

(

Free Report)

F5, Inc provides multi-cloud application security and delivery solutions in the United States, Europe, the Middle East, Africa, and the Asia Pacific region. The company's distributed cloud services enable its customers to deploy, secure, and operate applications in any architecture, from on-premises to the public cloud.

Featured Articles

Before you consider F5, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and F5 wasn't on the list.

While F5 currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.