BNP Paribas Financial Markets grew its position in Agilysys, Inc. (NASDAQ:AGYS - Free Report) by 9.6% during the third quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 47,900 shares of the software maker's stock after buying an additional 4,213 shares during the period. BNP Paribas Financial Markets owned 0.17% of Agilysys worth $5,220,000 at the end of the most recent quarter.

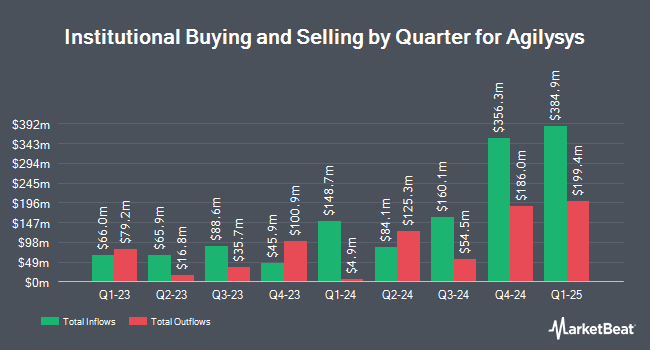

A number of other institutional investors have also modified their holdings of the company. SG Americas Securities LLC acquired a new stake in Agilysys in the 2nd quarter worth approximately $1,847,000. Eagle Asset Management Inc. boosted its stake in Agilysys by 59.1% in the 3rd quarter. Eagle Asset Management Inc. now owns 142,738 shares of the software maker's stock worth $16,959,000 after purchasing an additional 53,026 shares in the last quarter. Natixis Advisors LLC acquired a new stake in Agilysys in the 2nd quarter worth approximately $1,111,000. Seven Eight Capital LP acquired a new stake in Agilysys in the 2nd quarter worth approximately $580,000. Finally, William Blair Investment Management LLC acquired a new stake in Agilysys in the 2nd quarter worth approximately $21,039,000. 88.00% of the stock is currently owned by institutional investors.

Insider Buying and Selling

In related news, CFO William David Wood III sold 588 shares of the business's stock in a transaction on Friday, November 1st. The shares were sold at an average price of $100.86, for a total value of $59,305.68. Following the completion of the sale, the chief financial officer now owns 49,479 shares of the company's stock, valued at approximately $4,990,451.94. The trade was a 1.17 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, insider Chris J. Robertson sold 264 shares of Agilysys stock in a transaction on Friday, November 1st. The stock was sold at an average price of $100.86, for a total transaction of $26,627.04. Following the sale, the insider now directly owns 22,624 shares in the company, valued at approximately $2,281,856.64. This trade represents a 1.15 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 30,122 shares of company stock valued at $3,319,491. 19.30% of the stock is owned by corporate insiders.

Agilysys Stock Performance

Shares of NASDAQ:AGYS traded up $0.13 during trading on Wednesday, hitting $133.12. 54,396 shares of the stock traded hands, compared to its average volume of 215,557. The company has a quick ratio of 1.07, a current ratio of 1.13 and a debt-to-equity ratio of 0.19. The company has a market cap of $3.72 billion, a price-to-earnings ratio of 37.89 and a beta of 0.93. The company has a fifty day moving average price of $116.92 and a two-hundred day moving average price of $108.37. Agilysys, Inc. has a 52-week low of $73.52 and a 52-week high of $139.99.

Agilysys (NASDAQ:AGYS - Get Free Report) last posted its earnings results on Monday, October 28th. The software maker reported $0.34 earnings per share for the quarter, beating the consensus estimate of $0.30 by $0.04. The firm had revenue of $68.30 million during the quarter, compared to analyst estimates of $67.54 million. Agilysys had a net margin of 37.54% and a return on equity of 10.53%. The business's quarterly revenue was up 16.6% on a year-over-year basis. During the same period in the previous year, the firm earned $0.25 EPS. As a group, equities analysts predict that Agilysys, Inc. will post 0.81 EPS for the current year.

Analyst Upgrades and Downgrades

A number of analysts recently commented on the stock. Northland Securities reiterated an "outperform" rating and issued a $145.00 target price (up from $132.00) on shares of Agilysys in a research note on Tuesday, October 29th. Oppenheimer lifted their price objective on shares of Agilysys from $135.00 to $150.00 and gave the company an "outperform" rating in a research note on Tuesday. StockNews.com cut shares of Agilysys from a "buy" rating to a "hold" rating in a research note on Thursday, October 31st. BTIG Research lifted their price objective on shares of Agilysys from $118.00 to $124.00 and gave the company a "buy" rating in a research note on Tuesday, October 29th. Finally, Needham & Company LLC lifted their price objective on shares of Agilysys from $125.00 to $145.00 and gave the company a "buy" rating in a research note on Friday, November 15th. One investment analyst has rated the stock with a hold rating and six have assigned a buy rating to the company's stock. According to MarketBeat, Agilysys presently has an average rating of "Moderate Buy" and a consensus target price of $137.80.

Check Out Our Latest Stock Report on AGYS

About Agilysys

(

Free Report)

Agilysys, Inc operates as a developer and marketer of software-enabled solutions and services to the hospitality industry in North America, Europe, the Asia-Pacific, and India. It offers software solutions fully integrated with third party hardware and operating systems; cloud applications, support, and maintenance; subscription and maintenance; and professional services.

See Also

Before you consider Agilysys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agilysys wasn't on the list.

While Agilysys currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.