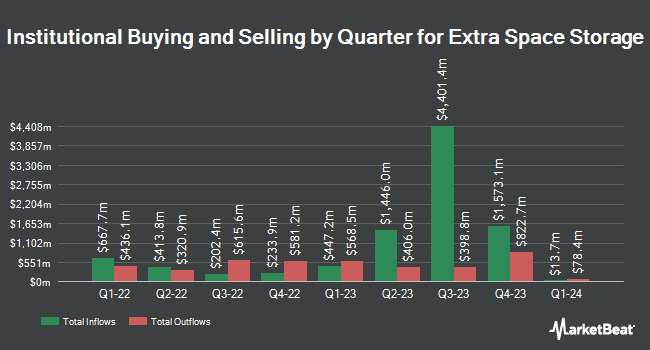

BNP Paribas Financial Markets boosted its stake in shares of Extra Space Storage Inc. (NYSE:EXR - Free Report) by 31.8% in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 341,983 shares of the real estate investment trust's stock after buying an additional 82,587 shares during the period. BNP Paribas Financial Markets owned approximately 0.16% of Extra Space Storage worth $61,622,000 at the end of the most recent reporting period.

A number of other large investors have also added to or reduced their stakes in the stock. EdgeRock Capital LLC bought a new position in shares of Extra Space Storage during the second quarter valued at $25,000. Centerpoint Advisors LLC bought a new stake in Extra Space Storage during the 2nd quarter valued at about $27,000. Ashton Thomas Securities LLC purchased a new position in Extra Space Storage in the third quarter worth about $33,000. Blue Trust Inc. raised its holdings in Extra Space Storage by 540.5% in the second quarter. Blue Trust Inc. now owns 237 shares of the real estate investment trust's stock worth $35,000 after buying an additional 200 shares during the last quarter. Finally, Harvest Fund Management Co. Ltd bought a new position in shares of Extra Space Storage in the third quarter worth approximately $42,000. Hedge funds and other institutional investors own 99.11% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts recently weighed in on EXR shares. Truist Financial boosted their price objective on shares of Extra Space Storage from $152.00 to $167.00 and gave the stock a "hold" rating in a report on Friday, August 16th. Barclays boosted their price target on Extra Space Storage from $188.00 to $192.00 and gave the stock an "overweight" rating in a research note on Monday, October 28th. Bank of America cut Extra Space Storage from a "neutral" rating to an "underperform" rating and dropped their price objective for the company from $172.00 to $155.00 in a research report on Monday, August 5th. Evercore ISI lowered their target price on shares of Extra Space Storage from $170.00 to $168.00 and set an "in-line" rating on the stock in a research note on Monday, October 14th. Finally, StockNews.com downgraded Extra Space Storage from a "hold" rating to a "sell" rating in a research note on Thursday, October 31st. Three analysts have rated the stock with a sell rating, seven have given a hold rating and five have issued a buy rating to the company's stock. Based on data from MarketBeat, Extra Space Storage presently has a consensus rating of "Hold" and a consensus target price of $171.36.

Check Out Our Latest Research Report on Extra Space Storage

Insider Activity

In related news, Director Kenneth M. Woolley sold 6,647 shares of the stock in a transaction on Friday, September 13th. The stock was sold at an average price of $177.23, for a total transaction of $1,178,047.81. Following the sale, the director now owns 404,306 shares in the company, valued at approximately $71,655,152.38. This represents a 1.62 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, Director Diane Olmstead sold 3,081 shares of the firm's stock in a transaction on Friday, November 15th. The stock was sold at an average price of $164.56, for a total value of $507,009.36. Following the completion of the sale, the director now owns 5,877 shares of the company's stock, valued at approximately $967,119.12. This represents a 34.39 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 17,228 shares of company stock worth $3,023,957. 1.36% of the stock is currently owned by corporate insiders.

Extra Space Storage Price Performance

Extra Space Storage stock traded up $1.00 during midday trading on Thursday, reaching $172.68. 614,087 shares of the stock traded hands, compared to its average volume of 1,028,503. The stock has a market cap of $36.60 billion, a P/E ratio of 45.20, a PEG ratio of 8.58 and a beta of 0.87. The stock's fifty day moving average is $169.82 and its 200-day moving average is $164.15. The company has a quick ratio of 0.23, a current ratio of 0.23 and a debt-to-equity ratio of 0.77. Extra Space Storage Inc. has a 12 month low of $125.82 and a 12 month high of $184.87.

Extra Space Storage (NYSE:EXR - Get Free Report) last posted its earnings results on Tuesday, October 29th. The real estate investment trust reported $0.91 EPS for the quarter, missing analysts' consensus estimates of $2.03 by ($1.12). Extra Space Storage had a net margin of 25.35% and a return on equity of 5.51%. The firm had revenue of $824.80 million for the quarter, compared to the consensus estimate of $826.93 million. During the same quarter in the prior year, the company posted $2.02 earnings per share. The firm's revenue was up 10.2% compared to the same quarter last year. As a group, equities research analysts anticipate that Extra Space Storage Inc. will post 8.09 EPS for the current year.

Extra Space Storage Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Stockholders of record on Monday, December 16th will be issued a $1.62 dividend. The ex-dividend date of this dividend is Monday, December 16th. This represents a $6.48 dividend on an annualized basis and a dividend yield of 3.75%. Extra Space Storage's dividend payout ratio (DPR) is presently 169.63%.

Extra Space Storage Company Profile

(

Free Report)

Extra Space Storage Inc, headquartered in Salt Lake City, Utah, is a self-administered and self-managed REIT and a member of the S&P 500. As of December 31, 2023, the Company owned and/or operated 3,714 self-storage stores in 42 states and Washington, DC The Company's stores comprise approximately 2.6 million units and approximately 283.0 million square feet of rentable space operating under the Extra Space, Life Storage and Storage Express brands.

Featured Stories

Before you consider Extra Space Storage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Extra Space Storage wasn't on the list.

While Extra Space Storage currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.