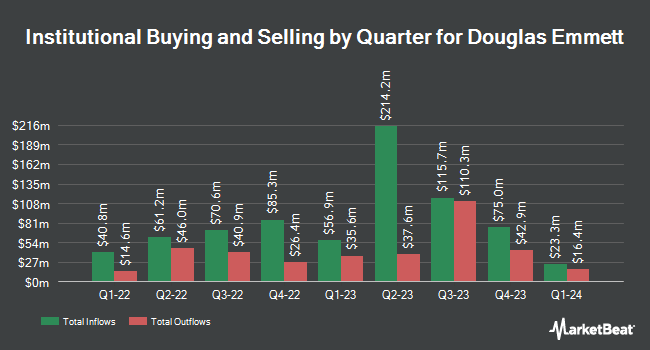

BNP Paribas Financial Markets reduced its position in Douglas Emmett, Inc. (NYSE:DEI - Free Report) by 73.6% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 56,374 shares of the real estate investment trust's stock after selling 156,774 shares during the period. BNP Paribas Financial Markets' holdings in Douglas Emmett were worth $990,000 at the end of the most recent quarter.

A number of other hedge funds also recently made changes to their positions in the company. SG Americas Securities LLC raised its position in Douglas Emmett by 623.3% during the second quarter. SG Americas Securities LLC now owns 157,156 shares of the real estate investment trust's stock valued at $2,092,000 after purchasing an additional 135,428 shares during the period. Raymond James & Associates raised its position in Douglas Emmett by 50.6% during the second quarter. Raymond James & Associates now owns 431,342 shares of the real estate investment trust's stock valued at $5,741,000 after purchasing an additional 144,995 shares during the period. Neo Ivy Capital Management purchased a new stake in Douglas Emmett during the second quarter valued at approximately $2,573,000. Louisiana State Employees Retirement System raised its position in Douglas Emmett by 1.9% during the second quarter. Louisiana State Employees Retirement System now owns 84,200 shares of the real estate investment trust's stock valued at $1,121,000 after purchasing an additional 1,600 shares during the period. Finally, Bank of New York Mellon Corp grew its stake in shares of Douglas Emmett by 1.0% during the second quarter. Bank of New York Mellon Corp now owns 2,417,865 shares of the real estate investment trust's stock valued at $32,182,000 after buying an additional 24,272 shares during the last quarter. 97.37% of the stock is currently owned by hedge funds and other institutional investors.

Douglas Emmett Price Performance

Shares of NYSE:DEI traded up $0.21 during midday trading on Wednesday, hitting $19.66. The company's stock had a trading volume of 1,144,372 shares, compared to its average volume of 1,613,142. Douglas Emmett, Inc. has a 12-month low of $12.35 and a 12-month high of $20.27. The company has a market cap of $3.29 billion, a P/E ratio of -196.60 and a beta of 1.11. The company has a debt-to-equity ratio of 1.51, a quick ratio of 4.09 and a current ratio of 4.09. The business's 50 day simple moving average is $18.62 and its 200 day simple moving average is $16.23.

Douglas Emmett (NYSE:DEI - Get Free Report) last released its quarterly earnings data on Monday, November 4th. The real estate investment trust reported $0.03 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.41 by ($0.38). The firm had revenue of $250.75 million for the quarter, compared to analyst estimates of $242.75 million. Douglas Emmett had a negative return on equity of 0.43% and a negative net margin of 1.68%. Douglas Emmett's revenue for the quarter was down 1.8% on a year-over-year basis. During the same quarter in the previous year, the business posted $0.45 earnings per share. On average, analysts forecast that Douglas Emmett, Inc. will post 1.7 EPS for the current year.

Wall Street Analysts Forecast Growth

DEI has been the topic of a number of analyst reports. Citigroup upped their target price on Douglas Emmett from $14.00 to $16.00 and gave the company a "neutral" rating in a research note on Thursday, September 12th. JPMorgan Chase & Co. increased their price objective on Douglas Emmett from $15.00 to $18.00 and gave the stock a "neutral" rating in a research note on Monday, September 9th. Scotiabank raised Douglas Emmett from a "sector perform" rating to a "sector outperform" rating and increased their price objective for the stock from $16.00 to $21.00 in a research note on Thursday, November 14th. Wells Fargo & Company increased their price objective on Douglas Emmett from $15.00 to $17.00 and gave the stock an "overweight" rating in a research note on Wednesday, September 11th. Finally, Evercore ISI upped their target price on Douglas Emmett from $16.00 to $19.00 and gave the stock an "in-line" rating in a report on Thursday, November 7th. Six research analysts have rated the stock with a hold rating and two have assigned a buy rating to the company. Based on data from MarketBeat.com, Douglas Emmett currently has an average rating of "Hold" and an average target price of $17.43.

Check Out Our Latest Research Report on DEI

Douglas Emmett Company Profile

(

Free Report)

Douglas Emmett, Inc (DEI) is a fully integrated, self-administered and self-managed real estate investment trust (REIT), and one of the largest owners and operators of high-quality office and multifamily properties located in the premier coastal submarkets of Los Angeles and Honolulu. Douglas Emmett focuses on owning and acquiring a substantial share of top-tier office properties and premier multifamily communities in neighborhoods that possess significant supply constraints, high-end executive housing and key lifestyle amenities.

Featured Articles

Before you consider Douglas Emmett, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Douglas Emmett wasn't on the list.

While Douglas Emmett currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.