BNP Paribas Financial Markets lifted its holdings in shares of QuinStreet, Inc. (NASDAQ:QNST - Free Report) by 145.8% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 52,209 shares of the technology company's stock after purchasing an additional 30,969 shares during the period. BNP Paribas Financial Markets owned about 0.09% of QuinStreet worth $999,000 at the end of the most recent reporting period.

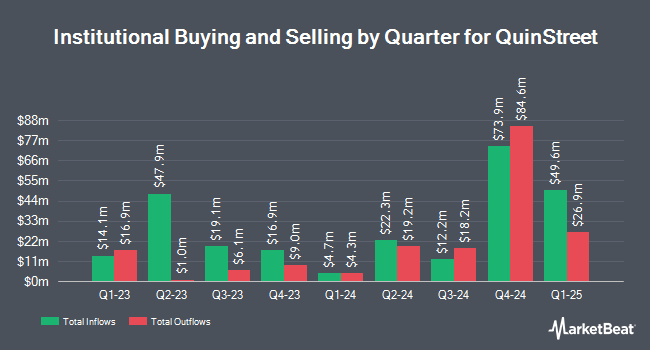

A number of other hedge funds and other institutional investors have also added to or reduced their stakes in QNST. American Century Companies Inc. raised its stake in QuinStreet by 27.5% in the 2nd quarter. American Century Companies Inc. now owns 2,035,127 shares of the technology company's stock valued at $33,763,000 after acquiring an additional 438,947 shares during the period. Divisadero Street Capital Management LP bought a new stake in shares of QuinStreet during the second quarter valued at about $6,499,000. Driehaus Capital Management LLC increased its position in shares of QuinStreet by 17.6% during the second quarter. Driehaus Capital Management LLC now owns 1,509,937 shares of the technology company's stock valued at $25,050,000 after buying an additional 225,720 shares during the period. Squarepoint Ops LLC increased its position in shares of QuinStreet by 248.7% during the second quarter. Squarepoint Ops LLC now owns 174,367 shares of the technology company's stock valued at $2,893,000 after buying an additional 124,367 shares during the period. Finally, FMR LLC increased its position in shares of QuinStreet by 5.2% during the third quarter. FMR LLC now owns 2,233,345 shares of the technology company's stock valued at $42,724,000 after buying an additional 109,892 shares during the period. 97.83% of the stock is currently owned by institutional investors.

QuinStreet Trading Up 0.5 %

Shares of NASDAQ QNST traded up $0.11 during midday trading on Wednesday, hitting $21.92. 222,784 shares of the company's stock were exchanged, compared to its average volume of 412,695. QuinStreet, Inc. has a 12-month low of $11.22 and a 12-month high of $26.27. The company has a market cap of $1.23 billion, a price-to-earnings ratio of -54.80 and a beta of 1.07. The business's fifty day moving average price is $20.78 and its two-hundred day moving average price is $18.85.

QuinStreet (NASDAQ:QNST - Get Free Report) last issued its earnings results on Monday, November 4th. The technology company reported $0.22 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.15 by $0.07. The business had revenue of $279.22 million during the quarter, compared to analyst estimates of $222.68 million. QuinStreet had a negative return on equity of 8.79% and a negative net margin of 2.88%. QuinStreet's revenue for the quarter was up 125.3% on a year-over-year basis. During the same quarter in the prior year, the firm earned ($0.19) earnings per share. Equities analysts expect that QuinStreet, Inc. will post 0.15 earnings per share for the current fiscal year.

Insiders Place Their Bets

In other QuinStreet news, Director Matthew Glickman sold 30,000 shares of the company's stock in a transaction that occurred on Tuesday, November 12th. The stock was sold at an average price of $22.63, for a total value of $678,900.00. Following the completion of the sale, the director now owns 113,140 shares of the company's stock, valued at $2,560,358.20. This represents a 20.96 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, Director Stuart Huizinga sold 7,020 shares of the business's stock in a transaction that occurred on Monday, November 25th. The shares were sold at an average price of $23.21, for a total value of $162,934.20. Following the completion of the sale, the director now owns 174,903 shares of the company's stock, valued at $4,059,498.63. The trade was a 3.86 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 40,000 shares of company stock valued at $910,374 over the last quarter. 5.00% of the stock is owned by corporate insiders.

Wall Street Analysts Forecast Growth

Several equities research analysts have recently weighed in on the company. StockNews.com cut QuinStreet from a "hold" rating to a "sell" rating in a research report on Tuesday. B. Riley upped their price target on QuinStreet from $24.00 to $32.00 and gave the company a "buy" rating in a research report on Tuesday, November 5th. Lake Street Capital upped their price target on QuinStreet from $20.00 to $25.00 and gave the company a "hold" rating in a research report on Tuesday, November 5th. Barrington Research reiterated an "outperform" rating and set a $29.00 price target on shares of QuinStreet in a research report on Friday, December 6th. Finally, Stephens boosted their price objective on QuinStreet from $23.00 to $27.00 and gave the stock an "overweight" rating in a report on Tuesday, November 5th. One research analyst has rated the stock with a sell rating, one has issued a hold rating and four have given a buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $29.00.

Get Our Latest Research Report on QNST

QuinStreet Profile

(

Free Report)

QuinStreet, Inc, an online performance marketing company, provides customer acquisition services for its clients in the United States and internationally. The company offers online marketing services, such as qualified clicks, leads, calls, applications, and customers through its websites or third-party publishers.

Featured Articles

Before you consider QuinStreet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and QuinStreet wasn't on the list.

While QuinStreet currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.