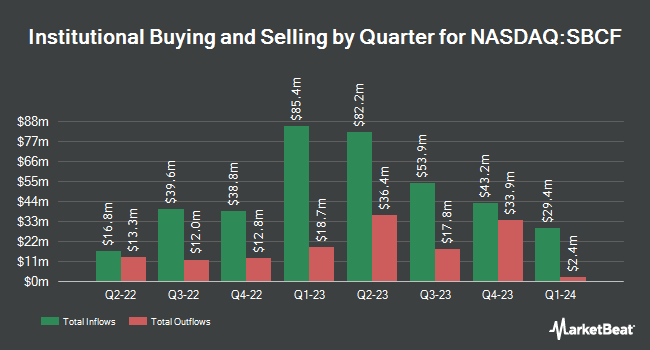

BNP Paribas Financial Markets grew its holdings in Seacoast Banking Co. of Florida (NASDAQ:SBCF - Free Report) by 97.8% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 34,238 shares of the financial services provider's stock after buying an additional 16,930 shares during the period. BNP Paribas Financial Markets' holdings in Seacoast Banking Co. of Florida were worth $912,000 at the end of the most recent quarter.

Several other hedge funds and other institutional investors also recently made changes to their positions in SBCF. FMR LLC boosted its holdings in shares of Seacoast Banking Co. of Florida by 57.3% during the 3rd quarter. FMR LLC now owns 5,382 shares of the financial services provider's stock worth $143,000 after buying an additional 1,960 shares during the period. Advantage Alpha Capital Partners LP lifted its position in Seacoast Banking Co. of Florida by 46.8% during the third quarter. Advantage Alpha Capital Partners LP now owns 18,404 shares of the financial services provider's stock worth $490,000 after acquiring an additional 5,865 shares during the last quarter. Citigroup Inc. lifted its position in Seacoast Banking Co. of Florida by 14.6% during the third quarter. Citigroup Inc. now owns 157,927 shares of the financial services provider's stock worth $4,209,000 after acquiring an additional 20,122 shares during the last quarter. Charles Schwab Investment Management Inc. boosted its holdings in shares of Seacoast Banking Co. of Florida by 7.2% during the third quarter. Charles Schwab Investment Management Inc. now owns 849,811 shares of the financial services provider's stock worth $22,647,000 after acquiring an additional 56,897 shares during the period. Finally, Intech Investment Management LLC grew its position in shares of Seacoast Banking Co. of Florida by 176.6% in the third quarter. Intech Investment Management LLC now owns 30,767 shares of the financial services provider's stock valued at $820,000 after purchasing an additional 19,643 shares during the last quarter. 81.77% of the stock is currently owned by institutional investors.

Seacoast Banking Co. of Florida Price Performance

Shares of NASDAQ:SBCF traded down $0.55 during trading on Thursday, reaching $29.10. 289,753 shares of the company traded hands, compared to its average volume of 408,780. The firm has a market capitalization of $2.49 billion, a PE ratio of 21.48 and a beta of 1.08. Seacoast Banking Co. of Florida has a 52 week low of $21.90 and a 52 week high of $31.68. The company has a quick ratio of 0.86, a current ratio of 0.86 and a debt-to-equity ratio of 0.16. The company's 50 day moving average is $28.39 and its two-hundred day moving average is $26.44.

Seacoast Banking Co. of Florida (NASDAQ:SBCF - Get Free Report) last posted its quarterly earnings data on Thursday, October 24th. The financial services provider reported $0.36 earnings per share for the quarter, hitting the consensus estimate of $0.36. The business had revenue of $130.30 million during the quarter, compared to analysts' expectations of $129.20 million. Seacoast Banking Co. of Florida had a net margin of 14.55% and a return on equity of 5.44%. Seacoast Banking Co. of Florida's revenue was up 5.5% compared to the same quarter last year. During the same quarter in the prior year, the business posted $0.37 earnings per share. As a group, sell-side analysts predict that Seacoast Banking Co. of Florida will post 1.41 earnings per share for the current year.

Seacoast Banking Co. of Florida Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Friday, December 13th will be given a dividend of $0.18 per share. The ex-dividend date of this dividend is Friday, December 13th. This represents a $0.72 annualized dividend and a dividend yield of 2.47%. Seacoast Banking Co. of Florida's dividend payout ratio is 52.17%.

Insider Activity at Seacoast Banking Co. of Florida

In other Seacoast Banking Co. of Florida news, CEO Charles M. Shaffer sold 21,255 shares of the firm's stock in a transaction on Monday, November 11th. The stock was sold at an average price of $30.36, for a total value of $645,301.80. Following the sale, the chief executive officer now owns 126,232 shares of the company's stock, valued at approximately $3,832,403.52. This trade represents a 14.41 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. 1.50% of the stock is currently owned by insiders.

Analysts Set New Price Targets

Several analysts recently weighed in on SBCF shares. Truist Financial dropped their price target on Seacoast Banking Co. of Florida from $30.00 to $28.00 and set a "hold" rating for the company in a report on Monday, October 28th. Stephens boosted their target price on shares of Seacoast Banking Co. of Florida from $25.00 to $26.00 and gave the company an "equal weight" rating in a research report on Monday, October 28th. Finally, Keefe, Bruyette & Woods reaffirmed an "outperform" rating and set a $31.00 price target on shares of Seacoast Banking Co. of Florida in a research report on Wednesday, August 21st. Three analysts have rated the stock with a hold rating and two have assigned a buy rating to the company's stock. According to MarketBeat, the company presently has an average rating of "Hold" and an average price target of $28.70.

Read Our Latest Stock Report on SBCF

About Seacoast Banking Co. of Florida

(

Free Report)

Seacoast Banking Corporation of Florida operates as the bank holding company for Seacoast National Bank that provides integrated financial services to retail and commercial customers in Florida. The company offers noninterest and interest-bearing demand deposit, money market, savings, and customer sweep accounts; time certificates of deposit; construction and land development, commercial and residential real estate, and commercial and financial loans; and consumer loans, including installment loans and revolving lines, as well as loans for automobiles, boats, and personal and family purposes.

Read More

Before you consider Seacoast Banking Co. of Florida, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Seacoast Banking Co. of Florida wasn't on the list.

While Seacoast Banking Co. of Florida currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.