BNP Paribas Financial Markets boosted its stake in shares of Loews Co. (NYSE:L - Free Report) by 42.1% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 235,569 shares of the insurance provider's stock after purchasing an additional 69,836 shares during the quarter. BNP Paribas Financial Markets owned about 0.11% of Loews worth $18,622,000 at the end of the most recent reporting period.

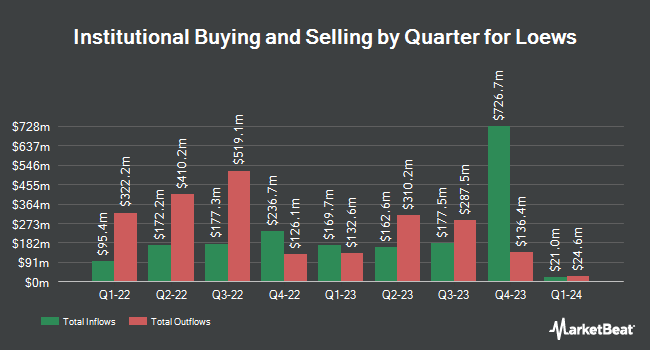

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in L. Public Employees Retirement Association of Colorado bought a new stake in shares of Loews in the first quarter valued at about $462,000. Cetera Advisors LLC bought a new stake in shares of Loews in the first quarter valued at about $339,000. DekaBank Deutsche Girozentrale boosted its position in shares of Loews by 62.8% in the first quarter. DekaBank Deutsche Girozentrale now owns 46,675 shares of the insurance provider's stock valued at $3,630,000 after acquiring an additional 18,001 shares during the period. GAMMA Investing LLC boosted its position in shares of Loews by 39.4% in the second quarter. GAMMA Investing LLC now owns 4,596 shares of the insurance provider's stock valued at $344,000 after acquiring an additional 1,299 shares during the period. Finally, DNB Asset Management AS boosted its position in shares of Loews by 16.3% in the second quarter. DNB Asset Management AS now owns 31,510 shares of the insurance provider's stock valued at $2,355,000 after acquiring an additional 4,425 shares during the period. 58.33% of the stock is owned by institutional investors.

Insider Buying and Selling

In other news, insider Jonathan M. Tisch sold 62,500 shares of the firm's stock in a transaction on Thursday, September 5th. The stock was sold at an average price of $80.84, for a total transaction of $5,052,500.00. Following the completion of the sale, the insider now directly owns 6,781,634 shares of the company's stock, valued at $548,227,292.56. This trade represents a 0.91 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Also, Director Ann E. Berman sold 1,087 shares of the firm's stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $81.38, for a total value of $88,460.06. Following the sale, the director now directly owns 4,998 shares of the company's stock, valued at approximately $406,737.24. This represents a 17.86 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 213,587 shares of company stock worth $17,586,460 in the last ninety days. Corporate insiders own 18.70% of the company's stock.

Loews Trading Down 0.4 %

Shares of Loews stock traded down $0.32 on Friday, reaching $86.73. 408,304 shares of the company's stock were exchanged, compared to its average volume of 755,357. The company has a market capitalization of $18.89 billion, a P/E ratio of 11.52 and a beta of 0.82. Loews Co. has a 52 week low of $67.20 and a 52 week high of $87.45. The firm's 50-day moving average is $81.20 and its two-hundred day moving average is $78.72. The company has a debt-to-equity ratio of 0.48, a quick ratio of 0.34 and a current ratio of 0.34.

Loews Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, December 10th. Investors of record on Wednesday, November 27th will be issued a $0.0625 dividend. This represents a $0.25 dividend on an annualized basis and a dividend yield of 0.29%. The ex-dividend date of this dividend is Wednesday, November 27th. Loews's dividend payout ratio is currently 3.32%.

Analyst Upgrades and Downgrades

Separately, StockNews.com downgraded Loews from a "strong-buy" rating to a "buy" rating in a research note on Wednesday, November 20th.

Check Out Our Latest Report on L

Loews Profile

(

Free Report)

Loews Corporation provides commercial property and casualty insurance in the United States and internationally. The company offers specialty insurance products, such as management and professional liability, and other coverage products; surety and fidelity bonds; property insurance products that include standard and excess property, marine and boiler, and machinery coverages; and casualty insurance products, such as workers' compensation, general and product liability, and commercial auto, surplus, and umbrella coverages.

See Also

Before you consider Loews, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Loews wasn't on the list.

While Loews currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.