BNP Paribas Financial Markets cut its stake in shares of Applied Optoelectronics, Inc. (NASDAQ:AAOI - Free Report) by 93.2% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 7,822 shares of the semiconductor company's stock after selling 107,524 shares during the quarter. BNP Paribas Financial Markets' holdings in Applied Optoelectronics were worth $112,000 as of its most recent SEC filing.

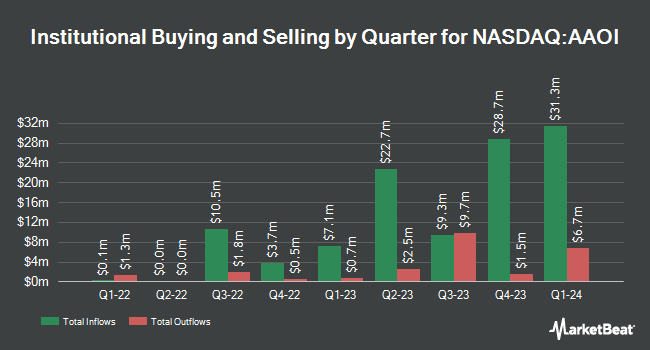

A number of other hedge funds and other institutional investors have also recently bought and sold shares of AAOI. AQR Capital Management LLC grew its holdings in Applied Optoelectronics by 90.7% during the second quarter. AQR Capital Management LLC now owns 75,981 shares of the semiconductor company's stock worth $630,000 after acquiring an additional 36,138 shares during the period. Harbor Capital Advisors Inc. acquired a new position in shares of Applied Optoelectronics during the 3rd quarter worth $1,319,000. Westfield Capital Management Co. LP purchased a new position in shares of Applied Optoelectronics in the 3rd quarter valued at about $19,019,000. Bank of New York Mellon Corp acquired a new stake in shares of Applied Optoelectronics in the second quarter valued at about $956,000. Finally, Royce & Associates LP boosted its holdings in Applied Optoelectronics by 47.7% during the third quarter. Royce & Associates LP now owns 1,596,545 shares of the semiconductor company's stock worth $22,847,000 after buying an additional 515,489 shares in the last quarter. 61.72% of the stock is currently owned by hedge funds and other institutional investors.

Applied Optoelectronics Trading Down 4.7 %

Shares of NASDAQ AAOI traded down $1.58 during trading on Thursday, hitting $32.39. 3,672,016 shares of the company traded hands, compared to its average volume of 2,751,896. The company has a quick ratio of 1.06, a current ratio of 1.61 and a debt-to-equity ratio of 0.36. The firm has a market capitalization of $1.46 billion, a P/E ratio of -15.72 and a beta of 2.37. The company has a 50-day moving average price of $27.12 and a 200-day moving average price of $16.34. Applied Optoelectronics, Inc. has a 1 year low of $6.70 and a 1 year high of $44.50.

Insiders Place Their Bets

In related news, insider David C. Kuo sold 10,000 shares of the stock in a transaction on Friday, November 8th. The stock was sold at an average price of $26.93, for a total value of $269,300.00. Following the completion of the sale, the insider now directly owns 118,122 shares in the company, valued at approximately $3,181,025.46. This represents a 7.81 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, insider Hung-Lun (Fred) Chang sold 20,323 shares of the firm's stock in a transaction dated Wednesday, November 20th. The shares were sold at an average price of $30.35, for a total value of $616,803.05. Following the completion of the transaction, the insider now directly owns 195,572 shares in the company, valued at $5,935,610.20. This trade represents a 9.41 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 96,769 shares of company stock worth $3,165,737 over the last three months. 5.40% of the stock is owned by insiders.

Analyst Ratings Changes

Several analysts have recently issued reports on AAOI shares. B. Riley downgraded Applied Optoelectronics from a "neutral" rating to a "sell" rating and set a $14.00 price objective on the stock. in a research report on Tuesday, December 10th. Rosenblatt Securities raised their price target on shares of Applied Optoelectronics from $27.50 to $44.00 and gave the stock a "buy" rating in a research note on Friday, December 13th. StockNews.com upgraded shares of Applied Optoelectronics to a "sell" rating in a report on Friday, October 25th. Northland Securities reissued an "outperform" rating and set a $40.00 price objective (up previously from $25.00) on shares of Applied Optoelectronics in a research note on Wednesday. Finally, Raymond James boosted their price target on Applied Optoelectronics from $17.00 to $23.00 and gave the company an "outperform" rating in a report on Friday, November 8th. Two research analysts have rated the stock with a sell rating, one has given a hold rating and three have issued a buy rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus target price of $26.00.

Read Our Latest Stock Report on AAOI

About Applied Optoelectronics

(

Free Report)

Applied Optoelectronics, Inc designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China. It offers optical modules, optical filters, lasers, laser components, subassemblies, transmitters and transceivers, turn-key equipment, headend, node, distribution equipment, and amplifiers.

Featured Articles

Before you consider Applied Optoelectronics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Applied Optoelectronics wasn't on the list.

While Applied Optoelectronics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.