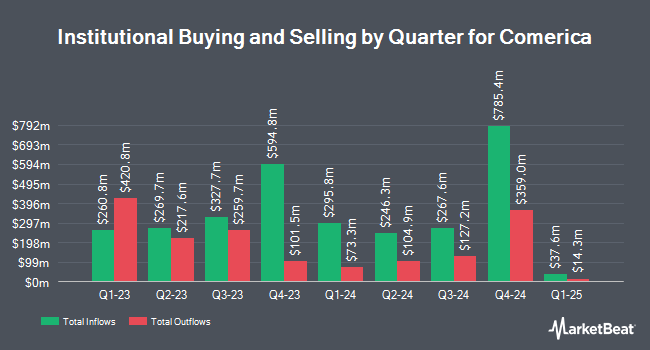

BNP Paribas Financial Markets cut its stake in shares of Comerica Incorporated (NYSE:CMA - Free Report) by 82.4% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 20,120 shares of the financial services provider's stock after selling 94,279 shares during the quarter. BNP Paribas Financial Markets' holdings in Comerica were worth $1,205,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other institutional investors also recently bought and sold shares of the company. Dimensional Fund Advisors LP increased its position in Comerica by 51.3% during the 2nd quarter. Dimensional Fund Advisors LP now owns 4,045,656 shares of the financial services provider's stock valued at $206,468,000 after buying an additional 1,370,886 shares in the last quarter. Samlyn Capital LLC bought a new stake in shares of Comerica in the 2nd quarter worth $35,375,000. Citigroup Inc. increased its holdings in shares of Comerica by 390.6% in the 3rd quarter. Citigroup Inc. now owns 761,601 shares of the financial services provider's stock worth $45,628,000 after purchasing an additional 606,375 shares in the last quarter. Vaughan Nelson Investment Management L.P. increased its holdings in shares of Comerica by 31.3% in the 3rd quarter. Vaughan Nelson Investment Management L.P. now owns 2,408,820 shares of the financial services provider's stock worth $144,312,000 after purchasing an additional 574,516 shares in the last quarter. Finally, Principal Financial Group Inc. increased its holdings in shares of Comerica by 311.2% in the 2nd quarter. Principal Financial Group Inc. now owns 663,100 shares of the financial services provider's stock worth $33,845,000 after purchasing an additional 501,857 shares in the last quarter. 80.74% of the stock is currently owned by hedge funds and other institutional investors.

Comerica Stock Performance

Shares of NYSE CMA traded down $0.05 during midday trading on Tuesday, reaching $67.64. 2,218,808 shares of the stock were exchanged, compared to its average volume of 2,105,871. The firm has a market cap of $8.90 billion, a price-to-earnings ratio of 16.91 and a beta of 1.23. Comerica Incorporated has a twelve month low of $45.32 and a twelve month high of $73.45. The firm has a 50-day simple moving average of $65.79 and a two-hundred day simple moving average of $57.73. The company has a quick ratio of 0.97, a current ratio of 0.97 and a debt-to-equity ratio of 0.97.

Comerica (NYSE:CMA - Get Free Report) last issued its quarterly earnings data on Friday, October 18th. The financial services provider reported $1.33 EPS for the quarter, topping analysts' consensus estimates of $1.17 by $0.16. Comerica had a net margin of 11.17% and a return on equity of 12.54%. The business had revenue of $1.26 billion for the quarter, compared to analysts' expectations of $806.49 million. During the same quarter last year, the company earned $1.84 EPS. As a group, analysts anticipate that Comerica Incorporated will post 5.37 EPS for the current fiscal year.

Comerica Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, January 1st. Investors of record on Friday, December 13th will be paid a $0.71 dividend. The ex-dividend date of this dividend is Friday, December 13th. This represents a $2.84 dividend on an annualized basis and a yield of 4.20%. Comerica's dividend payout ratio is currently 71.00%.

Comerica announced that its Board of Directors has initiated a share repurchase program on Tuesday, November 5th that allows the company to buyback 10,000,000 shares. This buyback authorization allows the financial services provider to purchase shares of its stock through open market purchases. Shares buyback programs are generally a sign that the company's management believes its shares are undervalued.

Wall Street Analyst Weigh In

CMA has been the subject of a number of research analyst reports. Robert W. Baird lifted their target price on Comerica from $75.00 to $80.00 and gave the stock an "outperform" rating in a report on Monday, November 18th. JPMorgan Chase & Co. raised their price target on Comerica from $65.00 to $70.00 and gave the stock a "neutral" rating in a research note on Monday, October 21st. Wells Fargo & Company upgraded Comerica from an "underweight" rating to an "equal weight" rating and raised their price target for the stock from $51.00 to $73.00 in a research note on Friday, November 15th. Barclays raised their price target on Comerica from $56.00 to $66.00 and gave the stock an "underweight" rating in a research note on Monday, October 21st. Finally, DA Davidson raised their price target on Comerica from $64.00 to $68.00 and gave the stock a "neutral" rating in a research note on Monday, October 21st. Two analysts have rated the stock with a sell rating, thirteen have given a hold rating and nine have issued a buy rating to the stock. Based on data from MarketBeat, the company currently has a consensus rating of "Hold" and a consensus target price of $67.27.

View Our Latest Research Report on CMA

Insider Activity at Comerica

In other news, EVP Allysun C. Fleming sold 1,392 shares of Comerica stock in a transaction on Thursday, November 7th. The stock was sold at an average price of $68.83, for a total transaction of $95,811.36. Following the transaction, the executive vice president now owns 8,730 shares in the company, valued at $600,885.90. The trade was a 13.75 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, EVP James Harry Weber sold 6,500 shares of Comerica stock in a transaction on Thursday, October 24th. The stock was sold at an average price of $63.23, for a total value of $410,995.00. Following the transaction, the executive vice president now owns 15,773 shares in the company, valued at approximately $997,326.79. This represents a 29.18 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 15,456 shares of company stock valued at $977,287. 0.19% of the stock is owned by company insiders.

Comerica Profile

(

Free Report)

Comerica Incorporated, through its subsidiaries, provides various financial products and services. The company operates through Commercial Bank, Retail Bank, Wealth Management, and Finance segments. The Commercial Bank segment offers various products and services, including commercial loans and lines of credit, deposits, cash management, payment solutions, card services, capital market products, international trade finance, letters of credit, foreign exchange management services, and loan syndication services for small and middle market businesses, multinational corporations, and governmental entities.

Recommended Stories

Before you consider Comerica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Comerica wasn't on the list.

While Comerica currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report