BNP Paribas Financial Markets lessened its stake in shares of Columbus McKinnon Co. (NASDAQ:CMCO - Free Report) by 55.1% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 12,683 shares of the industrial products company's stock after selling 15,546 shares during the quarter. BNP Paribas Financial Markets' holdings in Columbus McKinnon were worth $457,000 at the end of the most recent quarter.

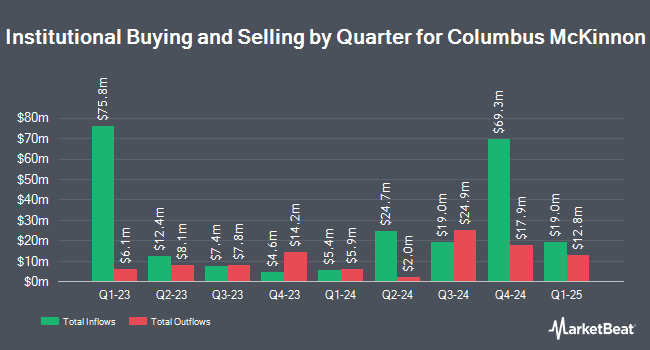

Other institutional investors and hedge funds also recently modified their holdings of the company. State of New Jersey Common Pension Fund D grew its holdings in Columbus McKinnon by 31.6% during the 3rd quarter. State of New Jersey Common Pension Fund D now owns 58,444 shares of the industrial products company's stock valued at $2,104,000 after purchasing an additional 14,018 shares in the last quarter. Barrow Hanley Mewhinney & Strauss LLC acquired a new stake in shares of Columbus McKinnon during the second quarter valued at about $35,540,000. Renaissance Technologies LLC increased its position in shares of Columbus McKinnon by 250.3% during the second quarter. Renaissance Technologies LLC now owns 107,885 shares of the industrial products company's stock worth $3,726,000 after acquiring an additional 77,085 shares during the last quarter. Charles Schwab Investment Management Inc. lifted its stake in shares of Columbus McKinnon by 5.1% in the third quarter. Charles Schwab Investment Management Inc. now owns 390,745 shares of the industrial products company's stock worth $14,067,000 after acquiring an additional 18,802 shares in the last quarter. Finally, Harbor Capital Advisors Inc. boosted its holdings in Columbus McKinnon by 152.8% in the third quarter. Harbor Capital Advisors Inc. now owns 234,124 shares of the industrial products company's stock valued at $8,428,000 after purchasing an additional 141,502 shares during the last quarter. Hedge funds and other institutional investors own 95.96% of the company's stock.

Columbus McKinnon Stock Down 0.4 %

CMCO stock traded down $0.15 during midday trading on Friday, hitting $38.90. 178,878 shares of the company's stock were exchanged, compared to its average volume of 187,883. The firm has a 50 day moving average price of $36.22 and a 200-day moving average price of $35.13. Columbus McKinnon Co. has a 12-month low of $29.26 and a 12-month high of $45.84. The stock has a market capitalization of $1.12 billion, a price-to-earnings ratio of 73.40 and a beta of 1.23. The company has a current ratio of 2.04, a quick ratio of 1.16 and a debt-to-equity ratio of 0.50.

Columbus McKinnon Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Monday, November 18th. Investors of record on Friday, November 8th were issued a $0.07 dividend. The ex-dividend date of this dividend was Friday, November 8th. This represents a $0.28 annualized dividend and a yield of 0.72%. Columbus McKinnon's dividend payout ratio is presently 52.83%.

Insider Activity at Columbus McKinnon

In other news, CEO David J. Wilson bought 31,300 shares of Columbus McKinnon stock in a transaction on Friday, November 1st. The shares were bought at an average price of $32.02 per share, with a total value of $1,002,226.00. Following the acquisition, the chief executive officer now directly owns 31,300 shares in the company, valued at approximately $1,002,226. This represents a ∞ increase in their position. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, Director Christopher J. Stephens purchased 1,000 shares of the stock in a transaction dated Thursday, November 14th. The stock was purchased at an average price of $37.34 per share, with a total value of $37,340.00. Following the completion of the acquisition, the director now directly owns 6,014 shares in the company, valued at approximately $224,562.76. The trade was a 19.94 % increase in their position. The disclosure for this purchase can be found here. 1.98% of the stock is currently owned by corporate insiders.

About Columbus McKinnon

(

Free Report)

Columbus McKinnon Corporation designs, manufactures, and markets motion solutions for moving, lifting, positioning, and securing materials worldwide. It offers manual, battery, electric, and air hoists; steel, rack, and pinion jacks; winches, hydraulic jacks and tools, trolleys and its clamps, and lifting tables; skates and heavy load moving systems; material handling equipment; mobile, workplace, and jib cranes; crane components and kits; and below-the-hook lifting devices, lifting slings, and lashing systems.

Further Reading

Before you consider Columbus McKinnon, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Columbus McKinnon wasn't on the list.

While Columbus McKinnon currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.