BNP Paribas Financial Markets reduced its position in Central Garden & Pet (NASDAQ:CENTA - Free Report) by 58.1% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 13,821 shares of the company's stock after selling 19,136 shares during the quarter. BNP Paribas Financial Markets' holdings in Central Garden & Pet were worth $434,000 as of its most recent SEC filing.

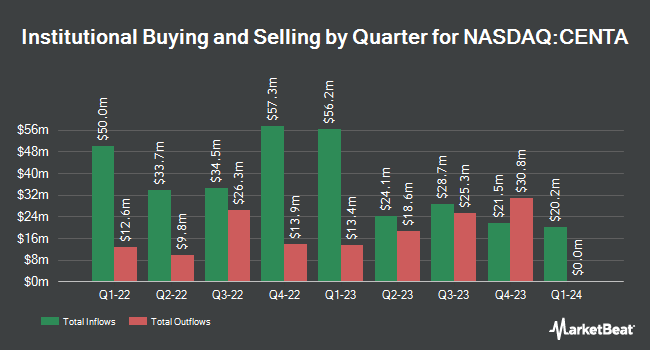

Several other institutional investors also recently bought and sold shares of the company. Nisa Investment Advisors LLC raised its holdings in Central Garden & Pet by 16.5% in the second quarter. Nisa Investment Advisors LLC now owns 2,511 shares of the company's stock valued at $83,000 after acquiring an additional 355 shares in the last quarter. Arizona State Retirement System increased its holdings in Central Garden & Pet by 2.5% in the second quarter. Arizona State Retirement System now owns 15,269 shares of the company's stock valued at $504,000 after buying an additional 377 shares during the last quarter. Louisiana State Employees Retirement System raised its stake in Central Garden & Pet by 2.2% in the second quarter. Louisiana State Employees Retirement System now owns 27,300 shares of the company's stock valued at $902,000 after buying an additional 600 shares in the last quarter. Quarry LP lifted its holdings in Central Garden & Pet by 503.2% during the 2nd quarter. Quarry LP now owns 754 shares of the company's stock worth $25,000 after buying an additional 629 shares during the last quarter. Finally, KBC Group NV boosted its holdings in Central Garden & Pet by 43.8% in the third quarter. KBC Group NV now owns 2,402 shares of the company's stock valued at $75,000 after purchasing an additional 732 shares in the last quarter. 50.82% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

A number of research firms recently weighed in on CENTA. StockNews.com lowered shares of Central Garden & Pet from a "buy" rating to a "hold" rating in a research report on Wednesday, October 16th. JPMorgan Chase & Co. dropped their price target on Central Garden & Pet from $34.00 to $32.00 and set a "neutral" rating for the company in a research report on Friday, October 11th. Two research analysts have rated the stock with a hold rating, two have issued a buy rating and two have assigned a strong buy rating to the stock. According to data from MarketBeat.com, Central Garden & Pet has an average rating of "Buy" and a consensus target price of $41.33.

Get Our Latest Analysis on Central Garden & Pet

Central Garden & Pet Trading Up 2.1 %

Central Garden & Pet stock traded up $0.73 during trading hours on Friday, reaching $34.72. 197,174 shares of the company's stock traded hands, compared to its average volume of 280,205. The company has a debt-to-equity ratio of 0.76, a quick ratio of 2.19 and a current ratio of 3.66. Central Garden & Pet has a fifty-two week low of $27.70 and a fifty-two week high of $41.03. The firm's 50 day moving average is $31.58 and its 200-day moving average is $32.80. The firm has a market capitalization of $2.28 billion, a price-to-earnings ratio of 21.46 and a beta of 0.78.

About Central Garden & Pet

(

Free Report)

Central Garden & Pet Company produces and distributes various products for the lawn and garden, and pet supplies markets in the United States. It operates through two segments: Pet and Garden. The Pet segment provides dog and cat supplies, such as dog treats and chews, toys, pet beds and containment, grooming products, waste management, and training pads; supplies for aquatics, small animals, reptiles, and pet birds, including toys, cages and habitats, bedding, and food and supplements; products for equine and livestock; animal and household health and insect control products; aquariums and terrariums, including fixtures and stands, water conditioners and supplements, water pumps and filters, and lighting systems and accessories; and live fish and small animals, as well as outdoor cushions.

Recommended Stories

Before you consider Central Garden & Pet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Central Garden & Pet wasn't on the list.

While Central Garden & Pet currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.