BNP Paribas Financial Markets cut its stake in shares of Williams-Sonoma, Inc. (NYSE:WSM - Free Report) by 38.5% in the third quarter, according to its most recent disclosure with the SEC. The firm owned 62,481 shares of the specialty retailer's stock after selling 39,149 shares during the period. BNP Paribas Financial Markets' holdings in Williams-Sonoma were worth $9,680,000 at the end of the most recent quarter.

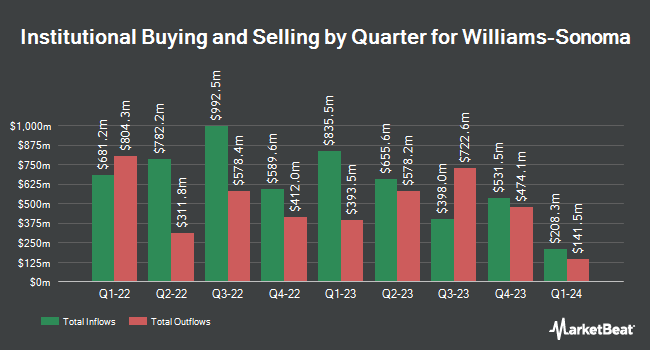

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in WSM. Brooklyn Investment Group purchased a new stake in shares of Williams-Sonoma during the third quarter worth $28,000. Quantbot Technologies LP increased its stake in Williams-Sonoma by 471.1% in the 3rd quarter. Quantbot Technologies LP now owns 40,331 shares of the specialty retailer's stock valued at $6,248,000 after buying an additional 33,269 shares during the period. D.A. Davidson & CO. lifted its holdings in shares of Williams-Sonoma by 63.9% in the 3rd quarter. D.A. Davidson & CO. now owns 5,648 shares of the specialty retailer's stock valued at $875,000 after buying an additional 2,201 shares during the period. FMR LLC boosted its holdings in Williams-Sonoma by 72.7% during the third quarter. FMR LLC now owns 8,781,201 shares of the specialty retailer's stock worth $1,360,384,000 after buying an additional 3,695,837 shares in the last quarter. Finally, Blue Investment Partners LLC increased its stake in Williams-Sonoma by 67.9% in the 3rd quarter. Blue Investment Partners LLC now owns 1,963 shares of the specialty retailer's stock valued at $304,000 after purchasing an additional 794 shares in the last quarter. Hedge funds and other institutional investors own 99.29% of the company's stock.

Williams-Sonoma Trading Up 3.1 %

Williams-Sonoma stock traded up $5.36 during midday trading on Monday, reaching $177.38. The stock had a trading volume of 1,520,223 shares, compared to its average volume of 1,971,391. The company has a market capitalization of $21.84 billion, a P/E ratio of 20.35, a PEG ratio of 2.62 and a beta of 1.81. The company has a fifty day moving average price of $146.19 and a two-hundred day moving average price of $145.29. Williams-Sonoma, Inc. has a 12 month low of $94.63 and a 12 month high of $181.42.

Williams-Sonoma Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, November 22nd. Stockholders of record on Friday, October 18th were paid a dividend of $0.57 per share. The ex-dividend date of this dividend was Friday, October 18th. This represents a $2.28 annualized dividend and a dividend yield of 1.29%. Williams-Sonoma's payout ratio is 26.97%.

Analysts Set New Price Targets

A number of analysts recently commented on WSM shares. Barclays increased their price objective on Williams-Sonoma from $116.00 to $123.00 and gave the company an "underweight" rating in a research note on Thursday, November 21st. Robert W. Baird dropped their price target on Williams-Sonoma from $150.00 to $140.00 and set a "neutral" rating on the stock in a research report on Friday, August 23rd. Telsey Advisory Group upped their target price on shares of Williams-Sonoma from $165.00 to $190.00 and gave the stock an "outperform" rating in a research report on Thursday, November 21st. Wells Fargo & Company raised their target price on Williams-Sonoma from $140.00 to $165.00 and gave the company an "equal weight" rating in a research note on Thursday, November 21st. Finally, Jefferies Financial Group upgraded shares of Williams-Sonoma from a "hold" rating to a "buy" rating and upped their price target for the company from $148.00 to $156.00 in a research report on Wednesday, September 11th. Three research analysts have rated the stock with a sell rating, twelve have issued a hold rating and four have given a buy rating to the company's stock. According to data from MarketBeat, Williams-Sonoma has an average rating of "Hold" and a consensus price target of $154.41.

Read Our Latest Research Report on Williams-Sonoma

Insider Transactions at Williams-Sonoma

In other Williams-Sonoma news, CEO Laura Alber sold 40,000 shares of Williams-Sonoma stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $145.27, for a total transaction of $5,810,800.00. Following the completion of the sale, the chief executive officer now owns 1,030,956 shares of the company's stock, valued at $149,766,978.12. The trade was a 3.73 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Corporate insiders own 1.50% of the company's stock.

Williams-Sonoma Company Profile

(

Free Report)

Williams-Sonoma, Inc operates as an omni-channel specialty retailer of various products for home. It offers cooking, dining, and entertaining products, such as cookware, tools, electrics, cutlery, tabletop and bar, outdoor, furniture, and a library of cookbooks under the Williams Sonoma Home brand, as well as home furnishings and decorative accessories under the Williams Sonoma lifestyle brand; and furniture, bedding, lighting, rugs, table essentials, and decorative accessories under the Pottery Barn brand.

Featured Articles

Before you consider Williams-Sonoma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Williams-Sonoma wasn't on the list.

While Williams-Sonoma currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.