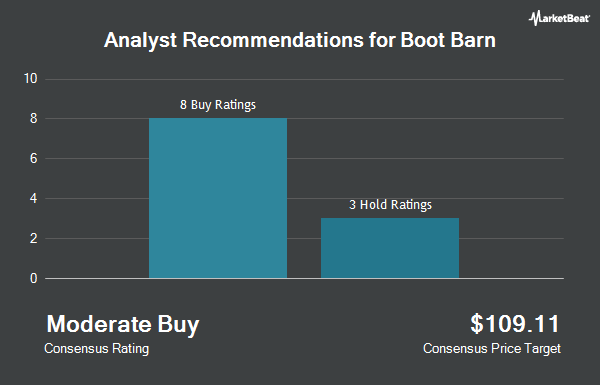

Shares of Boot Barn Holdings, Inc. (NYSE:BOOT - Get Free Report) have been assigned a consensus rating of "Moderate Buy" from the thirteen research firms that are presently covering the company, Marketbeat.com reports. Three equities research analysts have rated the stock with a hold recommendation, nine have issued a buy recommendation and one has given a strong buy recommendation to the company. The average 12-month price target among brokerages that have issued a report on the stock in the last year is $164.55.

A number of equities research analysts have recently commented on the stock. Benchmark reaffirmed a "buy" rating and set a $192.00 price objective on shares of Boot Barn in a research note on Tuesday, October 29th. Robert W. Baird upgraded shares of Boot Barn from a "neutral" rating to an "outperform" rating and set a $167.00 price target on the stock in a research report on Wednesday, October 30th. Craig Hallum lowered shares of Boot Barn from a "buy" rating to a "hold" rating and increased their target price for the stock from $154.00 to $162.00 in a research note on Friday, October 25th. BTIG Research raised their target price on Boot Barn from $165.00 to $185.00 and gave the company a "buy" rating in a research report on Tuesday, October 29th. Finally, JPMorgan Chase & Co. upped their price target on Boot Barn from $160.00 to $181.00 and gave the stock an "overweight" rating in a report on Tuesday, October 29th.

Read Our Latest Report on Boot Barn

Boot Barn Stock Performance

Shares of Boot Barn stock traded down $3.45 during trading on Wednesday, hitting $145.57. 492,412 shares of the company's stock were exchanged, compared to its average volume of 761,148. The stock has a market capitalization of $4.44 billion, a price-to-earnings ratio of 29.23 and a beta of 2.14. The business has a 50-day simple moving average of $145.01 and a 200-day simple moving average of $139.98. Boot Barn has a 52-week low of $68.37 and a 52-week high of $169.83.

Boot Barn (NYSE:BOOT - Get Free Report) last released its quarterly earnings data on Monday, October 28th. The company reported $0.95 earnings per share for the quarter, beating analysts' consensus estimates of $0.93 by $0.02. The business had revenue of $425.80 million during the quarter, compared to analyst estimates of $424.42 million. Boot Barn had a return on equity of 15.89% and a net margin of 8.73%. The company's revenue was up 13.7% on a year-over-year basis. During the same quarter last year, the business posted $0.91 EPS. On average, equities analysts anticipate that Boot Barn will post 5.48 earnings per share for the current fiscal year.

Institutional Trading of Boot Barn

Large investors have recently modified their holdings of the stock. Marshall Wace LLP acquired a new position in shares of Boot Barn during the 2nd quarter worth about $19,532,000. F M Investments LLC acquired a new position in Boot Barn in the second quarter valued at approximately $14,888,000. State Street Corp increased its stake in Boot Barn by 4.4% in the third quarter. State Street Corp now owns 1,208,345 shares of the company's stock valued at $202,132,000 after purchasing an additional 51,356 shares during the last quarter. B. Metzler seel. Sohn & Co. Holding AG purchased a new position in Boot Barn in the third quarter valued at approximately $5,931,000. Finally, Sei Investments Co. raised its holdings in Boot Barn by 39.3% during the second quarter. Sei Investments Co. now owns 102,933 shares of the company's stock worth $13,271,000 after purchasing an additional 29,049 shares in the last quarter.

About Boot Barn

(

Get Free ReportBoot Barn Holdings, Inc, a lifestyle retail chain, operates specialty retail stores in the United States. The company's specialty retail stores offer western and work-related footwear, apparel, and accessories for men, women, and kids. It offers boots, shirts, jackets, hats, belts and belt buckles, handbags, western-style jewelry, rugged footwear, outerwear, overalls, denim, and flame-resistant and high-visibility clothing.

See Also

Before you consider Boot Barn, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boot Barn wasn't on the list.

While Boot Barn currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.