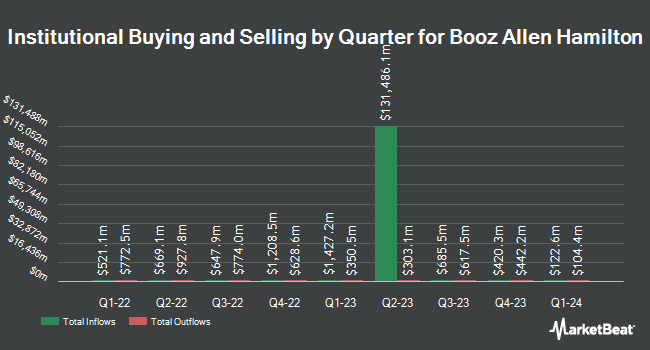

Verition Fund Management LLC raised its stake in Booz Allen Hamilton Holding Co. (NYSE:BAH - Free Report) by 93.8% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 15,249 shares of the business services provider's stock after acquiring an additional 7,382 shares during the period. Verition Fund Management LLC's holdings in Booz Allen Hamilton were worth $2,482,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other hedge funds also recently made changes to their positions in BAH. Opal Wealth Advisors LLC purchased a new position in Booz Allen Hamilton during the 2nd quarter worth approximately $26,000. OFI Invest Asset Management purchased a new position in shares of Booz Allen Hamilton during the second quarter worth approximately $29,000. Peterson Financial Group Inc. acquired a new position in shares of Booz Allen Hamilton in the 3rd quarter valued at $31,000. Innealta Capital LLC acquired a new position in shares of Booz Allen Hamilton in the 2nd quarter valued at $34,000. Finally, Gilliland Jeter Wealth Management LLC purchased a new stake in Booz Allen Hamilton in the 3rd quarter valued at $45,000. Hedge funds and other institutional investors own 91.82% of the company's stock.

Insider Activity at Booz Allen Hamilton

In related news, CFO Matthew Calderone sold 3,865 shares of the stock in a transaction dated Monday, September 23rd. The stock was sold at an average price of $160.00, for a total transaction of $618,400.00. Following the transaction, the chief financial officer now directly owns 33,683 shares in the company, valued at approximately $5,389,280. This represents a 10.29 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this hyperlink. Also, EVP Richard Crowe sold 4,243 shares of Booz Allen Hamilton stock in a transaction dated Thursday, October 24th. The shares were sold at an average price of $165.00, for a total value of $700,095.00. Following the completion of the sale, the executive vice president now owns 25,496 shares of the company's stock, valued at $4,206,840. This trade represents a 14.27 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 12,173 shares of company stock valued at $1,989,220. Company insiders own 1.59% of the company's stock.

Booz Allen Hamilton Price Performance

Shares of BAH traded up $3.04 during trading hours on Friday, reaching $145.74. 1,883,044 shares of the company traded hands, compared to its average volume of 847,689. The stock has a fifty day simple moving average of $162.39 and a 200 day simple moving average of $156.43. Booz Allen Hamilton Holding Co. has a fifty-two week low of $123.17 and a fifty-two week high of $190.59. The stock has a market capitalization of $18.62 billion, a PE ratio of 22.88, a price-to-earnings-growth ratio of 1.75 and a beta of 0.52. The company has a quick ratio of 1.56, a current ratio of 1.56 and a debt-to-equity ratio of 2.76.

Booz Allen Hamilton Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Wednesday, December 4th. Stockholders of record on Friday, November 15th were given a $0.51 dividend. This represents a $2.04 dividend on an annualized basis and a dividend yield of 1.40%. The ex-dividend date was Friday, November 15th. Booz Allen Hamilton's dividend payout ratio is presently 32.03%.

Wall Street Analyst Weigh In

BAH has been the topic of a number of recent research reports. JPMorgan Chase & Co. lowered shares of Booz Allen Hamilton from a "neutral" rating to an "underweight" rating and lifted their price objective for the company from $154.00 to $158.00 in a research note on Wednesday, October 2nd. UBS Group started coverage on shares of Booz Allen Hamilton in a research note on Monday. They set a "neutral" rating and a $159.00 price target on the stock. StockNews.com lowered Booz Allen Hamilton from a "buy" rating to a "hold" rating in a report on Thursday. Barclays boosted their target price on Booz Allen Hamilton from $142.00 to $175.00 and gave the stock an "underweight" rating in a research report on Tuesday, October 29th. Finally, Wells Fargo & Company dropped their price target on Booz Allen Hamilton from $206.00 to $177.00 and set an "overweight" rating for the company in a research report on Tuesday, November 26th. Two analysts have rated the stock with a sell rating, four have given a hold rating and four have assigned a buy rating to the company's stock. Based on data from MarketBeat, the company presently has an average rating of "Hold" and a consensus price target of $171.67.

Read Our Latest Analysis on BAH

Booz Allen Hamilton Profile

(

Free Report)

Booz Allen Hamilton Holding Corporation provides management and technology consulting, analytics, engineering, digital solutions, mission operations, and cyber services to governments, corporations, and not-for-profit organizations in the United States and internationally. It focuses on artificial intelligence services comprising of machine learning, predictive modeling, automation and decision analytics, and quantum computing.

See Also

Before you consider Booz Allen Hamilton, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Booz Allen Hamilton wasn't on the list.

While Booz Allen Hamilton currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.