Boston Properties (NYSE:BXP - Get Free Report) had its price target lifted by research analysts at Barclays from $88.00 to $89.00 in a research note issued to investors on Monday,Benzinga reports. The firm presently has an "equal weight" rating on the real estate investment trust's stock. Barclays's target price would suggest a potential upside of 13.51% from the company's previous close.

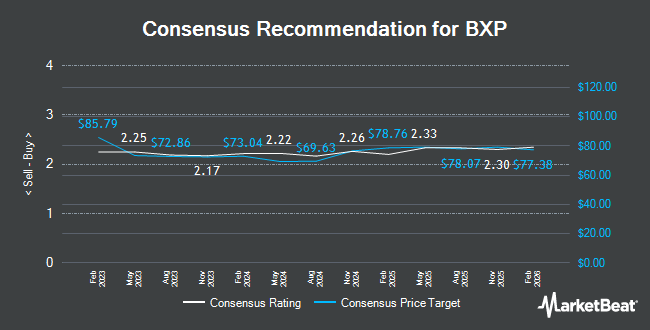

Several other analysts also recently issued reports on BXP. Wedbush lifted their target price on Boston Properties from $63.00 to $70.00 and gave the company a "neutral" rating in a research note on Monday, August 5th. Piper Sandler raised Boston Properties from a "neutral" rating to an "overweight" rating and lifted their price objective for the stock from $78.00 to $105.00 in a research note on Wednesday, October 23rd. StockNews.com downgraded Boston Properties from a "hold" rating to a "sell" rating in a research note on Thursday, October 31st. Wells Fargo & Company lifted their price objective on Boston Properties from $73.00 to $80.00 and gave the stock an "overweight" rating in a research note on Wednesday, September 11th. Finally, UBS Group lifted their price objective on Boston Properties from $64.00 to $80.00 and gave the stock a "neutral" rating in a research note on Tuesday, November 5th. One investment analyst has rated the stock with a sell rating, seven have issued a hold rating and six have issued a buy rating to the stock. Based on data from MarketBeat, the stock presently has an average rating of "Hold" and a consensus target price of $80.92.

Get Our Latest Stock Analysis on Boston Properties

Boston Properties Stock Performance

Shares of NYSE BXP traded down $0.12 during trading on Monday, hitting $78.41. The company had a trading volume of 1,066,277 shares, compared to its average volume of 1,273,649. The stock has a 50 day simple moving average of $82.02 and a 200 day simple moving average of $71.14. The company has a debt-to-equity ratio of 2.01, a quick ratio of 5.51 and a current ratio of 5.51. Boston Properties has a 12 month low of $52.61 and a 12 month high of $90.11. The firm has a market capitalization of $12.40 billion, a P/E ratio of 34.00, a price-to-earnings-growth ratio of 0.54 and a beta of 1.18.

Boston Properties (NYSE:BXP - Get Free Report) last issued its earnings results on Tuesday, October 29th. The real estate investment trust reported $0.53 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.81 by ($1.28). The business had revenue of $859.23 million for the quarter, compared to the consensus estimate of $829.91 million. Boston Properties had a net margin of 10.75% and a return on equity of 4.40%. The firm's revenue for the quarter was up 4.2% compared to the same quarter last year. During the same period last year, the business posted $1.86 EPS. As a group, analysts anticipate that Boston Properties will post 7.1 earnings per share for the current year.

Insider Activity at Boston Properties

In other Boston Properties news, EVP Peter V. Otteni sold 4,785 shares of the business's stock in a transaction dated Friday, August 23rd. The stock was sold at an average price of $73.44, for a total transaction of $351,410.40. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, EVP Raymond A. Ritchey sold 21,835 shares of the business's stock in a transaction dated Monday, September 9th. The shares were sold at an average price of $74.25, for a total value of $1,621,248.75. The disclosure for this sale can be found here. 1.35% of the stock is currently owned by corporate insiders.

Institutional Trading of Boston Properties

A number of hedge funds have recently modified their holdings of BXP. Earnest Partners LLC boosted its stake in shares of Boston Properties by 25.9% in the second quarter. Earnest Partners LLC now owns 2,637,235 shares of the real estate investment trust's stock worth $162,348,000 after buying an additional 542,610 shares during the last quarter. Sei Investments Co. boosted its position in Boston Properties by 32.9% during the second quarter. Sei Investments Co. now owns 1,503,687 shares of the real estate investment trust's stock worth $92,567,000 after purchasing an additional 371,946 shares in the last quarter. Swedbank AB acquired a new position in shares of Boston Properties during the first quarter valued at approximately $16,729,000. Point72 Asset Management L.P. acquired a new position in shares of Boston Properties during the second quarter valued at approximately $12,914,000. Finally, AMF Tjanstepension AB acquired a new position in shares of Boston Properties during the second quarter valued at approximately $8,941,000. Hedge funds and other institutional investors own 98.72% of the company's stock.

Boston Properties Company Profile

(

Get Free Report)

Boston Properties, Inc NYSE: BXP (BXP or the Company) is the largest publicly traded developer, owner, and manager of premier workplaces in the United States, concentrated in six dynamic gateway markets - Boston, Los Angeles, New York, San Francisco, Seattle, and Washington, DC. BXP has delivered places that power progress for our clients and communities for more than 50 years.

Featured Articles

Before you consider Boston Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boston Properties wasn't on the list.

While Boston Properties currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.