FMR LLC lowered its stake in shares of Bowlero Corp. (NYSE:BOWL - Free Report) by 17.1% during the third quarter, according to its most recent Form 13F filing with the SEC. The fund owned 1,289,040 shares of the company's stock after selling 265,323 shares during the period. FMR LLC owned 0.87% of Bowlero worth $15,133,000 at the end of the most recent quarter.

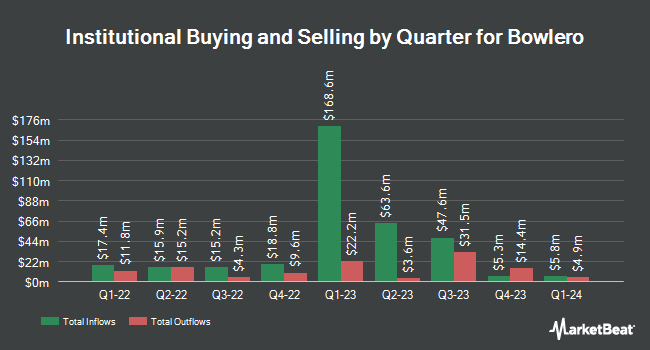

A number of other hedge funds and other institutional investors have also modified their holdings of BOWL. Price T Rowe Associates Inc. MD boosted its holdings in Bowlero by 7.0% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 14,953 shares of the company's stock valued at $205,000 after purchasing an additional 978 shares during the last quarter. Victory Capital Management Inc. raised its holdings in Bowlero by 13.1% in the 3rd quarter. Victory Capital Management Inc. now owns 33,099 shares of the company's stock valued at $389,000 after buying an additional 3,835 shares during the period. Schwartz Investment Counsel Inc. increased its position in shares of Bowlero by 5.2% during the second quarter. Schwartz Investment Counsel Inc. now owns 94,400 shares of the company's stock valued at $1,368,000 after acquiring an additional 4,700 shares during the last quarter. Summit Securities Group LLC purchased a new stake in shares of Bowlero in the 2nd quarter valued at approximately $392,000. Finally, XTX Topco Ltd acquired a new position in shares of Bowlero in the 2nd quarter worth approximately $411,000. 68.11% of the stock is owned by institutional investors and hedge funds.

Bowlero Trading Down 3.5 %

Shares of NYSE BOWL traded down $0.42 during trading hours on Wednesday, reaching $11.70. The stock had a trading volume of 569,573 shares, compared to its average volume of 796,863. The firm has a 50-day moving average of $11.71 and a 200-day moving average of $12.20. The firm has a market cap of $1.72 billion, a price-to-earnings ratio of -19.81 and a beta of 0.69. Bowlero Corp. has a fifty-two week low of $9.70 and a fifty-two week high of $15.47.

Bowlero (NYSE:BOWL - Get Free Report) last issued its quarterly earnings results on Monday, November 4th. The company reported $0.13 earnings per share for the quarter, topping analysts' consensus estimates of ($0.17) by $0.30. Bowlero had a negative net margin of 6.63% and a negative return on equity of 31.58%. The firm had revenue of $260.20 million during the quarter, compared to analysts' expectations of $249.42 million. During the same quarter in the prior year, the business earned ($0.10) EPS. On average, equities analysts predict that Bowlero Corp. will post 0.45 EPS for the current year.

Bowlero Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Friday, December 6th. Stockholders of record on Friday, November 22nd were issued a $0.055 dividend. This represents a $0.22 dividend on an annualized basis and a dividend yield of 1.88%. The ex-dividend date was Friday, November 22nd. Bowlero's payout ratio is currently -36.07%.

Wall Street Analysts Forecast Growth

BOWL has been the subject of a number of research reports. Piper Sandler assumed coverage on Bowlero in a research note on Monday, October 28th. They issued a "neutral" rating and a $12.00 price objective for the company. Truist Financial started coverage on shares of Bowlero in a report on Tuesday. They issued a "buy" rating and a $16.00 price objective for the company. Canaccord Genuity Group reiterated a "buy" rating and set a $18.00 target price on shares of Bowlero in a report on Monday, September 30th. JPMorgan Chase & Co. dropped their price target on shares of Bowlero from $16.00 to $15.00 and set an "overweight" rating for the company in a research note on Tuesday, November 5th. Finally, Royal Bank of Canada upgraded Bowlero to a "moderate buy" rating in a report on Thursday, October 3rd. Two analysts have rated the stock with a hold rating and eight have issued a buy rating to the company's stock. Based on data from MarketBeat, Bowlero currently has a consensus rating of "Moderate Buy" and an average target price of $15.89.

Read Our Latest Report on BOWL

Bowlero Company Profile

(

Free Report)

Bowlero Corp. operates bowling entertainment centers under the AMF, Bowlmor Lanes, and Bowlero brand names. The company also provides hosting and overseeing professional and non-professional bowling tournaments and related broadcasting. It operates bowling centers in the United States, Mexico, and Canada.

Featured Articles

Before you consider Bowlero, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bowlero wasn't on the list.

While Bowlero currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.