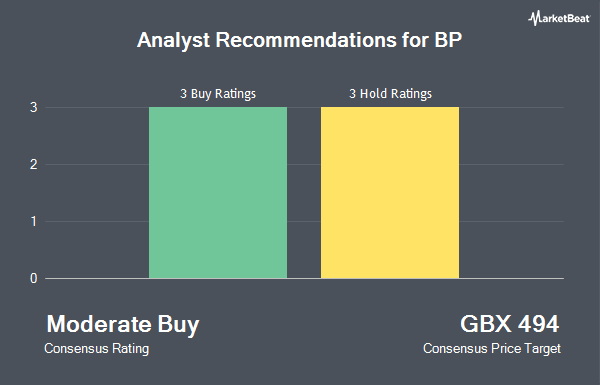

Shares of BP p.l.c. (LON:BP - Get Free Report) have been given an average recommendation of "Hold" by the eight research firms that are covering the company, Marketbeat reports. Two analysts have rated the stock with a sell rating, one has given a hold rating and five have issued a buy rating on the company. The average 12 month target price among brokerages that have issued a report on the stock in the last year is GBX 595 ($7.44).

Several research firms have recently commented on BP. Jefferies Financial Group reissued a "buy" rating and issued a GBX 540 ($6.75) target price on shares of BP in a report on Monday, December 16th. Berenberg Bank decreased their price target on shares of BP from GBX 470 ($5.88) to GBX 440 ($5.50) and set a "hold" rating on the stock in a research note on Friday, November 29th. Finally, JPMorgan Chase & Co. upped their price target on shares of BP from GBX 425 ($5.31) to GBX 440 ($5.50) and gave the company an "underweight" rating in a research note on Tuesday, January 14th.

Get Our Latest Stock Analysis on BP

Insider Buying and Selling

In other BP news, insider Murray Auchincloss bought 100 shares of the business's stock in a transaction on Monday, November 11th. The shares were bought at an average cost of GBX 373 ($4.66) per share, with a total value of £373 ($466.31). In the last quarter, insiders purchased 283 shares of company stock worth $111,954. 0.26% of the stock is owned by corporate insiders.

BP Stock Up 0.5 %

LON BP traded up GBX 2.20 ($0.03) during trading hours on Friday, reaching GBX 422.20 ($5.28). 43,779,088 shares of the company's stock traded hands, compared to its average volume of 8,560,774. The company has a debt-to-equity ratio of 79.91, a current ratio of 1.24 and a quick ratio of 0.62. The firm has a market cap of £66.92 billion, a PE ratio of 1,279.39, a PEG ratio of 0.35 and a beta of 0.49. BP has a 52-week low of GBX 379.70 ($4.75) and a 52-week high of GBX 562.30 ($7.03). The firm has a 50-day simple moving average of GBX 402.13 and a 200 day simple moving average of GBX 408.57.

About BP

(

Get Free ReportBP p.l.c. provides carbon products and services. The company operates through Gas & Low Carbon Energy, Oil Production & Operations, and Customers & Products segments. It engages in the production of natural gas, and integrated gas and power; trading of gas; operation of onshore and offshore wind power, as well as hydrogen and carbon capture and storage facilities; trading and marketing of renewable and non-renewable power; and production of crude oil.

Featured Articles

Before you consider BP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BP wasn't on the list.

While BP currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.