Braidwell LP boosted its holdings in Align Technology, Inc. (NASDAQ:ALGN - Free Report) by 13.3% in the third quarter, according to its most recent Form 13F filing with the SEC. The fund owned 311,679 shares of the medical equipment provider's stock after purchasing an additional 36,472 shares during the period. Align Technology comprises 2.2% of Braidwell LP's portfolio, making the stock its 14th largest position. Braidwell LP owned 0.42% of Align Technology worth $79,266,000 as of its most recent SEC filing.

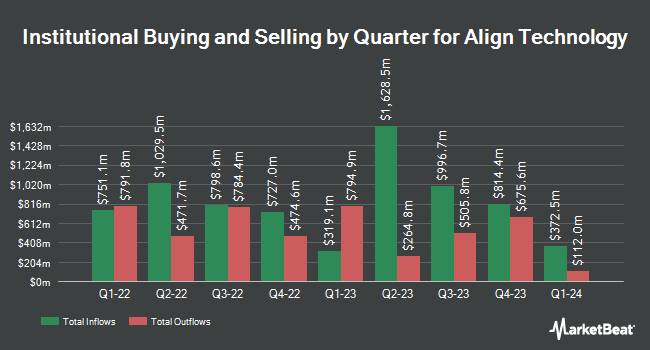

A number of other hedge funds have also recently bought and sold shares of ALGN. Tidal Investments LLC grew its holdings in Align Technology by 122.9% during the 1st quarter. Tidal Investments LLC now owns 4,408 shares of the medical equipment provider's stock worth $1,445,000 after acquiring an additional 2,430 shares in the last quarter. Comerica Bank increased its holdings in Align Technology by 4.9% in the first quarter. Comerica Bank now owns 28,842 shares of the medical equipment provider's stock valued at $9,458,000 after buying an additional 1,352 shares during the last quarter. LRI Investments LLC acquired a new stake in Align Technology during the first quarter valued at approximately $29,000. Cetera Investment Advisers lifted its holdings in Align Technology by 914.2% during the 1st quarter. Cetera Investment Advisers now owns 12,627 shares of the medical equipment provider's stock worth $4,140,000 after buying an additional 11,382 shares during the last quarter. Finally, Cetera Advisors LLC bought a new position in Align Technology during the 1st quarter worth approximately $337,000. Institutional investors and hedge funds own 88.43% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities research analysts have recently weighed in on ALGN shares. Stifel Nicolaus dropped their price target on Align Technology from $285.00 to $275.00 and set a "buy" rating on the stock in a research report on Thursday, October 24th. StockNews.com raised shares of Align Technology from a "hold" rating to a "buy" rating in a report on Thursday, September 19th. Piper Sandler reduced their price target on shares of Align Technology from $285.00 to $275.00 and set an "overweight" rating on the stock in a research report on Thursday, October 24th. Morgan Stanley lowered their price objective on shares of Align Technology from $310.00 to $280.00 and set an "overweight" rating for the company in a research report on Thursday, October 24th. Finally, Needham & Company LLC reissued a "hold" rating on shares of Align Technology in a report on Monday, November 4th. One investment analyst has rated the stock with a sell rating, four have issued a hold rating and six have issued a buy rating to the company's stock. Based on data from MarketBeat.com, Align Technology has a consensus rating of "Hold" and a consensus target price of $276.38.

Check Out Our Latest Report on Align Technology

Align Technology Price Performance

ALGN stock traded up $3.11 on Friday, reaching $232.77. The company's stock had a trading volume of 312,009 shares, compared to its average volume of 786,209. The firm has a fifty day moving average of $226.43 and a two-hundred day moving average of $236.31. The company has a market capitalization of $17.38 billion, a P/E ratio of 39.72, a price-to-earnings-growth ratio of 5.95 and a beta of 1.65. Align Technology, Inc. has a 52 week low of $196.09 and a 52 week high of $335.40.

Align Technology (NASDAQ:ALGN - Get Free Report) last issued its quarterly earnings results on Wednesday, October 23rd. The medical equipment provider reported $2.35 EPS for the quarter, beating analysts' consensus estimates of $2.31 by $0.04. The company had revenue of $977.87 million for the quarter, compared to analyst estimates of $990.05 million. Align Technology had a return on equity of 13.99% and a net margin of 11.15%. The company's quarterly revenue was up 1.8% compared to the same quarter last year. During the same period last year, the company earned $1.62 earnings per share. As a group, equities analysts expect that Align Technology, Inc. will post 7.45 EPS for the current fiscal year.

Align Technology Profile

(

Free Report)

Align Technology, Inc designs, manufactures, and markets Invisalign clear aligners, and iTero intraoral scanners and services for orthodontists and general practitioner dentists in the United States, Switzerland, and internationally. The company's Clear Aligner segment offers comprehensive products, including Invisalign comprehensive package that addresses the orthodontic needs of younger patients, such as mandibular advancement, compliance indicators, and compensation for tooth eruption; and Invisalign First Phase I and Invisalign First Comprehensive Phase 2 package for younger patients generally between the ages of six and ten years, which is a mixture of primary/baby and permanent teeth.

Featured Articles

Before you consider Align Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Align Technology wasn't on the list.

While Align Technology currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.