Brandes Investment Partners LP boosted its position in shares of Enel Chile S.A. (NYSE:ENIC - Free Report) by 2.7% during the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 5,707,753 shares of the utilities provider's stock after purchasing an additional 152,430 shares during the period. Brandes Investment Partners LP owned about 0.41% of Enel Chile worth $16,438,000 as of its most recent SEC filing.

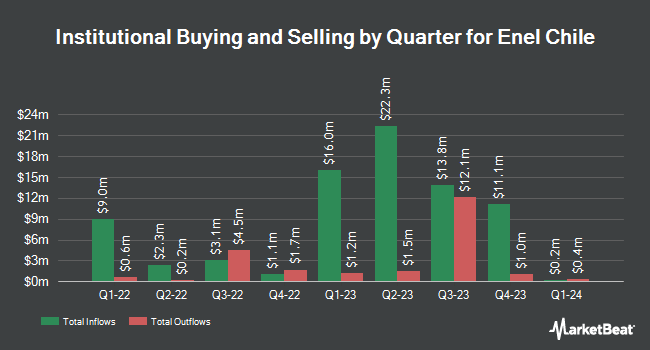

Several other hedge funds also recently added to or reduced their stakes in ENIC. Schechter Investment Advisors LLC grew its stake in Enel Chile by 2.1% in the 4th quarter. Schechter Investment Advisors LLC now owns 165,911 shares of the utilities provider's stock worth $478,000 after acquiring an additional 3,435 shares in the last quarter. Inspire Advisors LLC grew its stake in Enel Chile by 6.9% in the 4th quarter. Inspire Advisors LLC now owns 58,414 shares of the utilities provider's stock worth $168,000 after acquiring an additional 3,792 shares in the last quarter. Advisors Preferred LLC bought a new position in Enel Chile in the 4th quarter worth about $25,000. Intelligence Driven Advisers LLC bought a new position in Enel Chile in the 4th quarter worth about $31,000. Finally, Caprock Group LLC bought a new position in Enel Chile in the 4th quarter worth about $32,000. 3.20% of the stock is currently owned by institutional investors.

Enel Chile Trading Up 1.0 %

Shares of ENIC traded up $0.04 during mid-day trading on Wednesday, hitting $3.45. The company's stock had a trading volume of 521,357 shares, compared to its average volume of 459,905. The company's 50-day moving average is $3.19 and its 200-day moving average is $2.91. Enel Chile S.A. has a 52-week low of $2.51 and a 52-week high of $3.50. The firm has a market capitalization of $4.77 billion, a price-to-earnings ratio of 5.65 and a beta of 1.12.

Wall Street Analysts Forecast Growth

A number of equities analysts have commented on ENIC shares. StockNews.com downgraded shares of Enel Chile from a "buy" rating to a "hold" rating in a research note on Monday, March 3rd. Scotiabank cut shares of Enel Chile from a "sector outperform" rating to a "sector perform" rating and set a $3.90 price target for the company. in a research report on Friday, November 22nd.

View Our Latest Stock Analysis on ENIC

Enel Chile Profile

(

Free Report)

Enel Chile SA, an electricity utility company, engages in the generation, transmission, and distribution of electricity in Chile. The company operates through Generation, and Distribution and Networks Segments. It generates electricity through various sources, such as hydroelectric, thermal, wind, solar, and geothermal power plants.

Featured Articles

Before you consider Enel Chile, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enel Chile wasn't on the list.

While Enel Chile currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.