Brandywine Global Investment Management LLC purchased a new position in Embecta Corp. (NASDAQ:EMBC - Free Report) during the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund purchased 195,768 shares of the company's stock, valued at approximately $4,043,000. Brandywine Global Investment Management LLC owned about 0.34% of Embecta as of its most recent filing with the Securities and Exchange Commission (SEC).

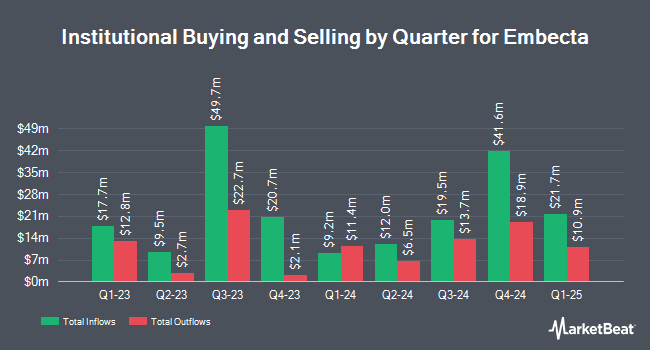

A number of other hedge funds also recently bought and sold shares of the business. Smartleaf Asset Management LLC increased its position in shares of Embecta by 175.1% during the 4th quarter. Smartleaf Asset Management LLC now owns 1,216 shares of the company's stock valued at $25,000 after purchasing an additional 774 shares during the last quarter. Quarry LP purchased a new position in Embecta during the third quarter worth $30,000. Oppenheimer Asset Management Inc. bought a new position in Embecta during the fourth quarter valued at $209,000. Intech Investment Management LLC purchased a new stake in shares of Embecta in the third quarter valued at $211,000. Finally, KLP Kapitalforvaltning AS bought a new stake in shares of Embecta in the 4th quarter worth about $215,000. Hedge funds and other institutional investors own 93.83% of the company's stock.

Embecta Trading Down 3.0 %

Shares of EMBC stock traded down $0.37 during trading hours on Friday, reaching $12.00. 1,414,450 shares of the stock were exchanged, compared to its average volume of 446,761. The firm has a market capitalization of $697.61 million, a price-to-earnings ratio of 12.00, a price-to-earnings-growth ratio of 0.78 and a beta of 1.23. Embecta Corp. has a 12-month low of $9.93 and a 12-month high of $21.48. The company's 50-day moving average price is $14.62 and its 200-day moving average price is $16.15.

Embecta (NASDAQ:EMBC - Get Free Report) last announced its quarterly earnings data on Thursday, February 6th. The company reported $0.65 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.45 by $0.20. Embecta had a net margin of 5.25% and a negative return on equity of 19.22%. On average, sell-side analysts expect that Embecta Corp. will post 2.85 EPS for the current year.

Embecta Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, March 14th. Stockholders of record on Friday, February 28th were given a dividend of $0.15 per share. The ex-dividend date of this dividend was Friday, February 28th. This represents a $0.60 annualized dividend and a dividend yield of 5.00%. Embecta's dividend payout ratio (DPR) is 60.00%.

Insider Transactions at Embecta

In other Embecta news, Director Milton Mayo Morris sold 3,100 shares of the company's stock in a transaction dated Thursday, February 13th. The shares were sold at an average price of $16.38, for a total value of $50,778.00. Following the transaction, the director now directly owns 36,133 shares in the company, valued at $591,858.54. This represents a 7.90 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Corporate insiders own 0.42% of the company's stock.

About Embecta

(

Free Report)

Embecta Corp., a medical device company, focuses on the provision of various solutions to enhance the health and wellbeing of people living with diabetes. Its products include pen needles, syringes, and safety injection devices, as well as digital applications to assist people with managing patient's diabetes.

Featured Articles

Before you consider Embecta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Embecta wasn't on the list.

While Embecta currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.