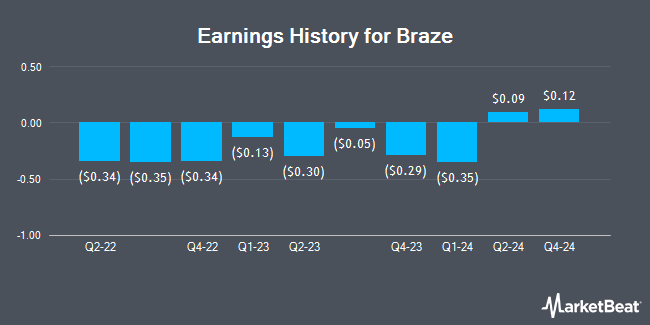

Braze (NASDAQ:BRZE - Get Free Report) posted its quarterly earnings data on Thursday. The company reported $0.12 EPS for the quarter, beating analysts' consensus estimates of $0.05 by $0.07, Briefing.com reports. The business had revenue of $160.40 million for the quarter, compared to analyst estimates of $155.72 million. Braze had a negative net margin of 20.41% and a negative return on equity of 24.88%. The business's revenue for the quarter was up 22.4% on a year-over-year basis. During the same quarter last year, the business earned ($0.04) earnings per share.

Braze Stock Performance

Shares of NASDAQ BRZE traded down $0.44 during mid-day trading on Tuesday, reaching $35.64. 407,469 shares of the company traded hands, compared to its average volume of 1,210,736. The company's fifty day moving average is $39.50 and its two-hundred day moving average is $38.04. Braze has a fifty-two week low of $29.18 and a fifty-two week high of $48.33. The stock has a market cap of $3.69 billion, a PE ratio of -31.25 and a beta of 1.17.

Analyst Ratings Changes

BRZE has been the topic of several research reports. DA Davidson reaffirmed a "buy" rating and issued a $50.00 price target on shares of Braze in a report on Wednesday, March 26th. Raymond James boosted their price objective on Braze from $45.00 to $48.00 and gave the stock an "outperform" rating in a report on Friday. Citigroup raised their target price on shares of Braze from $50.00 to $55.00 and gave the stock a "buy" rating in a report on Friday. Canaccord Genuity Group boosted their price target on shares of Braze from $45.00 to $50.00 and gave the company a "buy" rating in a report on Friday. Finally, Stephens began coverage on shares of Braze in a research note on Wednesday, March 19th. They issued an "overweight" rating and a $43.00 price objective for the company. One investment analyst has rated the stock with a hold rating, nineteen have assigned a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, Braze presently has an average rating of "Buy" and an average target price of $53.00.

Read Our Latest Analysis on BRZE

Insider Buying and Selling at Braze

In related news, General Counsel Susan Wiseman sold 14,000 shares of Braze stock in a transaction on Monday, January 6th. The shares were sold at an average price of $45.52, for a total value of $637,280.00. Following the transaction, the general counsel now owns 199,520 shares in the company, valued at $9,082,150.40. This trade represents a 6.56 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, insider Myles Kleeger sold 8,365 shares of the business's stock in a transaction on Thursday, February 20th. The stock was sold at an average price of $40.12, for a total transaction of $335,603.80. Following the transaction, the insider now directly owns 168,882 shares of the company's stock, valued at approximately $6,775,545.84. This represents a 4.72 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 89,470 shares of company stock worth $3,841,921 over the last 90 days. Insiders own 24.03% of the company's stock.

Braze Company Profile

(

Get Free Report)

Braze, Inc operates a customer engagement platform that provides interactions between consumers and brands worldwide. The company offers Braze software development kits that automatically manage data ingestion and deliver mobile and web notifications, in-application/in-browser interstitial messages, and content cards; REST API that can be used to import or export data or to trigger workflows between Braze and brands' existing technology stacks; Partner Data Integrations, which allow brands to sync user cohorts from partners; Data Transformation, in which brands can programmatically sync and transform user data; and Braze Cloud Data Ingestion that enables brands to harness their customer data.

Read More

Before you consider Braze, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Braze wasn't on the list.

While Braze currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.