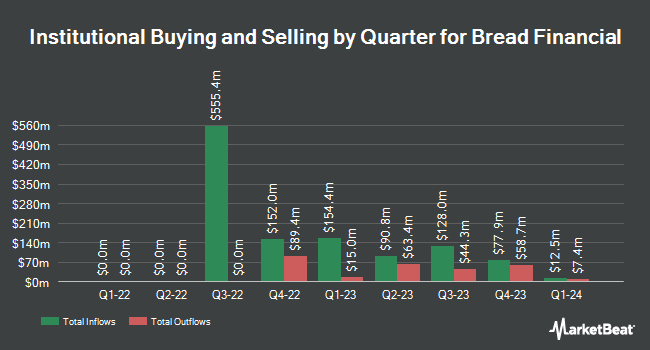

XTX Topco Ltd increased its holdings in Bread Financial Holdings, Inc. (NYSE:BFH - Free Report) by 94.1% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 35,190 shares of the company's stock after purchasing an additional 17,057 shares during the quarter. XTX Topco Ltd owned approximately 0.07% of Bread Financial worth $1,674,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other large investors also recently modified their holdings of the business. Price T Rowe Associates Inc. MD lifted its holdings in Bread Financial by 5.8% in the first quarter. Price T Rowe Associates Inc. MD now owns 33,782 shares of the company's stock worth $1,259,000 after buying an additional 1,856 shares during the period. CWM LLC lifted its holdings in shares of Bread Financial by 47.5% during the second quarter. CWM LLC now owns 1,708 shares of the company's stock valued at $76,000 after purchasing an additional 550 shares during the last quarter. Neo Ivy Capital Management purchased a new position in shares of Bread Financial during the second quarter valued at approximately $3,109,000. Pallas Capital Advisors LLC purchased a new position in shares of Bread Financial during the second quarter valued at approximately $201,000. Finally, Louisiana State Employees Retirement System lifted its holdings in shares of Bread Financial by 2.0% during the second quarter. Louisiana State Employees Retirement System now owns 24,900 shares of the company's stock valued at $1,110,000 after purchasing an additional 500 shares during the last quarter. 99.52% of the stock is owned by institutional investors.

Bread Financial Stock Performance

Shares of BFH stock traded up $1.23 during mid-day trading on Friday, reaching $63.19. 600,596 shares of the company's stock traded hands, compared to its average volume of 634,771. Bread Financial Holdings, Inc. has a 12 month low of $28.00 and a 12 month high of $63.25. The firm has a 50 day moving average price of $54.17 and a two-hundred day moving average price of $50.32. The company has a debt-to-equity ratio of 0.33, a quick ratio of 1.19 and a current ratio of 1.19. The firm has a market capitalization of $3.14 billion, a PE ratio of 10.06 and a beta of 1.96.

Bread Financial (NYSE:BFH - Get Free Report) last issued its quarterly earnings data on Thursday, October 24th. The company reported $1.83 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.86 by ($0.03). Bread Financial had a net margin of 6.37% and a return on equity of 13.33%. The business had revenue of $983.00 million for the quarter, compared to the consensus estimate of $981.26 million. During the same period in the previous year, the firm earned $3.46 EPS. The company's revenue was down 4.7% on a year-over-year basis. On average, research analysts forecast that Bread Financial Holdings, Inc. will post 7.49 EPS for the current year.

Bread Financial Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, December 13th. Investors of record on Friday, November 8th will be paid a dividend of $0.21 per share. This represents a $0.84 dividend on an annualized basis and a dividend yield of 1.33%. The ex-dividend date of this dividend is Friday, November 8th. Bread Financial's dividend payout ratio (DPR) is 13.38%.

Analyst Ratings Changes

Several equities analysts have recently issued reports on the stock. The Goldman Sachs Group lifted their target price on shares of Bread Financial from $52.00 to $58.00 and gave the company a "sell" rating in a report on Tuesday, November 19th. Bank of America lowered their target price on shares of Bread Financial from $61.00 to $57.00 and set a "buy" rating for the company in a report on Wednesday, September 25th. Barclays decreased their price objective on shares of Bread Financial from $35.00 to $34.00 and set an "underweight" rating for the company in a report on Friday, October 25th. JPMorgan Chase & Co. boosted their price objective on shares of Bread Financial from $48.00 to $59.00 and gave the stock a "neutral" rating in a report on Tuesday, August 20th. Finally, Evercore ISI boosted their price objective on shares of Bread Financial from $52.00 to $54.00 and gave the stock an "in-line" rating in a report on Wednesday, October 30th. Three investment analysts have rated the stock with a sell rating, nine have issued a hold rating and five have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Hold" and an average target price of $50.00.

View Our Latest Stock Analysis on BFH

Insider Activity at Bread Financial

In related news, Director John J. Fawcett purchased 1,000 shares of the firm's stock in a transaction on Monday, October 28th. The shares were acquired at an average price of $51.02 per share, for a total transaction of $51,020.00. Following the purchase, the director now directly owns 6,473 shares in the company, valued at $330,252.46. This trade represents a 18.27 % increase in their ownership of the stock. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. 0.62% of the stock is owned by corporate insiders.

Bread Financial Company Profile

(

Free Report)

Bread Financial Holdings, Inc provides tech-forward payment and lending solutions to customers and consumer-based industries in North America. It offers credit card and other loans financing services, including risk management solutions, account origination, and funding services for private label and co-brand credit card programs, as well as through Bread partnerships; and Comenity-branded general purpose cash-back credit.

See Also

Before you consider Bread Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bread Financial wasn't on the list.

While Bread Financial currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.