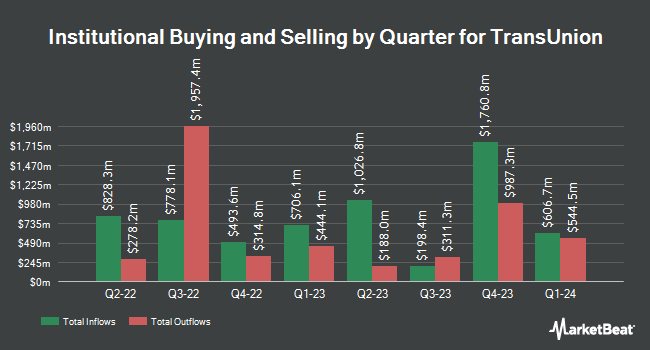

Bridgewater Associates LP decreased its position in shares of TransUnion (NYSE:TRU - Free Report) by 54.2% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 213,822 shares of the business services provider's stock after selling 253,083 shares during the quarter. Bridgewater Associates LP owned 0.11% of TransUnion worth $22,387,000 as of its most recent filing with the Securities & Exchange Commission.

Other institutional investors have also recently made changes to their positions in the company. Huntington National Bank boosted its holdings in TransUnion by 84.5% in the third quarter. Huntington National Bank now owns 286 shares of the business services provider's stock worth $30,000 after purchasing an additional 131 shares during the last quarter. Quarry LP boosted its holdings in TransUnion by 963.0% in the second quarter. Quarry LP now owns 574 shares of the business services provider's stock worth $43,000 after purchasing an additional 520 shares during the last quarter. National Bank of Canada FI boosted its holdings in TransUnion by 22.3% in the second quarter. National Bank of Canada FI now owns 910 shares of the business services provider's stock worth $66,000 after purchasing an additional 166 shares during the last quarter. Blue Trust Inc. boosted its holdings in TransUnion by 156.6% in the second quarter. Blue Trust Inc. now owns 857 shares of the business services provider's stock worth $68,000 after purchasing an additional 523 shares during the last quarter. Finally, Ridgewood Investments LLC purchased a new stake in TransUnion in the second quarter worth approximately $75,000.

Insider Buying and Selling at TransUnion

In related news, Director George M. Awad sold 12,000 shares of the company's stock in a transaction dated Monday, November 25th. The shares were sold at an average price of $100.00, for a total transaction of $1,200,000.00. Following the transaction, the director now directly owns 27,026 shares in the company, valued at approximately $2,702,600. This represents a 30.75 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, insider Steven M. Chaouki sold 1,000 shares of the stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $95.65, for a total transaction of $95,650.00. Following the completion of the sale, the insider now directly owns 64,488 shares in the company, valued at $6,168,277.20. This trade represents a 1.53 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 19,500 shares of company stock worth $1,954,740 over the last ninety days. Company insiders own 0.28% of the company's stock.

TransUnion Price Performance

NYSE TRU traded up $0.27 during trading on Thursday, hitting $101.00. 820,115 shares of the stock traded hands, compared to its average volume of 1,606,387. The company has a market capitalization of $19.68 billion, a P/E ratio of 87.83, a price-to-earnings-growth ratio of 1.42 and a beta of 1.62. TransUnion has a 12-month low of $56.85 and a 12-month high of $113.17. The firm has a 50-day simple moving average of $103.70 and a 200-day simple moving average of $90.18. The company has a quick ratio of 1.68, a current ratio of 1.68 and a debt-to-equity ratio of 1.19.

TransUnion (NYSE:TRU - Get Free Report) last released its quarterly earnings results on Wednesday, October 23rd. The business services provider reported $1.04 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.01 by $0.03. TransUnion had a net margin of 5.47% and a return on equity of 15.38%. The company had revenue of $1.09 billion for the quarter, compared to the consensus estimate of $1.06 billion. During the same quarter in the prior year, the firm earned $0.80 earnings per share. TransUnion's revenue was up 12.0% on a year-over-year basis. As a group, analysts predict that TransUnion will post 3.45 EPS for the current year.

TransUnion Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Monday, December 9th. Shareholders of record on Friday, November 22nd will be paid a dividend of $0.105 per share. The ex-dividend date is Friday, November 22nd. This represents a $0.42 annualized dividend and a yield of 0.42%. TransUnion's payout ratio is currently 36.52%.

Analysts Set New Price Targets

Several brokerages recently issued reports on TRU. Royal Bank of Canada restated an "outperform" rating and issued a $121.00 target price on shares of TransUnion in a report on Thursday, October 24th. Oppenheimer dropped their target price on shares of TransUnion from $122.00 to $115.00 and set an "outperform" rating on the stock in a report on Wednesday, November 20th. The Goldman Sachs Group lifted their price target on shares of TransUnion from $97.00 to $109.00 and gave the stock a "neutral" rating in a research note on Wednesday, October 2nd. Needham & Company LLC reiterated a "hold" rating on shares of TransUnion in a research note on Thursday, October 24th. Finally, Robert W. Baird lifted their price target on shares of TransUnion from $104.00 to $130.00 and gave the stock an "outperform" rating in a research note on Thursday, October 24th. Seven analysts have rated the stock with a hold rating and ten have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $106.38.

Check Out Our Latest Stock Report on TransUnion

TransUnion Profile

(

Free Report)

TransUnion operates as a global consumer credit reporting agency that provides risk and information solutions. The company operates through U.S. Markets, International, and Consumer Interactive segments. The U.S. Markets segment provides consumer reports, actionable insights, and analytic services to businesses, which uses its services to acquire new customers; assess consumer ability to pay for services; identify cross-selling opportunities; measure and manage debt portfolio risk; collect debt; verify consumer identities; and mitigate fraud risk.

See Also

Before you consider TransUnion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TransUnion wasn't on the list.

While TransUnion currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.