Bridgewater Associates LP decreased its stake in Inter Parfums, Inc. (NASDAQ:IPAR - Free Report) by 63.5% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 12,267 shares of the company's stock after selling 21,341 shares during the quarter. Bridgewater Associates LP's holdings in Inter Parfums were worth $1,588,000 as of its most recent SEC filing.

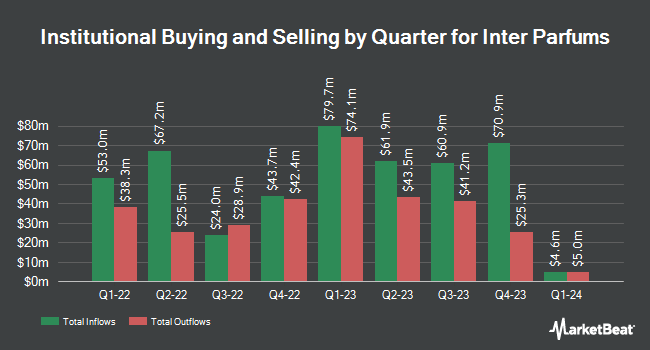

Several other institutional investors have also recently made changes to their positions in the stock. CWM LLC increased its holdings in Inter Parfums by 44.4% in the 2nd quarter. CWM LLC now owns 286 shares of the company's stock worth $33,000 after acquiring an additional 88 shares in the last quarter. Commonwealth Equity Services LLC boosted its position in shares of Inter Parfums by 2.8% in the second quarter. Commonwealth Equity Services LLC now owns 3,363 shares of the company's stock worth $390,000 after purchasing an additional 92 shares during the period. Louisiana State Employees Retirement System increased its stake in shares of Inter Parfums by 1.1% in the second quarter. Louisiana State Employees Retirement System now owns 9,000 shares of the company's stock worth $1,044,000 after purchasing an additional 100 shares in the last quarter. Arizona State Retirement System increased its stake in shares of Inter Parfums by 2.0% in the second quarter. Arizona State Retirement System now owns 5,378 shares of the company's stock worth $624,000 after purchasing an additional 105 shares in the last quarter. Finally, Inspire Investing LLC raised its position in shares of Inter Parfums by 3.9% during the 3rd quarter. Inspire Investing LLC now owns 3,208 shares of the company's stock valued at $415,000 after purchasing an additional 120 shares during the period. Institutional investors own 55.57% of the company's stock.

Inter Parfums Price Performance

Shares of Inter Parfums stock traded up $2.26 during trading on Monday, reaching $139.92. 137,626 shares of the stock traded hands, compared to its average volume of 144,973. Inter Parfums, Inc. has a 52-week low of $108.39 and a 52-week high of $156.75. The company has a debt-to-equity ratio of 0.14, a current ratio of 2.82 and a quick ratio of 1.60. The business has a fifty day simple moving average of $125.82 and a two-hundred day simple moving average of $123.53. The company has a market capitalization of $4.48 billion, a price-to-earnings ratio of 30.03 and a beta of 1.16.

Inter Parfums (NASDAQ:IPAR - Get Free Report) last released its quarterly earnings results on Wednesday, November 6th. The company reported $1.93 earnings per share for the quarter, beating the consensus estimate of $1.83 by $0.10. The business had revenue of $425.00 million during the quarter, compared to analysts' expectations of $425.00 million. Inter Parfums had a return on equity of 16.34% and a net margin of 10.60%. The firm's revenue for the quarter was up 15.5% compared to the same quarter last year. During the same quarter last year, the business posted $1.66 EPS. Sell-side analysts expect that Inter Parfums, Inc. will post 5.15 EPS for the current year.

Wall Street Analysts Forecast Growth

Several research analysts recently weighed in on the stock. StockNews.com raised shares of Inter Parfums from a "sell" rating to a "hold" rating in a report on Wednesday, August 7th. Piper Sandler dropped their price objective on Inter Parfums from $158.00 to $155.00 and set an "overweight" rating for the company in a research note on Wednesday, November 13th. BWS Financial reissued a "buy" rating and set a $172.00 target price on shares of Inter Parfums in a research note on Monday, November 11th. Finally, DA Davidson restated a "buy" rating and issued a $163.00 price target on shares of Inter Parfums in a research note on Tuesday, November 12th. One equities research analyst has rated the stock with a hold rating and four have issued a buy rating to the stock. Based on data from MarketBeat.com, Inter Parfums has a consensus rating of "Moderate Buy" and a consensus price target of $157.50.

Get Our Latest Stock Report on IPAR

Insider Buying and Selling at Inter Parfums

In other news, COO Pelayo Frederic Garcia sold 4,000 shares of Inter Parfums stock in a transaction that occurred on Friday, November 22nd. The stock was sold at an average price of $133.04, for a total value of $532,160.00. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. 43.90% of the stock is owned by company insiders.

Inter Parfums Profile

(

Free Report)

Inter Parfums, Inc, together with its subsidiaries, manufactures, markets, and distributes a range of fragrances and fragrance related products in the United States and internationally. It operates in two segments, European Based Operations and United States Based Operations. The company offers its fragrance and cosmetic products under the Boucheron, Coach, Jimmy Choo, Karl Lagerfeld, Kate Spade, Lanvin, Moncler, Montblanc, Rochas, S.T.

Recommended Stories

Before you consider Inter Parfums, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Inter Parfums wasn't on the list.

While Inter Parfums currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.