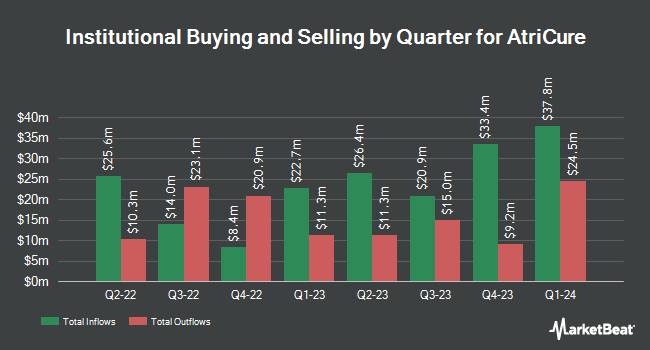

Bridgewater Associates LP decreased its position in AtriCure, Inc. (NASDAQ:ATRC - Free Report) by 51.2% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 19,685 shares of the medical device company's stock after selling 20,632 shares during the quarter. Bridgewater Associates LP's holdings in AtriCure were worth $552,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other institutional investors also recently made changes to their positions in ATRC. Arcadia Investment Management Corp MI purchased a new stake in shares of AtriCure during the third quarter valued at approximately $28,000. Comerica Bank grew its holdings in AtriCure by 70.5% in the 1st quarter. Comerica Bank now owns 2,522 shares of the medical device company's stock worth $77,000 after acquiring an additional 1,043 shares during the last quarter. nVerses Capital LLC increased its position in shares of AtriCure by 733.3% in the third quarter. nVerses Capital LLC now owns 5,000 shares of the medical device company's stock valued at $140,000 after acquiring an additional 4,400 shares during the period. Quest Partners LLC raised its stake in shares of AtriCure by 38.3% during the second quarter. Quest Partners LLC now owns 5,868 shares of the medical device company's stock valued at $134,000 after acquiring an additional 1,626 shares during the last quarter. Finally, Mount Yale Investment Advisors LLC boosted its holdings in shares of AtriCure by 32.1% during the second quarter. Mount Yale Investment Advisors LLC now owns 9,743 shares of the medical device company's stock worth $222,000 after purchasing an additional 2,368 shares during the period. Hedge funds and other institutional investors own 99.11% of the company's stock.

AtriCure Stock Down 2.5 %

AtriCure stock traded down $0.94 during mid-day trading on Tuesday, hitting $36.12. The company had a trading volume of 484,789 shares, compared to its average volume of 711,201. AtriCure, Inc. has a 12 month low of $18.94 and a 12 month high of $39.04. The company has a market capitalization of $1.76 billion, a PE ratio of -43.63 and a beta of 1.40. The stock's 50 day moving average price is $31.87 and its two-hundred day moving average price is $26.52. The company has a current ratio of 3.62, a quick ratio of 2.59 and a debt-to-equity ratio of 0.13.

AtriCure (NASDAQ:ATRC - Get Free Report) last announced its quarterly earnings data on Tuesday, October 29th. The medical device company reported ($0.17) EPS for the quarter, beating the consensus estimate of ($0.19) by $0.02. The company had revenue of $115.91 million for the quarter, compared to the consensus estimate of $112.23 million. AtriCure had a negative net margin of 8.70% and a negative return on equity of 8.12%. AtriCure's revenue for the quarter was up 17.9% on a year-over-year basis. During the same period in the prior year, the firm posted ($0.20) EPS. As a group, sell-side analysts anticipate that AtriCure, Inc. will post -0.72 earnings per share for the current fiscal year.

Analyst Ratings Changes

ATRC has been the topic of a number of research analyst reports. UBS Group boosted their price target on AtriCure from $35.00 to $40.00 and gave the company a "buy" rating in a report on Wednesday, October 30th. Canaccord Genuity Group upped their target price on AtriCure from $49.00 to $53.00 and gave the company a "buy" rating in a report on Wednesday, October 30th. Oppenheimer lifted their price target on shares of AtriCure from $32.00 to $36.00 and gave the company an "outperform" rating in a report on Wednesday, October 30th. StockNews.com upgraded shares of AtriCure from a "sell" rating to a "hold" rating in a report on Saturday, September 14th. Finally, JPMorgan Chase & Co. lifted their target price on shares of AtriCure from $30.00 to $40.00 and gave the company an "overweight" rating in a research note on Wednesday, October 30th. One analyst has rated the stock with a hold rating and eight have assigned a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $41.00.

View Our Latest Stock Analysis on AtriCure

About AtriCure

(

Free Report)

AtriCure, Inc develops, manufactures, and sells devices for surgical ablation of cardiac tissue, exclusion of the left atrial appendage, and temporarily blocking pain by ablating peripheral nerves to medical centers in the United States, Europe, the Asia-Pacific, and internationally. The company offers Isolator Synergy Clamps, single-use disposable radio frequency products; multifunctional pens and linear ablation devices, such as the MAX Pen device that enables surgeons to evaluate cardiac arrhythmias, perform temporary cardiac pacing, sensing, and stimulation, and ablate cardiac tissue with the same device; and the Coolrail device, which enables users to make longer linear lines of ablation.

Recommended Stories

Before you consider AtriCure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AtriCure wasn't on the list.

While AtriCure currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.