Bridgewater Associates LP purchased a new stake in shares of Open Text Co. (NASDAQ:OTEX - Free Report) TSE: OTC during the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor purchased 37,726 shares of the software maker's stock, valued at approximately $1,257,000.

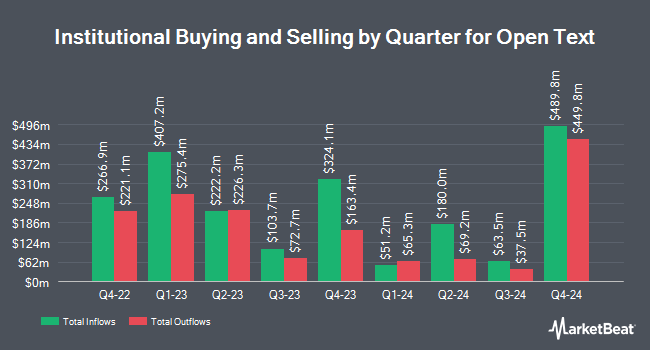

A number of other hedge funds and other institutional investors have also recently modified their holdings of OTEX. Brandes Investment Partners LP raised its position in Open Text by 236.8% in the 2nd quarter. Brandes Investment Partners LP now owns 1,834,835 shares of the software maker's stock worth $55,059,000 after buying an additional 1,290,011 shares during the last quarter. The Manufacturers Life Insurance Company raised its holdings in shares of Open Text by 25.1% during the second quarter. The Manufacturers Life Insurance Company now owns 5,578,835 shares of the software maker's stock valued at $167,277,000 after purchasing an additional 1,118,479 shares during the last quarter. Cooke & Bieler LP raised its holdings in shares of Open Text by 18.6% during the second quarter. Cooke & Bieler LP now owns 5,536,769 shares of the software maker's stock valued at $166,325,000 after purchasing an additional 867,978 shares during the last quarter. JARISLOWSKY FRASER Ltd lifted its position in Open Text by 5.1% during the second quarter. JARISLOWSKY FRASER Ltd now owns 15,702,510 shares of the software maker's stock valued at $471,415,000 after purchasing an additional 767,822 shares during the period. Finally, National Bank of Canada FI grew its position in Open Text by 17.5% in the 2nd quarter. National Bank of Canada FI now owns 4,021,893 shares of the software maker's stock worth $120,390,000 after purchasing an additional 599,790 shares during the period. 70.37% of the stock is owned by institutional investors.

Open Text Price Performance

NASDAQ:OTEX traded down $0.15 during trading hours on Monday, hitting $30.28. 537,110 shares of the stock traded hands, compared to its average volume of 648,800. The stock has a 50 day moving average price of $31.70 and a 200 day moving average price of $31.02. The company has a quick ratio of 0.79, a current ratio of 0.79 and a debt-to-equity ratio of 1.54. The company has a market cap of $8.05 billion, a price-to-earnings ratio of 17.48 and a beta of 1.13. Open Text Co. has a 1 year low of $27.50 and a 1 year high of $45.47.

Open Text (NASDAQ:OTEX - Get Free Report) TSE: OTC last released its earnings results on Thursday, October 31st. The software maker reported $0.93 earnings per share for the quarter, beating analysts' consensus estimates of $0.80 by $0.13. The company had revenue of $1.27 billion for the quarter, compared to analysts' expectations of $1.28 billion. Open Text had a net margin of 8.35% and a return on equity of 24.34%. Open Text's revenue for the quarter was down 11.0% on a year-over-year basis. During the same quarter in the previous year, the company earned $0.90 EPS. Sell-side analysts forecast that Open Text Co. will post 3.37 EPS for the current fiscal year.

Open Text Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, December 20th. Investors of record on Friday, November 29th will be given a dividend of $0.262 per share. The ex-dividend date is Friday, November 29th. This represents a $1.05 annualized dividend and a dividend yield of 3.46%. This is a boost from Open Text's previous quarterly dividend of $0.19. Open Text's dividend payout ratio (DPR) is currently 60.69%.

Analyst Ratings Changes

Several equities analysts have recently weighed in on OTEX shares. Barclays lowered their price target on Open Text from $36.00 to $34.00 and set an "equal weight" rating on the stock in a report on Friday, November 1st. Royal Bank of Canada downgraded Open Text from an "outperform" rating to a "sector perform" rating and lowered their target price for the company from $45.00 to $33.00 in a report on Friday, November 1st. Citigroup cut their price target on Open Text from $34.00 to $33.00 and set a "neutral" rating for the company in a research note on Friday, November 1st. TD Securities lowered their price objective on shares of Open Text from $40.00 to $38.00 and set a "buy" rating on the stock in a research note on Friday, November 1st. Finally, BMO Capital Markets dropped their price objective on shares of Open Text from $33.00 to $32.00 and set a "market perform" rating on the stock in a report on Friday, November 1st. Eight equities research analysts have rated the stock with a hold rating and four have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus price target of $35.90.

Check Out Our Latest Analysis on Open Text

Open Text Profile

(

Free Report)

Open Text Corporation provides information management software and solutions. The company offers content services, which includes content collaboration and intelligent capture to records management, collaboration, e-signatures, and archiving; and operates experience cloud platform that provides customer experience and web content management, digital asset management, customer analytics, AI and insights, e-discovery, digital fax, omnichannel communications, secure messaging, and voice of customer, as well as customer journey, testing, and segmentation.

Featured Articles

Before you consider Open Text, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Open Text wasn't on the list.

While Open Text currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.