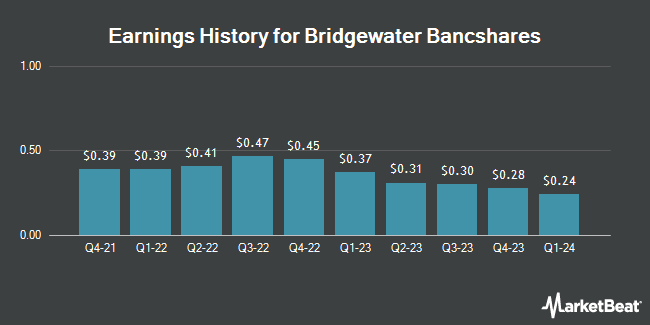

Bridgewater Bancshares (NASDAQ:BWB - Get Free Report) is expected to be announcing its earnings results after the market closes on Wednesday, January 22nd. Analysts expect the company to announce earnings of $0.23 per share and revenue of $28,400.00 billion for the quarter.

Bridgewater Bancshares Trading Up 1.5 %

NASDAQ:BWB traded up $0.20 on Wednesday, hitting $13.26. 30,850 shares of the stock were exchanged, compared to its average volume of 48,321. The stock has a market capitalization of $363.67 million, a price-to-earnings ratio of 12.63 and a beta of 0.68. The company has a debt-to-equity ratio of 1.11, a quick ratio of 1.02 and a current ratio of 1.02. Bridgewater Bancshares has a 52 week low of $10.52 and a 52 week high of $16.00. The company's 50-day moving average price is $14.41 and its 200 day moving average price is $13.97.

Insider Activity at Bridgewater Bancshares

In other Bridgewater Bancshares news, CFO Joseph M. Chybowski sold 3,000 shares of the firm's stock in a transaction dated Wednesday, December 11th. The stock was sold at an average price of $15.51, for a total transaction of $46,530.00. Following the transaction, the chief financial officer now owns 98,416 shares in the company, valued at approximately $1,526,432.16. This trade represents a 2.96 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director David B. Juran sold 2,060 shares of the business's stock in a transaction dated Thursday, October 31st. The stock was sold at an average price of $14.66, for a total value of $30,199.60. Following the transaction, the director now owns 1,341,407 shares of the company's stock, valued at $19,665,026.62. The trade was a 0.15 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 32,046 shares of company stock worth $478,580 over the last ninety days. Company insiders own 23.21% of the company's stock.

Bridgewater Bancshares Company Profile

(

Get Free Report)

Bridgewater Bancshares, Inc operates as the bank holding company for Bridgewater Bank that provides banking products and services to commercial real estate investors, entrepreneurs, business clients, and individuals in the United States. The company provides savings and money market accounts, demand deposits, time and brokered deposits, and interest and noninterest bearing transaction, as well as certificates of deposit.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bridgewater Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bridgewater Bancshares wasn't on the list.

While Bridgewater Bancshares currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.