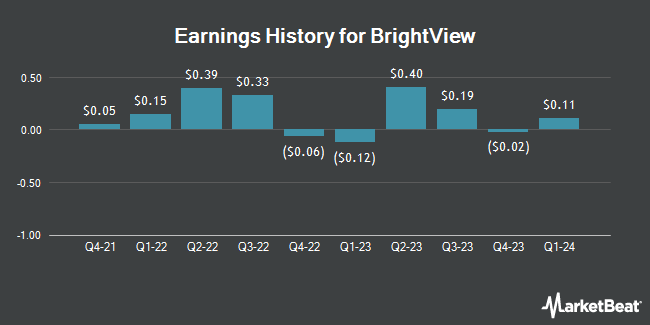

BrightView (NYSE:BV - Get Free Report) posted its earnings results on Wednesday. The company reported $0.30 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.28 by $0.02, Briefing.com reports. The firm had revenue of $728.70 million during the quarter, compared to the consensus estimate of $723.01 million. BrightView had a net margin of 2.40% and a return on equity of 7.69%. The company's revenue was down 2.0% on a year-over-year basis. During the same quarter in the prior year, the company earned $0.14 EPS. BrightView updated its FY 2025 guidance to EPS.

BrightView Stock Performance

BV traded down $0.15 during trading hours on Friday, hitting $15.66. 905,053 shares of the stock were exchanged, compared to its average volume of 623,161. The stock has a 50-day simple moving average of $16.23 and a 200-day simple moving average of $14.67. BrightView has a 12 month low of $6.94 and a 12 month high of $18.89. The stock has a market cap of $1.48 billion, a price-to-earnings ratio of 142.36 and a beta of 1.28. The company has a debt-to-equity ratio of 0.64, a current ratio of 1.45 and a quick ratio of 1.45.

Analysts Set New Price Targets

Several analysts have issued reports on the stock. The Goldman Sachs Group increased their price objective on shares of BrightView from $11.30 to $12.90 and gave the company a "sell" rating in a research report on Friday. Loop Capital increased their price objective on shares of BrightView from $18.00 to $20.00 and gave the company a "buy" rating in a research report on Friday. Robert W. Baird increased their price objective on shares of BrightView from $18.00 to $20.00 and gave the company an "outperform" rating in a research report on Thursday. Jefferies Financial Group raised shares of BrightView from a "hold" rating to a "buy" rating and increased their price objective for the company from $13.00 to $17.00 in a research report on Wednesday, August 21st. Finally, JPMorgan Chase & Co. increased their price objective on shares of BrightView from $11.00 to $14.00 and gave the company an "underweight" rating in a research report on Friday, August 2nd. Two research analysts have rated the stock with a sell rating, one has given a hold rating, five have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat, BrightView has a consensus rating of "Moderate Buy" and a consensus price target of $16.41.

Check Out Our Latest Analysis on BrightView

BrightView Company Profile

(

Get Free Report)

BrightView Holdings, Inc, through its subsidiaries, provides commercial landscaping services in the United States. It operates through two segments, Maintenance Services and Development Services. The Maintenance Services segment delivers a suite of recurring commercial landscaping services, including mowing, gardening, mulching and snow removal, water management, irrigation maintenance, tree care, golf course maintenance, and specialty turf maintenance.

Featured Stories

Before you consider BrightView, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BrightView wasn't on the list.

While BrightView currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.