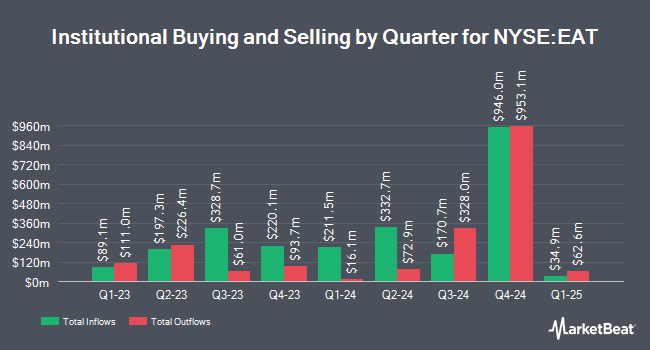

AMJ Financial Wealth Management decreased its position in Brinker International, Inc. (NYSE:EAT - Free Report) by 25.6% in the 4th quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 101,066 shares of the restaurant operator's stock after selling 34,693 shares during the period. Brinker International accounts for 3.7% of AMJ Financial Wealth Management's investment portfolio, making the stock its biggest holding. AMJ Financial Wealth Management owned 0.23% of Brinker International worth $13,370,000 at the end of the most recent quarter.

Other hedge funds have also recently modified their holdings of the company. Geode Capital Management LLC lifted its holdings in Brinker International by 0.8% during the third quarter. Geode Capital Management LLC now owns 998,278 shares of the restaurant operator's stock worth $76,413,000 after acquiring an additional 8,105 shares during the period. Fisher Asset Management LLC boosted its holdings in shares of Brinker International by 4.3% in the 3rd quarter. Fisher Asset Management LLC now owns 691,230 shares of the restaurant operator's stock worth $52,900,000 after buying an additional 28,373 shares during the last quarter. Hennessy Advisors Inc. purchased a new position in shares of Brinker International in the 4th quarter worth about $81,888,000. Wellington Management Group LLP increased its holdings in Brinker International by 55.1% during the third quarter. Wellington Management Group LLP now owns 618,728 shares of the restaurant operator's stock worth $47,351,000 after buying an additional 219,836 shares during the last quarter. Finally, Assenagon Asset Management S.A. boosted its stake in Brinker International by 2,612.4% in the fourth quarter. Assenagon Asset Management S.A. now owns 588,594 shares of the restaurant operator's stock valued at $77,865,000 after acquiring an additional 566,894 shares during the last quarter.

Insider Activity at Brinker International

In related news, Director Cindy L. Davis sold 5,802 shares of the business's stock in a transaction that occurred on Monday, February 3rd. The stock was sold at an average price of $187.86, for a total value of $1,089,963.72. Following the completion of the sale, the director now owns 11,107 shares in the company, valued at $2,086,561.02. The trade was a 34.31 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. Also, COO Douglas N. Comings sold 7,500 shares of the stock in a transaction that occurred on Thursday, February 6th. The shares were sold at an average price of $187.90, for a total transaction of $1,409,250.00. Following the transaction, the chief operating officer now owns 34,252 shares in the company, valued at $6,435,950.80. The trade was a 17.96 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 20,802 shares of company stock valued at $3,752,464 over the last 90 days. 1.72% of the stock is owned by insiders.

Analyst Upgrades and Downgrades

EAT has been the topic of a number of research reports. Northcoast Research raised shares of Brinker International from a "neutral" rating to a "buy" rating and set a $215.00 price target on the stock in a report on Thursday, January 30th. JPMorgan Chase & Co. raised their target price on Brinker International from $140.00 to $160.00 and gave the stock a "neutral" rating in a research report on Thursday, January 30th. StockNews.com raised Brinker International from a "hold" rating to a "buy" rating in a research report on Friday, January 31st. Barclays lifted their price objective on Brinker International from $150.00 to $190.00 and gave the stock an "equal weight" rating in a report on Thursday, January 30th. Finally, Argus raised shares of Brinker International from a "hold" rating to a "buy" rating and set a $150.00 price objective on the stock in a report on Tuesday, December 24th. Fourteen equities research analysts have rated the stock with a hold rating and five have issued a buy rating to the stock. Based on data from MarketBeat, the company has an average rating of "Hold" and a consensus price target of $140.18.

Read Our Latest Analysis on EAT

Brinker International Price Performance

Shares of EAT traded up $1.95 during trading hours on Friday, reaching $141.42. 1,771,448 shares of the company's stock traded hands, compared to its average volume of 1,394,431. Brinker International, Inc. has a 12 month low of $43.37 and a 12 month high of $192.22. The company has a current ratio of 0.33, a quick ratio of 0.27 and a debt-to-equity ratio of 4.96. The stock has a market cap of $6.28 billion, a PE ratio of 24.51, a price-to-earnings-growth ratio of 0.49 and a beta of 2.56. The firm's 50 day simple moving average is $154.61 and its 200-day simple moving average is $118.36.

Brinker International (NYSE:EAT - Get Free Report) last announced its earnings results on Wednesday, January 29th. The restaurant operator reported $2.80 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.37 by $1.43. Brinker International had a net margin of 5.45% and a return on equity of 879.47%. Equities analysts expect that Brinker International, Inc. will post 8.3 EPS for the current year.

About Brinker International

(

Free Report)

Brinker International, Inc, together with its subsidiaries, engages in the ownership, development, operation, and franchising of casual dining restaurants in the United States and internationally. It operates and franchises Chili's Grill & Bar and Maggiano's Little Italy restaurant brands.

See Also

Before you consider Brinker International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brinker International wasn't on the list.

While Brinker International currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.