Thrivent Financial for Lutherans lowered its holdings in British American Tobacco p.l.c. (NYSE:BTI - Free Report) by 26.2% in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 17,908 shares of the company's stock after selling 6,354 shares during the period. Thrivent Financial for Lutherans' holdings in British American Tobacco were worth $650,000 as of its most recent filing with the Securities and Exchange Commission.

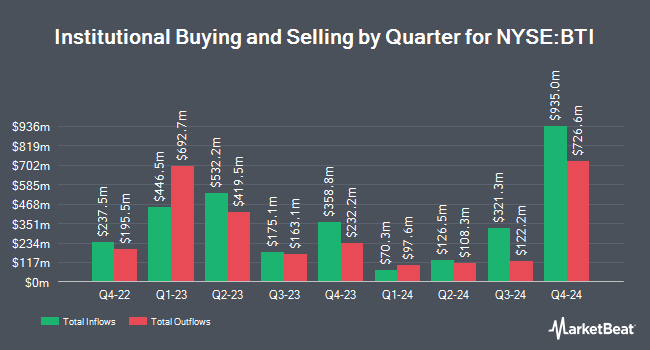

Several other hedge funds and other institutional investors have also recently added to or reduced their stakes in the business. PDS Planning Inc increased its position in shares of British American Tobacco by 5.9% in the fourth quarter. PDS Planning Inc now owns 5,989 shares of the company's stock valued at $218,000 after acquiring an additional 335 shares during the last quarter. Signaturefd LLC grew its stake in British American Tobacco by 6.3% in the fourth quarter. Signaturefd LLC now owns 44,440 shares of the company's stock valued at $1,614,000 after purchasing an additional 2,649 shares in the last quarter. Creative Financial Designs Inc. ADV increased its position in shares of British American Tobacco by 32.7% during the 4th quarter. Creative Financial Designs Inc. ADV now owns 1,650 shares of the company's stock worth $60,000 after purchasing an additional 407 shares during the last quarter. Harbour Investments Inc. boosted its holdings in shares of British American Tobacco by 17.0% in the 4th quarter. Harbour Investments Inc. now owns 2,095 shares of the company's stock valued at $76,000 after buying an additional 305 shares during the last quarter. Finally, one8zero8 LLC bought a new position in shares of British American Tobacco in the fourth quarter valued at $210,000. 16.16% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several analysts have issued reports on BTI shares. StockNews.com raised shares of British American Tobacco from a "hold" rating to a "buy" rating in a research report on Monday, February 17th. UBS Group upgraded shares of British American Tobacco from a "neutral" rating to a "buy" rating in a research note on Monday, January 27th.

View Our Latest Analysis on British American Tobacco

British American Tobacco Stock Performance

BTI traded down $0.41 during trading hours on Monday, reaching $39.45. The company's stock had a trading volume of 8,968,140 shares, compared to its average volume of 4,630,671. The company has a debt-to-equity ratio of 0.65, a quick ratio of 0.58 and a current ratio of 0.76. The company's 50-day moving average is $40.26 and its 200-day moving average is $37.73. British American Tobacco p.l.c. has a 52 week low of $28.25 and a 52 week high of $42.74. The firm has a market cap of $81.72 billion, a PE ratio of 8.10 and a beta of 0.38.

British American Tobacco Announces Dividend

The business also recently announced a dividend, which will be paid on Monday, May 12th. Stockholders of record on Friday, March 28th will be paid a dividend of $0.7491 per share. The ex-dividend date of this dividend is Friday, March 28th. British American Tobacco's dividend payout ratio is presently 60.57%.

British American Tobacco Company Profile

(

Free Report)

British American Tobacco p.l.c. engages in the provision of tobacco and nicotine products to consumers worldwide. It also offers vapour, heated, and modern oral nicotine products; combustible cigarettes; and traditional oral products, such as snus and moist snuff. The company offers its products under the Vuse, glo, Velo, Grizzly, Kodiak, Dunhill, Kent, Lucky Strike, Pall Mall, Rothmans, Camel, Natural American Spirit, Newport, Vogue, Viceroy, Kool, Peter Stuyvesant, Craven A, State Express 555 and Shuang Xi brands.

Read More

Before you consider British American Tobacco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and British American Tobacco wasn't on the list.

While British American Tobacco currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.