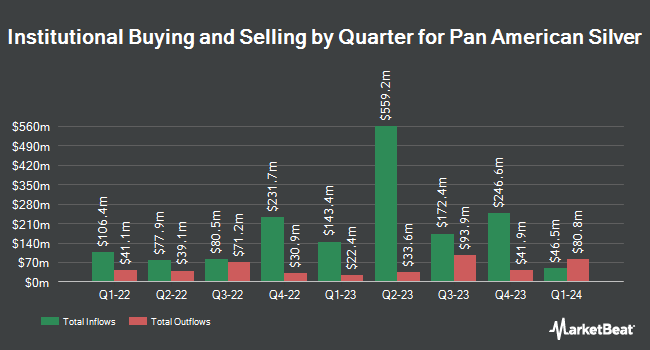

BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp lowered its holdings in Pan American Silver Corp. (NYSE:PAAS - Free Report) TSE: PAAS by 13.7% during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 176,336 shares of the basic materials company's stock after selling 27,954 shares during the quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp's holdings in Pan American Silver were worth $3,682,000 as of its most recent filing with the SEC.

Several other large investors have also recently bought and sold shares of the company. Lighthouse Investment Partners LLC acquired a new position in shares of Pan American Silver in the second quarter valued at approximately $990,000. Point72 Asia Singapore Pte. Ltd. acquired a new stake in Pan American Silver during the second quarter worth about $963,000. Cetera Investment Advisers acquired a new position in shares of Pan American Silver during the 1st quarter worth $1,565,000. Stratos Wealth Advisors LLC lifted its stake in shares of Pan American Silver by 33.4% in the 3rd quarter. Stratos Wealth Advisors LLC now owns 159,268 shares of the basic materials company's stock valued at $3,324,000 after acquiring an additional 39,873 shares during the last quarter. Finally, Janus Henderson Group PLC lifted its holdings in shares of Pan American Silver by 121.6% during the first quarter. Janus Henderson Group PLC now owns 45,279 shares of the basic materials company's stock worth $682,000 after purchasing an additional 24,847 shares during the period. Institutional investors and hedge funds own 55.43% of the company's stock.

Wall Street Analyst Weigh In

A number of research analysts recently weighed in on the company. StockNews.com downgraded Pan American Silver from a "buy" rating to a "hold" rating in a research note on Sunday. Royal Bank of Canada upped their price target on Pan American Silver from $25.00 to $27.00 and gave the company an "outperform" rating in a research report on Tuesday, September 10th. Finally, Jefferies Financial Group lifted their price objective on shares of Pan American Silver from $21.00 to $23.00 and gave the company a "hold" rating in a research note on Friday, October 4th. Two research analysts have rated the stock with a hold rating and four have issued a buy rating to the company. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $25.42.

Read Our Latest Stock Report on PAAS

Pan American Silver Price Performance

Shares of NYSE:PAAS traded up $0.01 during trading on Wednesday, hitting $22.62. 2,251,460 shares of the company's stock were exchanged, compared to its average volume of 4,045,365. The company has a debt-to-equity ratio of 0.16, a current ratio of 2.06 and a quick ratio of 0.96. Pan American Silver Corp. has a 52-week low of $12.16 and a 52-week high of $26.05. The business's 50-day simple moving average is $22.56 and its 200 day simple moving average is $21.51. The company has a market cap of $8.21 billion, a price-to-earnings ratio of -132.94 and a beta of 1.28.

Pan American Silver Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, November 29th. Investors of record on Monday, November 18th were paid a dividend of $0.10 per share. The ex-dividend date was Monday, November 18th. This represents a $0.40 dividend on an annualized basis and a dividend yield of 1.77%. Pan American Silver's payout ratio is -235.29%.

Pan American Silver Profile

(

Free Report)

Pan American Silver Corp. engages in the exploration, mine development, extraction, processing, refining, and reclamation of silver, gold, zinc, lead, and copper mines in Canada, Mexico, Peru, Bolivia, Argentina, Chile, and Brazil. The company was formerly known as Pan American Minerals Corp. and changed its name to Pan American Silver Corp.

Further Reading

Before you consider Pan American Silver, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pan American Silver wasn't on the list.

While Pan American Silver currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.