BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp lessened its stake in shares of AbbVie Inc. (NYSE:ABBV - Free Report) by 13.1% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 294,644 shares of the company's stock after selling 44,511 shares during the period. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp's holdings in AbbVie were worth $58,186,000 at the end of the most recent reporting period.

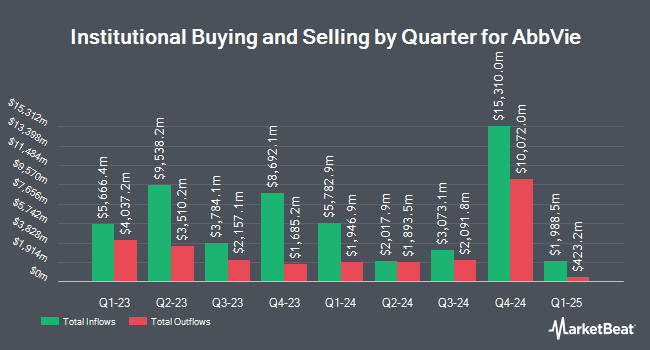

Several other hedge funds have also recently made changes to their positions in ABBV. International Assets Investment Management LLC grew its stake in shares of AbbVie by 1,745.0% during the 3rd quarter. International Assets Investment Management LLC now owns 4,728,063 shares of the company's stock worth $933,698,000 after purchasing an additional 4,471,806 shares during the period. Assenagon Asset Management S.A. lifted its stake in AbbVie by 314.1% in the 2nd quarter. Assenagon Asset Management S.A. now owns 1,315,000 shares of the company's stock valued at $225,549,000 after buying an additional 997,441 shares in the last quarter. Dimensional Fund Advisors LP boosted its stake in shares of AbbVie by 7.6% in the second quarter. Dimensional Fund Advisors LP now owns 8,841,189 shares of the company's stock worth $1,516,358,000 after acquiring an additional 623,569 shares during the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC grew its holdings in shares of AbbVie by 6.1% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 10,175,926 shares of the company's stock worth $2,009,542,000 after buying an additional 582,953 shares in the last quarter. Finally, Saturna Capital Corp increased its holdings in shares of AbbVie by 486.1% in the third quarter. Saturna Capital Corp now owns 676,176 shares of the company's stock valued at $133,531,000 after purchasing an additional 560,808 shares during the last quarter. 70.23% of the stock is owned by institutional investors and hedge funds.

AbbVie Trading Down 0.1 %

Shares of ABBV stock traded down $0.15 on Friday, reaching $182.93. 2,710,732 shares of the stock were exchanged, compared to its average volume of 5,543,668. The firm has a 50 day moving average of $188.23 and a two-hundred day moving average of $181.75. AbbVie Inc. has a 1-year low of $138.01 and a 1-year high of $207.32. The company has a quick ratio of 0.54, a current ratio of 0.65 and a debt-to-equity ratio of 9.64. The stock has a market cap of $323.26 billion, a P/E ratio of 63.52, a price-to-earnings-growth ratio of 2.09 and a beta of 0.63.

AbbVie (NYSE:ABBV - Get Free Report) last posted its earnings results on Wednesday, October 30th. The company reported $3.00 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.92 by $0.08. AbbVie had a return on equity of 244.01% and a net margin of 9.22%. The business had revenue of $14.46 billion during the quarter, compared to analyst estimates of $14.28 billion. During the same quarter last year, the firm earned $2.95 earnings per share. The company's revenue for the quarter was up 3.8% compared to the same quarter last year. On average, research analysts anticipate that AbbVie Inc. will post 10.95 EPS for the current year.

AbbVie Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Friday, February 14th. Investors of record on Wednesday, January 15th will be paid a $1.64 dividend. This represents a $6.56 dividend on an annualized basis and a yield of 3.59%. This is an increase from AbbVie's previous quarterly dividend of $1.55. The ex-dividend date of this dividend is Wednesday, January 15th. AbbVie's dividend payout ratio (DPR) is 227.78%.

Analysts Set New Price Targets

ABBV has been the topic of several recent analyst reports. Truist Financial upped their price target on AbbVie from $210.00 to $215.00 and gave the company a "buy" rating in a research note on Thursday, October 10th. JPMorgan Chase & Co. dropped their price objective on shares of AbbVie from $210.00 to $200.00 and set an "overweight" rating on the stock in a research report on Wednesday, November 13th. William Blair raised shares of AbbVie to a "strong-buy" rating in a research report on Friday, August 30th. Leerink Partners upgraded shares of AbbVie from a "market perform" rating to an "outperform" rating and set a $206.00 price target for the company in a research note on Friday, November 22nd. Finally, Leerink Partnrs upgraded shares of AbbVie from a "hold" rating to a "strong-buy" rating in a research report on Friday, November 22nd. Three investment analysts have rated the stock with a hold rating, eighteen have assigned a buy rating and two have issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $203.50.

Read Our Latest Report on ABBV

AbbVie Profile

(

Free Report)

AbbVie Inc discovers, develops, manufactures, and sells pharmaceuticals worldwide. The company offers Humira, an injection for autoimmune and intestinal Behçet's diseases, and pyoderma gangrenosum; Skyrizi to treat moderate to severe plaque psoriasis, psoriatic disease, and Crohn's disease; Rinvoq to treat rheumatoid and psoriatic arthritis, ankylosing spondylitis, atopic dermatitis, axial spondyloarthropathy, ulcerative colitis, and Crohn's disease; Imbruvica for the treatment of adult patients with blood cancers; Epkinly to treat lymphoma; Elahere to treat cancer; and Venclexta/Venclyxto to treat blood cancers.

See Also

Before you consider AbbVie, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AbbVie wasn't on the list.

While AbbVie currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.