BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp lessened its stake in shares of Omnicom Group Inc. (NYSE:OMC - Free Report) by 12.9% during the 3rd quarter, according to its most recent 13F filing with the SEC. The firm owned 32,674 shares of the business services provider's stock after selling 4,835 shares during the period. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp's holdings in Omnicom Group were worth $3,378,000 at the end of the most recent quarter.

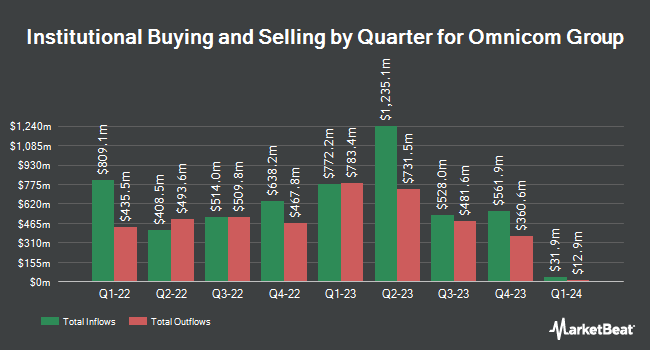

Other hedge funds also recently bought and sold shares of the company. Boston Trust Walden Corp grew its holdings in Omnicom Group by 8.2% in the second quarter. Boston Trust Walden Corp now owns 186,431 shares of the business services provider's stock valued at $16,723,000 after purchasing an additional 14,153 shares during the period. Central Pacific Bank Trust Division grew its position in shares of Omnicom Group by 16.3% during the third quarter. Central Pacific Bank Trust Division now owns 2,856 shares of the business services provider's stock worth $295,000 after buying an additional 401 shares in the last quarter. SG Americas Securities LLC lifted its stake in Omnicom Group by 37.0% during the second quarter. SG Americas Securities LLC now owns 64,481 shares of the business services provider's stock worth $5,784,000 after purchasing an additional 17,414 shares during the last quarter. Assetmark Inc. lifted its stake in Omnicom Group by 2.0% in the third quarter. Assetmark Inc. now owns 489,039 shares of the business services provider's stock valued at $50,562,000 after buying an additional 9,774 shares during the last quarter. Finally, Thrivent Financial for Lutherans lifted its stake in Omnicom Group by 40.9% in the third quarter. Thrivent Financial for Lutherans now owns 29,750 shares of the business services provider's stock valued at $3,077,000 after buying an additional 8,643 shares during the last quarter. Institutional investors own 91.97% of the company's stock.

Wall Street Analyst Weigh In

OMC has been the topic of several research reports. Barclays upped their target price on Omnicom Group from $110.00 to $121.00 and gave the company an "overweight" rating in a report on Thursday, October 17th. Bank of America boosted their price target on Omnicom Group from $87.00 to $89.00 and gave the company an "underperform" rating in a report on Thursday, September 5th. Wells Fargo & Company lowered Omnicom Group from an "overweight" rating to an "equal weight" rating and boosted their price target for the stock from $106.00 to $110.00 in a research report on Wednesday, October 16th. UBS Group boosted their target price on Omnicom Group from $120.00 to $124.00 and gave the stock a "buy" rating in a research report on Wednesday, October 16th. Finally, Macquarie boosted their target price on Omnicom Group from $110.00 to $120.00 and gave the company an "outperform" rating in a research note on Wednesday, October 16th. One research analyst has rated the stock with a sell rating, two have given a hold rating and seven have given a buy rating to the company. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus price target of $110.11.

Read Our Latest Stock Report on Omnicom Group

Omnicom Group Trading Down 0.5 %

OMC traded down $0.53 during trading on Wednesday, reaching $103.27. 949,031 shares of the stock traded hands, compared to its average volume of 1,543,899. The company has a quick ratio of 0.86, a current ratio of 0.98 and a debt-to-equity ratio of 1.37. The stock has a market capitalization of $20.15 billion, a PE ratio of 14.11, a P/E/G ratio of 2.36 and a beta of 0.94. The stock's 50-day moving average is $102.62 and its 200 day moving average is $97.23. Omnicom Group Inc. has a 12 month low of $80.92 and a 12 month high of $107.00.

Omnicom Group (NYSE:OMC - Get Free Report) last posted its earnings results on Tuesday, October 15th. The business services provider reported $2.03 earnings per share for the quarter, topping analysts' consensus estimates of $2.02 by $0.01. The company had revenue of $3.88 billion for the quarter, compared to analyst estimates of $3.79 billion. Omnicom Group had a net margin of 9.45% and a return on equity of 36.59%. During the same quarter in the prior year, the business posted $1.86 EPS. Equities analysts anticipate that Omnicom Group Inc. will post 7.94 earnings per share for the current year.

Insider Buying and Selling

In other news, CAO Andrew Castellaneta sold 4,000 shares of the company's stock in a transaction dated Friday, October 18th. The shares were sold at an average price of $105.29, for a total transaction of $421,160.00. Following the completion of the transaction, the chief accounting officer now directly owns 23,545 shares of the company's stock, valued at approximately $2,479,053.05. This represents a 14.52 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. 1.30% of the stock is owned by insiders.

Omnicom Group Profile

(

Free Report)

Omnicom Group Inc, together with its subsidiaries, offers advertising, marketing, and corporate communications services. It provides a range of services in the areas of advertising and media, precision marketing, commerce and branding, experiential, execution and support, public relations, and healthcare.

Read More

Before you consider Omnicom Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Omnicom Group wasn't on the list.

While Omnicom Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.