Broadridge Financial Solutions (NYSE:BR - Get Free Report) issued an update on its FY 2025 earnings guidance on Thursday morning. The company provided earnings per share (EPS) guidance of 8.350-8.660 for the period, compared to the consensus estimate of 8.500. The company issued revenue guidance of -.

Broadridge Financial Solutions Price Performance

NYSE BR traded down $2.17 during trading on Thursday, hitting $226.84. 77,336 shares of the stock traded hands, compared to its average volume of 517,983. The company has a market capitalization of $26.52 billion, a P/E ratio of 39.62 and a beta of 1.05. The firm has a 50-day simple moving average of $215.21 and a 200-day simple moving average of $207.66. The company has a quick ratio of 1.39, a current ratio of 1.39 and a debt-to-equity ratio of 1.63. Broadridge Financial Solutions has a 12-month low of $180.16 and a 12-month high of $230.00.

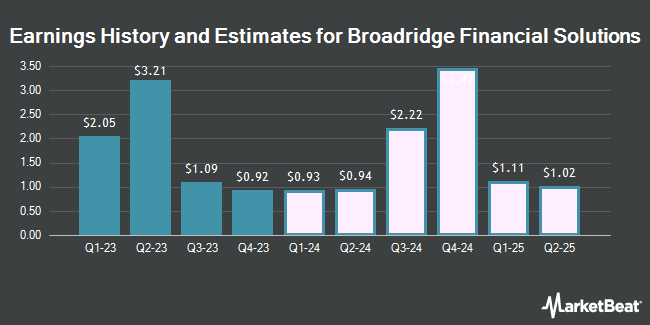

Broadridge Financial Solutions (NYSE:BR - Get Free Report) last posted its quarterly earnings data on Tuesday, November 5th. The business services provider reported $1.00 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.97 by $0.03. The business had revenue of $1.42 billion during the quarter, compared to analyst estimates of $1.48 billion. Broadridge Financial Solutions had a return on equity of 41.79% and a net margin of 10.57%. The company's revenue for the quarter was down .6% on a year-over-year basis. During the same period last year, the company earned $1.09 EPS. As a group, analysts predict that Broadridge Financial Solutions will post 8.53 EPS for the current year.

Wall Street Analyst Weigh In

A number of equities research analysts recently issued reports on the company. Morgan Stanley raised their price target on Broadridge Financial Solutions from $200.00 to $207.00 and gave the stock an "equal weight" rating in a research note on Wednesday, November 6th. StockNews.com lowered Broadridge Financial Solutions from a "buy" rating to a "hold" rating in a research note on Saturday, November 9th. Royal Bank of Canada reaffirmed an "outperform" rating and set a $246.00 target price on shares of Broadridge Financial Solutions in a research report on Wednesday, November 6th. Finally, JPMorgan Chase & Co. increased their price target on Broadridge Financial Solutions from $224.00 to $225.00 and gave the stock a "neutral" rating in a research report on Tuesday, August 20th. Four analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average price target of $217.83.

Check Out Our Latest Analysis on BR

Insider Activity at Broadridge Financial Solutions

In other Broadridge Financial Solutions news, Director Maura A. Markus sold 3,880 shares of the company's stock in a transaction on Monday, November 11th. The shares were sold at an average price of $227.02, for a total transaction of $880,837.60. Following the completion of the transaction, the director now directly owns 27,788 shares in the company, valued at approximately $6,308,431.76. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. In other Broadridge Financial Solutions news, President Christopher John Perry sold 300 shares of the company's stock in a transaction dated Friday, August 16th. The shares were sold at an average price of $210.00, for a total value of $63,000.00. Following the transaction, the president now owns 67,254 shares of the company's stock, valued at $14,123,340. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, Director Maura A. Markus sold 3,880 shares of the company's stock in a transaction dated Monday, November 11th. The shares were sold at an average price of $227.02, for a total transaction of $880,837.60. Following the completion of the transaction, the director now directly owns 27,788 shares in the company, valued at $6,308,431.76. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 140,996 shares of company stock worth $30,073,732 in the last three months. Company insiders own 1.30% of the company's stock.

About Broadridge Financial Solutions

(

Get Free Report)

Broadridge Financial Solutions, Inc provides investor communications and technology-driven solutions for the financial services industry. The company's Investor Communication Solutions segment processes and distributes proxy materials to investors in equity securities and mutual funds, as well as facilitates related vote processing services; and distributes regulatory reports, class action, and corporate action/reorganization event information, as well as tax reporting solutions.

Read More

Before you consider Broadridge Financial Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Broadridge Financial Solutions wasn't on the list.

While Broadridge Financial Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.