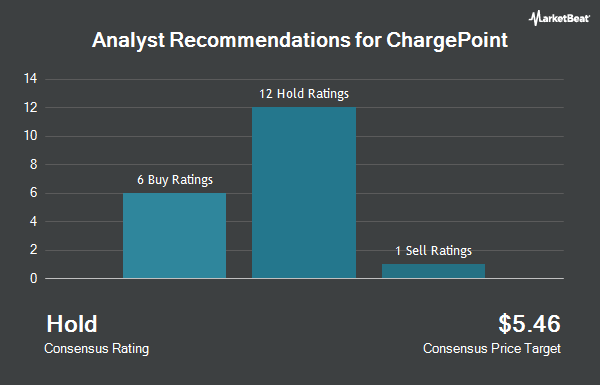

ChargePoint Holdings, Inc. (NYSE:CHPT - Get Free Report) has been assigned a consensus recommendation of "Hold" from the fifteen analysts that are covering the stock, Marketbeat reports. Two investment analysts have rated the stock with a sell rating, nine have given a hold rating, three have assigned a buy rating and one has given a strong buy rating to the company. The average 1-year price target among brokerages that have updated their coverage on the stock in the last year is $2.46.

Several equities research analysts have recently issued reports on CHPT shares. Benchmark reiterated a "buy" rating and set a $3.00 price objective on shares of ChargePoint in a research report on Wednesday, November 20th. Needham & Company LLC reissued a "hold" rating on shares of ChargePoint in a report on Thursday, December 5th. UBS Group reduced their target price on ChargePoint from $1.50 to $1.30 and set a "neutral" rating on the stock in a report on Tuesday, December 10th. Royal Bank of Canada cut their price target on ChargePoint from $2.50 to $2.00 and set a "sector perform" rating for the company in a report on Thursday, December 5th. Finally, Stifel Nicolaus reduced their target price on shares of ChargePoint from $3.00 to $2.00 and set a "hold" rating on the stock in a report on Wednesday, October 30th.

Get Our Latest Analysis on CHPT

Insider Activity

In other ChargePoint news, CAO Henrik Gerdes sold 28,536 shares of ChargePoint stock in a transaction on Monday, December 23rd. The stock was sold at an average price of $1.14, for a total transaction of $32,531.04. Following the completion of the sale, the chief accounting officer now directly owns 362,060 shares of the company's stock, valued at $412,748.40. The trade was a 7.31 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CFO Mansi Khetani sold 22,038 shares of the firm's stock in a transaction dated Monday, December 23rd. The shares were sold at an average price of $1.14, for a total transaction of $25,123.32. Following the transaction, the chief financial officer now directly owns 1,230,305 shares in the company, valued at $1,402,547.70. This trade represents a 1.76 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 87,148 shares of company stock valued at $99,349. 3.50% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently added to or reduced their stakes in CHPT. Financial Advocates Investment Management purchased a new stake in ChargePoint during the 3rd quarter valued at about $29,000. Point72 Asia Singapore Pte. Ltd. grew its stake in shares of ChargePoint by 131.0% during the 3rd quarter. Point72 Asia Singapore Pte. Ltd. now owns 36,628 shares of the company's stock worth $50,000 after purchasing an additional 20,773 shares during the period. Cibc World Markets Corp acquired a new position in shares of ChargePoint in the 4th quarter valued at $40,000. Algert Global LLC purchased a new position in ChargePoint in the second quarter valued at $58,000. Finally, Callan Family Office LLC acquired a new position in shares of ChargePoint in the fourth quarter worth about $45,000. 37.77% of the stock is currently owned by hedge funds and other institutional investors.

ChargePoint Price Performance

CHPT traded up $0.02 on Thursday, hitting $0.70. 64,446,820 shares of the company's stock traded hands, compared to its average volume of 28,696,865. ChargePoint has a one year low of $0.66 and a one year high of $2.44. The company has a current ratio of 1.94, a quick ratio of 1.24 and a debt-to-equity ratio of 1.65. The firm has a market cap of $309.99 million, a price-to-earnings ratio of -0.95 and a beta of 1.70. The company's 50 day simple moving average is $1.09 and its 200-day simple moving average is $1.32.

ChargePoint Company Profile

(

Get Free ReportChargePoint Holdings, Inc, together with its subsidiaries, provides electric vehicle (EV) charging networks and charging solutions in the North America and Europe. The company serves commercial, such as retail, workplace, hospitality, parking, recreation, municipal, education, and highway fast charge; fleet, which include delivery, take home, logistics, motor pool, transit, and shared mobility; and residential including single family homes and multi-family apartments and condominiums customers.

Featured Articles

Before you consider ChargePoint, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ChargePoint wasn't on the list.

While ChargePoint currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.