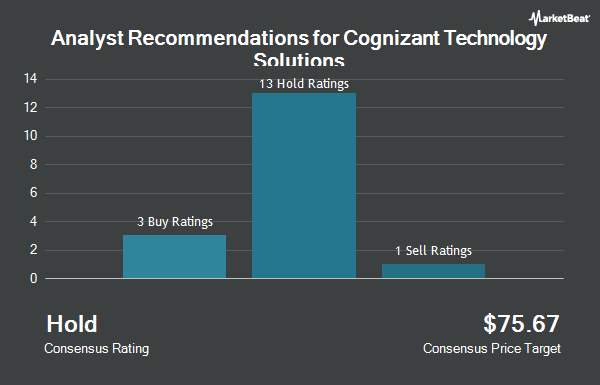

Cognizant Technology Solutions Co. (NASDAQ:CTSH - Get Free Report) has earned an average rating of "Hold" from the twenty brokerages that are currently covering the firm, Marketbeat reports. Sixteen equities research analysts have rated the stock with a hold recommendation and four have assigned a buy recommendation to the company. The average 12-month price target among analysts that have issued a report on the stock in the last year is $83.67.

Several analysts have weighed in on the stock. Royal Bank of Canada boosted their target price on shares of Cognizant Technology Solutions from $82.00 to $93.00 and gave the stock a "sector perform" rating in a research report on Thursday, February 6th. Needham & Company LLC reissued a "hold" rating on shares of Cognizant Technology Solutions in a research report on Thursday, February 6th. BMO Capital Markets lifted their price target on Cognizant Technology Solutions from $88.00 to $94.00 and gave the stock a "market perform" rating in a research report on Thursday, February 6th. StockNews.com raised Cognizant Technology Solutions from a "hold" rating to a "buy" rating in a report on Thursday, February 6th. Finally, Morgan Stanley lifted their target price on Cognizant Technology Solutions from $80.00 to $85.00 and gave the stock an "equal weight" rating in a report on Thursday, February 6th.

Get Our Latest Stock Report on Cognizant Technology Solutions

Hedge Funds Weigh In On Cognizant Technology Solutions

Institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Norges Bank purchased a new stake in shares of Cognizant Technology Solutions in the fourth quarter valued at about $527,719,000. National Bank of Canada FI increased its holdings in shares of Cognizant Technology Solutions by 54.6% during the 4th quarter. National Bank of Canada FI now owns 5,633,987 shares of the information technology service provider's stock worth $433,254,000 after buying an additional 1,990,515 shares during the last quarter. AE Industrial Partners LP purchased a new stake in shares of Cognizant Technology Solutions during the 4th quarter valued at approximately $113,088,000. Capital Research Global Investors grew its position in Cognizant Technology Solutions by 98.9% in the fourth quarter. Capital Research Global Investors now owns 2,742,442 shares of the information technology service provider's stock worth $210,894,000 after acquiring an additional 1,363,570 shares during the period. Finally, Deutsche Bank AG increased its stake in Cognizant Technology Solutions by 47.8% during the fourth quarter. Deutsche Bank AG now owns 3,303,355 shares of the information technology service provider's stock worth $254,028,000 after acquiring an additional 1,068,420 shares during the last quarter. Institutional investors and hedge funds own 92.44% of the company's stock.

Cognizant Technology Solutions Stock Down 1.8 %

Cognizant Technology Solutions stock traded down $1.53 during trading hours on Friday, reaching $82.47. The stock had a trading volume of 4,361,301 shares, compared to its average volume of 3,776,028. The company has a market cap of $40.79 billion, a price-to-earnings ratio of 18.29, a PEG ratio of 2.11 and a beta of 1.12. The business's 50 day moving average price is $82.12 and its 200-day moving average price is $79.34. Cognizant Technology Solutions has a 52 week low of $63.79 and a 52 week high of $90.82. The company has a debt-to-equity ratio of 0.06, a current ratio of 2.09 and a quick ratio of 2.09.

Cognizant Technology Solutions (NASDAQ:CTSH - Get Free Report) last posted its earnings results on Wednesday, February 5th. The information technology service provider reported $1.21 EPS for the quarter, beating analysts' consensus estimates of $1.12 by $0.09. Cognizant Technology Solutions had a net margin of 11.35% and a return on equity of 16.78%. Sell-side analysts anticipate that Cognizant Technology Solutions will post 4.98 EPS for the current year.

Cognizant Technology Solutions Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Wednesday, February 26th. Stockholders of record on Tuesday, February 18th were given a $0.31 dividend. The ex-dividend date was Tuesday, February 18th. This is a positive change from Cognizant Technology Solutions's previous quarterly dividend of $0.30. This represents a $1.24 dividend on an annualized basis and a dividend yield of 1.50%. Cognizant Technology Solutions's dividend payout ratio is 27.49%.

Cognizant Technology Solutions Company Profile

(

Get Free ReportCognizant Technology Solutions Corporation, a professional services company, provides consulting and technology, and outsourcing services in North America, Europe, and internationally. It operates through four segments: Financial Services, Health Sciences, Products and Resources, and Communications, Media and Technology.

Read More

Before you consider Cognizant Technology Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cognizant Technology Solutions wasn't on the list.

While Cognizant Technology Solutions currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.