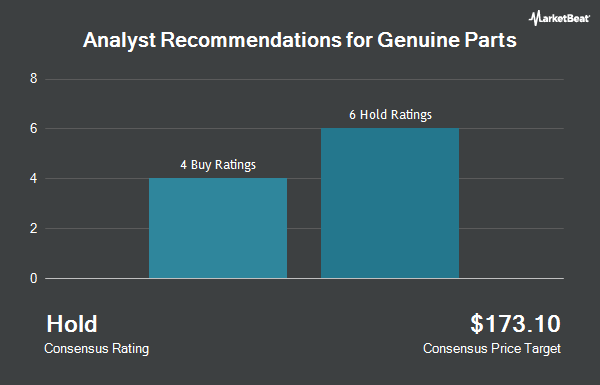

Shares of Genuine Parts (NYSE:GPC - Get Free Report) have been assigned an average rating of "Hold" from the ten analysts that are presently covering the firm, MarketBeat reports. Seven equities research analysts have rated the stock with a hold rating, two have assigned a buy rating and one has given a strong buy rating to the company. The average 12-month price objective among brokerages that have issued ratings on the stock in the last year is $137.63.

Several equities research analysts have recently commented on the company. Truist Financial boosted their price objective on Genuine Parts from $129.00 to $133.00 and gave the company a "buy" rating in a report on Wednesday, February 19th. Loop Capital initiated coverage on shares of Genuine Parts in a report on Thursday, January 16th. They set a "buy" rating and a $155.00 price objective for the company. Northcoast Research lowered shares of Genuine Parts from a "buy" rating to a "neutral" rating in a report on Friday, January 17th. Redburn Atlantic upgraded Genuine Parts to a "hold" rating in a research note on Monday, November 11th. Finally, Evercore ISI lowered their price objective on Genuine Parts from $128.00 to $125.00 and set an "in-line" rating for the company in a research note on Wednesday, February 19th.

View Our Latest Analysis on GPC

Genuine Parts Stock Down 0.9 %

Shares of Genuine Parts stock traded down $1.11 during trading on Tuesday, reaching $123.77. 843,381 shares of the company traded hands, compared to its average volume of 1,583,043. The firm has a market capitalization of $17.18 billion, a PE ratio of 19.14 and a beta of 0.94. Genuine Parts has a 1-year low of $112.74 and a 1-year high of $164.45. The company has a 50 day moving average price of $118.94 and a 200-day moving average price of $126.50. The company has a debt-to-equity ratio of 0.86, a current ratio of 1.16 and a quick ratio of 0.57.

Genuine Parts (NYSE:GPC - Get Free Report) last announced its quarterly earnings data on Tuesday, February 18th. The specialty retailer reported $1.61 earnings per share for the quarter, beating the consensus estimate of $1.54 by $0.07. The firm had revenue of $5.77 billion for the quarter, compared to analyst estimates of $5.71 billion. Genuine Parts had a net margin of 3.85% and a return on equity of 25.28%. During the same quarter in the prior year, the business earned $2.26 earnings per share. As a group, equities research analysts expect that Genuine Parts will post 7.9 earnings per share for the current fiscal year.

Genuine Parts Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, April 2nd. Shareholders of record on Friday, March 7th will be issued a dividend of $1.03 per share. This represents a $4.12 annualized dividend and a yield of 3.33%. This is a positive change from Genuine Parts's previous quarterly dividend of $1.00. The ex-dividend date is Friday, March 7th. Genuine Parts's dividend payout ratio is 63.68%.

Insider Buying and Selling at Genuine Parts

In other news, Director Wendy B. Needham sold 1,608 shares of the business's stock in a transaction that occurred on Friday, December 13th. The shares were sold at an average price of $120.78, for a total value of $194,214.24. Following the sale, the director now owns 11,357 shares of the company's stock, valued at $1,371,698.46. The trade was a 12.40 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Corporate insiders own 0.37% of the company's stock.

Institutional Investors Weigh In On Genuine Parts

Institutional investors have recently made changes to their positions in the stock. Norges Bank bought a new stake in shares of Genuine Parts during the 4th quarter valued at $206,645,000. Junto Capital Management LP bought a new position in Genuine Parts in the 4th quarter worth about $94,868,000. Equity Investment Corp purchased a new stake in Genuine Parts in the fourth quarter valued at approximately $84,128,000. Alyeska Investment Group L.P. raised its position in shares of Genuine Parts by 204.7% during the 4th quarter. Alyeska Investment Group L.P. now owns 789,050 shares of the specialty retailer's stock valued at $92,129,000 after buying an additional 530,057 shares in the last quarter. Finally, Invesco Ltd. lifted its stake in Genuine Parts by 18.9% during the fourth quarter. Invesco Ltd. now owns 3,262,229 shares of the specialty retailer's stock worth $380,898,000 after purchasing an additional 518,851 shares during the last quarter. Hedge funds and other institutional investors own 78.83% of the company's stock.

About Genuine Parts

(

Get Free ReportGenuine Parts Company distributes automotive replacement parts, and industrial parts and materials. It operates in two segments: Automotive Parts Group and Industrial Parts Group segments. The company distributes automotive replacement parts for hybrid and electric vehicles, trucks, SUVs, buses, motorcycles, recreational vehicles, farm vehicles, small engines, farm equipment, marine equipment, and heavy duty equipment; and equipment and parts used by repair shops, service stations, fleet operators, automobile and truck dealers, leasing companies, bus and truck lines, mass merchandisers, farms, and individuals.

Read More

Before you consider Genuine Parts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genuine Parts wasn't on the list.

While Genuine Parts currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.