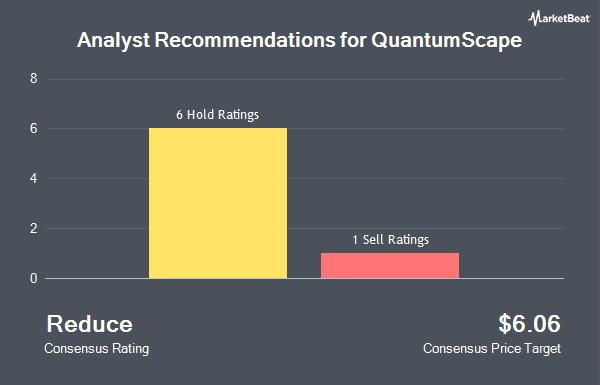

QuantumScape Co. (NYSE:QS - Get Free Report) has earned a consensus rating of "Reduce" from the seven research firms that are covering the stock, MarketBeat Ratings reports. One investment analyst has rated the stock with a sell rating and six have assigned a hold rating to the company. The average twelve-month price objective among brokers that have issued a report on the stock in the last year is $6.26.

A number of research analysts recently weighed in on the stock. Hsbc Global Res upgraded shares of QuantumScape to a "hold" rating in a report on Tuesday, November 19th. Truist Financial restated a "hold" rating and set a $7.00 price objective (up previously from $6.00) on shares of QuantumScape in a report on Friday, October 25th. Finally, HSBC raised shares of QuantumScape from a "reduce" rating to a "hold" rating and set a $5.30 price objective for the company in a research report on Tuesday, November 19th.

View Our Latest Stock Analysis on QS

QuantumScape Price Performance

Shares of QuantumScape stock traded down $0.08 on Thursday, hitting $5.00. 8,100,296 shares of the company were exchanged, compared to its average volume of 15,740,958. The stock has a market capitalization of $2.56 billion, a price-to-earnings ratio of -5.26 and a beta of 4.45. The company has a quick ratio of 14.07, a current ratio of 14.07 and a debt-to-equity ratio of 0.03. QuantumScape has a 1-year low of $4.65 and a 1-year high of $9.52. The company has a 50-day moving average price of $5.28 and a 200 day moving average price of $5.54.

Insiders Place Their Bets

In other news, insider Michael O. Mccarthy III sold 27,305 shares of the company's stock in a transaction dated Thursday, November 21st. The stock was sold at an average price of $5.07, for a total transaction of $138,436.35. Following the completion of the sale, the insider now owns 1,129,167 shares in the company, valued at approximately $5,724,876.69. This represents a 2.36 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, Director Jagdeep Singh sold 308,097 shares of the business's stock in a transaction dated Monday, December 9th. The stock was sold at an average price of $5.30, for a total value of $1,632,914.10. Following the transaction, the director now directly owns 2,563,767 shares of the company's stock, valued at $13,587,965.10. This represents a 10.73 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 573,409 shares of company stock worth $3,090,581. Company insiders own 12.03% of the company's stock.

Institutional Investors Weigh In On QuantumScape

Several large investors have recently made changes to their positions in QS. Norden Group LLC acquired a new position in shares of QuantumScape during the 4th quarter worth approximately $143,000. SVB Wealth LLC bought a new stake in QuantumScape during the fourth quarter worth $67,000. Towerview LLC lifted its stake in QuantumScape by 11.1% in the fourth quarter. Towerview LLC now owns 100,000 shares of the company's stock valued at $519,000 after acquiring an additional 10,000 shares during the last quarter. Y Intercept Hong Kong Ltd bought a new position in shares of QuantumScape in the 4th quarter valued at about $1,275,000. Finally, Birchcreek Wealth Management LLC increased its stake in shares of QuantumScape by 13.6% during the 4th quarter. Birchcreek Wealth Management LLC now owns 22,583 shares of the company's stock worth $117,000 after purchasing an additional 2,700 shares during the last quarter. Institutional investors own 29.87% of the company's stock.

QuantumScape Company Profile

(

Get Free ReportQuantumScape Corporation, a research and development stage company, focuses on the development and commercialization of solid-state lithium-metal batteries for electric vehicles and other applications. The company was founded in 2010 and is headquartered in San Jose, California.

Recommended Stories

Before you consider QuantumScape, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and QuantumScape wasn't on the list.

While QuantumScape currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.