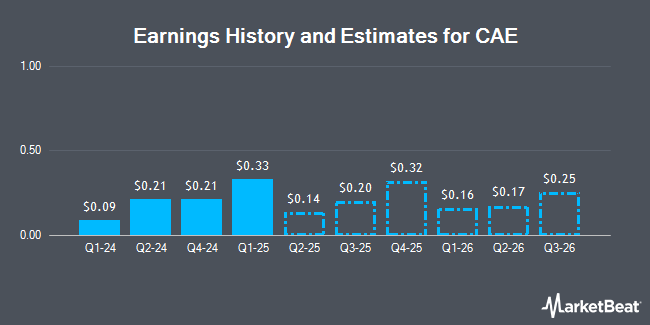

CAE Inc. (NYSE:CAE - Free Report) TSE: CAE - Stock analysts at Desjardins raised their FY2025 EPS estimates for shares of CAE in a report released on Wednesday, November 13th. Desjardins analyst B. Poirier now anticipates that the aerospace company will earn $0.86 per share for the year, up from their prior forecast of $0.82. The consensus estimate for CAE's current full-year earnings is $0.85 per share. Desjardins also issued estimates for CAE's FY2027 earnings at $1.14 EPS.

CAE (NYSE:CAE - Get Free Report) TSE: CAE last released its quarterly earnings results on Tuesday, August 13th. The aerospace company reported $0.21 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.20 by $0.01. The firm had revenue of $1.07 billion for the quarter, compared to analyst estimates of $1.05 billion. CAE had a positive return on equity of 5.79% and a negative net margin of 7.49%. The business's revenue was up 6.0% on a year-over-year basis. During the same quarter last year, the company posted $0.18 earnings per share.

Several other brokerages also recently weighed in on CAE. Royal Bank of Canada raised CAE from a "hold" rating to a "moderate buy" rating in a report on Thursday, August 15th. Morgan Stanley downgraded shares of CAE from an "overweight" rating to an "equal weight" rating in a report on Friday, August 16th. Finally, StockNews.com raised shares of CAE from a "hold" rating to a "buy" rating in a report on Thursday. One equities research analyst has rated the stock with a sell rating, six have issued a hold rating and two have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average target price of $28.00.

Check Out Our Latest Analysis on CAE

CAE Stock Down 1.1 %

CAE stock traded down $0.24 during mid-day trading on Friday, reaching $21.75. 629,753 shares of the company were exchanged, compared to its average volume of 592,390. The company has a quick ratio of 0.61, a current ratio of 0.84 and a debt-to-equity ratio of 0.62. The firm's 50-day simple moving average is $18.52 and its two-hundred day simple moving average is $18.57. CAE has a twelve month low of $15.95 and a twelve month high of $22.11.

Institutional Inflows and Outflows

Hedge funds have recently added to or reduced their stakes in the stock. Mitsubishi UFJ Trust & Banking Corp increased its position in shares of CAE by 86.2% in the first quarter. Mitsubishi UFJ Trust & Banking Corp now owns 2,376 shares of the aerospace company's stock valued at $48,000 after buying an additional 1,100 shares in the last quarter. Intech Investment Management LLC acquired a new position in CAE during the first quarter worth about $305,000. Vanguard Group Inc. grew its position in shares of CAE by 1.2% in the first quarter. Vanguard Group Inc. now owns 10,832,988 shares of the aerospace company's stock valued at $223,593,000 after purchasing an additional 127,504 shares during the last quarter. Clearbridge Investments LLC increased its stake in shares of CAE by 17.1% during the 1st quarter. Clearbridge Investments LLC now owns 3,710,044 shares of the aerospace company's stock worth $76,575,000 after purchasing an additional 541,066 shares in the last quarter. Finally, UniSuper Management Pty Ltd raised its position in shares of CAE by 104.5% during the 1st quarter. UniSuper Management Pty Ltd now owns 4,500 shares of the aerospace company's stock worth $93,000 after purchasing an additional 2,300 shares during the last quarter. 67.36% of the stock is owned by hedge funds and other institutional investors.

About CAE

(

Get Free Report)

CAE Inc, together with its subsidiaries, provides simulation training and critical operations support solutions in Canada, the United States, the United Kingdom, Europe, Asia, the Oceania, Africa, and Rest of the Americas. It operates through two segments, Civil Aviation; and Defense and Security. The Civil Aviation segment offers training solutions for flight, cabin, maintenance, and ground personnel in commercial, business, and helicopter aviation; a range of flight simulation training devices; and ab initio pilot training and crew sourcing services, as well as aircraft flight operations solutions.

Recommended Stories

Before you consider CAE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CAE wasn't on the list.

While CAE currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.