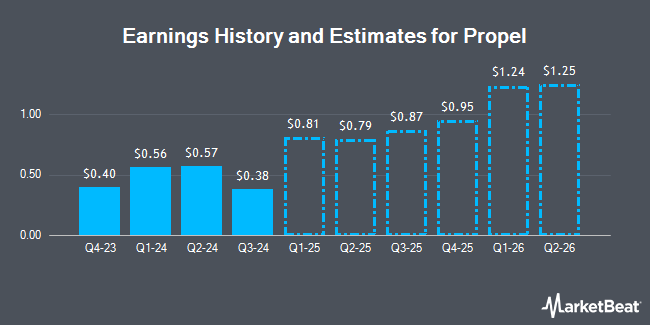

Propel Holdings Inc. (TSE:PRL - Free Report) - Equities researchers at Ventum Cap Mkts decreased their Q1 2025 earnings per share estimates for Propel in a report released on Thursday, April 24th. Ventum Cap Mkts analyst R. Goff now anticipates that the company will earn $0.67 per share for the quarter, down from their prior forecast of $0.69. The consensus estimate for Propel's current full-year earnings is $5.39 per share. Ventum Cap Mkts also issued estimates for Propel's Q2 2025 earnings at $0.76 EPS.

Several other equities research analysts also recently issued reports on the company. Scotiabank lowered their price target on Propel from C$44.00 to C$38.00 and set an "outperform" rating on the stock in a research report on Thursday. Raymond James reduced their price objective on Propel from C$52.00 to C$44.00 and set an "outperform" rating for the company in a research report on Thursday, March 13th. Three equities research analysts have rated the stock with a buy rating and three have given a strong buy rating to the stock. According to data from MarketBeat.com, Propel currently has a consensus rating of "Strong Buy" and an average target price of $41.25.

Check Out Our Latest Report on Propel

Propel Price Performance

Shares of TSE PRL traded down $0.03 during trading hours on Friday, hitting $26.71. 110,533 shares of the stock were exchanged, compared to its average volume of 208,149. The firm has a market capitalization of $743.63 million, a P/E ratio of 16.52 and a beta of 1.75. Propel has a one year low of $19.91 and a one year high of $43.36. The company's 50 day moving average is $25.28 and its 200 day moving average is $32.57.

Propel Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Wednesday, March 5th. Stockholders of record on Wednesday, March 5th were given a dividend of $0.66 per share. The ex-dividend date of this dividend was Wednesday, February 19th. This is a boost from Propel's previous quarterly dividend of $0.15. This represents a $2.64 dividend on an annualized basis and a dividend yield of 9.88%. Propel's payout ratio is currently 34.64%.

About Propel

(

Get Free Report)

Propel Holdings Inc is a financial technology company committed to credit inclusion and helping underserved consumers by providing fair, fast, and transparent access to credit. It operates through its two brands: MoneyKey and CreditFresh. The company, through its MoneyKey brand, is a state-licensed direct lender and offers either Installment Loans or Lines of Credit to new customers in several US states.

Recommended Stories

Before you consider Propel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Propel wasn't on the list.

While Propel currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.