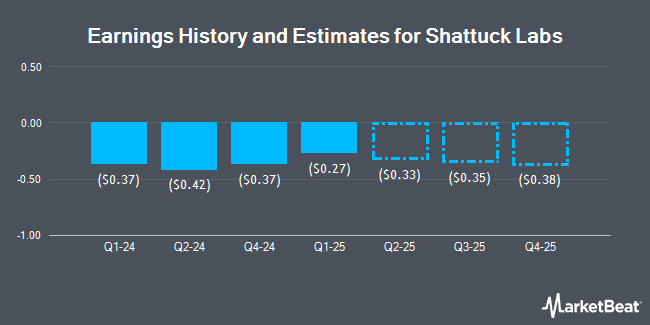

Shattuck Labs, Inc. (NASDAQ:STTK - Free Report) - HC Wainwright issued their Q1 2025 EPS estimates for shares of Shattuck Labs in a report released on Thursday, March 27th. HC Wainwright analyst J. Pantginis expects that the company will post earnings of ($0.40) per share for the quarter. HC Wainwright has a "Neutral" rating on the stock. The consensus estimate for Shattuck Labs' current full-year earnings is ($1.48) per share. HC Wainwright also issued estimates for Shattuck Labs' Q2 2025 earnings at ($0.42) EPS, Q3 2025 earnings at ($0.46) EPS, Q4 2025 earnings at ($0.50) EPS, FY2025 earnings at ($1.51) EPS, FY2026 earnings at ($1.46) EPS, FY2027 earnings at ($1.67) EPS and FY2028 earnings at ($2.00) EPS.

STTK has been the subject of several other research reports. Needham & Company LLC reaffirmed a "hold" rating on shares of Shattuck Labs in a report on Thursday, March 27th. Leerink Partners assumed coverage on shares of Shattuck Labs in a research note on Monday, March 17th. They issued an "outperform" rating and a $4.00 price target for the company. Finally, Leerink Partnrs upgraded shares of Shattuck Labs to a "strong-buy" rating in a research note on Monday, March 17th. Four investment analysts have rated the stock with a hold rating, one has assigned a buy rating and two have issued a strong buy rating to the company. According to data from MarketBeat, Shattuck Labs presently has a consensus rating of "Moderate Buy" and an average target price of $7.50.

View Our Latest Report on Shattuck Labs

Shattuck Labs Stock Performance

Shares of NASDAQ:STTK traded down $0.17 on Monday, hitting $0.81. The company's stock had a trading volume of 97,539 shares, compared to its average volume of 376,261. The company has a market capitalization of $38.81 million, a price-to-earnings ratio of -0.53 and a beta of 1.66. Shattuck Labs has a 12 month low of $0.81 and a 12 month high of $11.76. The stock's 50-day moving average is $1.23 and its two-hundred day moving average is $1.41.

Shattuck Labs (NASDAQ:STTK - Get Free Report) last issued its quarterly earnings data on Thursday, March 27th. The company reported ($0.37) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.38) by $0.01. Shattuck Labs had a negative return on equity of 61.92% and a negative net margin of 1,156.46%.

Hedge Funds Weigh In On Shattuck Labs

Several large investors have recently made changes to their positions in the business. Zacks Investment Management acquired a new stake in Shattuck Labs during the fourth quarter valued at approximately $25,000. Virtu Financial LLC bought a new position in shares of Shattuck Labs in the fourth quarter valued at $30,000. Atom Investors LP acquired a new stake in shares of Shattuck Labs during the 3rd quarter valued at $35,000. Readystate Asset Management LP bought a new stake in shares of Shattuck Labs during the 3rd quarter worth $39,000. Finally, Schonfeld Strategic Advisors LLC acquired a new position in shares of Shattuck Labs in the 4th quarter worth $45,000. Institutional investors own 58.74% of the company's stock.

Shattuck Labs Company Profile

(

Get Free Report)

Shattuck Labs, Inc, a clinical-stage biotechnology company, develops therapeutics for the treatment of cancer and autoimmune disease in the United States. The company's lead product candidate is SL-172154, which is in Phase 1 clinical trial for the treatment of ovarian, fallopian tube, and peritoneal cancers.

Featured Articles

Before you consider Shattuck Labs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shattuck Labs wasn't on the list.

While Shattuck Labs currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.