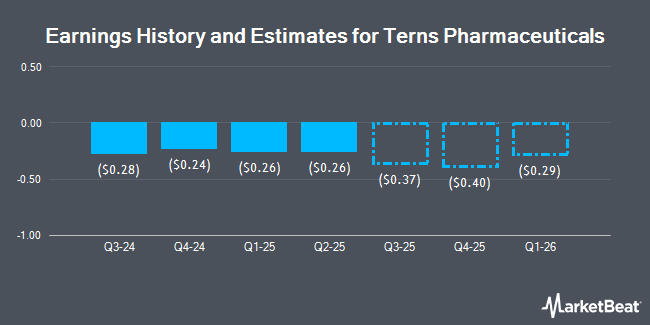

Terns Pharmaceuticals, Inc. (NASDAQ:TERN - Free Report) - Equities research analysts at HC Wainwright issued their Q1 2025 earnings per share (EPS) estimates for Terns Pharmaceuticals in a report issued on Wednesday, November 13th. HC Wainwright analyst E. Arce forecasts that the company will post earnings per share of ($0.30) for the quarter. HC Wainwright currently has a "Neutral" rating and a $7.50 target price on the stock. The consensus estimate for Terns Pharmaceuticals' current full-year earnings is ($1.28) per share.

Several other analysts also recently commented on the company. BMO Capital Markets reiterated an "outperform" rating and set a $26.00 target price (up from $19.00) on shares of Terns Pharmaceuticals in a research note on Monday, September 16th. JMP Securities boosted their target price on Terns Pharmaceuticals from $15.00 to $20.00 and gave the stock a "market outperform" rating in a research report on Tuesday, September 10th. Finally, Oppenheimer started coverage on shares of Terns Pharmaceuticals in a report on Thursday, October 31st. They issued an "outperform" rating and a $82.00 target price on the stock. One analyst has rated the stock with a hold rating and five have issued a buy rating to the company. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average price target of $27.25.

View Our Latest Research Report on Terns Pharmaceuticals

Terns Pharmaceuticals Stock Down 3.4 %

Terns Pharmaceuticals stock traded down $0.23 during trading hours on Thursday, hitting $6.55. The stock had a trading volume of 820,792 shares, compared to its average volume of 1,279,998. The stock has a market capitalization of $460.73 million, a P/E ratio of -5.75 and a beta of -0.32. The stock's 50-day moving average price is $8.08 and its 200-day moving average price is $7.46. Terns Pharmaceuticals has a 12-month low of $3.51 and a 12-month high of $11.40.

Institutional Investors Weigh In On Terns Pharmaceuticals

Several institutional investors have recently made changes to their positions in the company. Janus Henderson Group PLC raised its position in Terns Pharmaceuticals by 40.6% in the 1st quarter. Janus Henderson Group PLC now owns 2,003,263 shares of the company's stock worth $13,131,000 after purchasing an additional 578,500 shares during the period. Bank of New York Mellon Corp boosted its holdings in Terns Pharmaceuticals by 56.8% during the 2nd quarter. Bank of New York Mellon Corp now owns 176,673 shares of the company's stock valued at $1,203,000 after acquiring an additional 64,018 shares during the period. Russell Investments Group Ltd. grew its position in Terns Pharmaceuticals by 127.9% in the 1st quarter. Russell Investments Group Ltd. now owns 632,965 shares of the company's stock valued at $4,152,000 after acquiring an additional 355,224 shares during the last quarter. Point72 Asset Management L.P. increased its stake in Terns Pharmaceuticals by 21.1% in the second quarter. Point72 Asset Management L.P. now owns 2,690,376 shares of the company's stock worth $18,321,000 after purchasing an additional 469,176 shares during the period. Finally, Vanguard Group Inc. lifted its position in shares of Terns Pharmaceuticals by 0.5% during the first quarter. Vanguard Group Inc. now owns 2,199,006 shares of the company's stock worth $14,425,000 after purchasing an additional 11,535 shares during the last quarter. Institutional investors own 98.26% of the company's stock.

Insiders Place Their Bets

In other news, CFO Mark J. Vignola sold 10,000 shares of the firm's stock in a transaction that occurred on Tuesday, September 10th. The stock was sold at an average price of $11.00, for a total value of $110,000.00. Following the completion of the sale, the chief financial officer now directly owns 91,940 shares of the company's stock, valued at $1,011,340. This trade represents a 9.81 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Director Hongbo Lu bought 476,190 shares of the company's stock in a transaction dated Thursday, September 12th. The stock was bought at an average price of $10.50 per share, with a total value of $4,999,995.00. Following the acquisition, the director now owns 476,190 shares in the company, valued at approximately $4,999,995. This trade represents a ∞ increase in their position. The disclosure for this purchase can be found here. 15.10% of the stock is owned by company insiders.

About Terns Pharmaceuticals

(

Get Free Report)

Terns Pharmaceuticals, Inc, a clinical-stage biopharmaceutical company, develops small-molecule product candidates for the treatment of oncology, metabolic dysfunction-associated steatohepatitis (MASH), and obesity. The company develops TERN-701, an allosteric BCR-ABL tyrosine kinase inhibitor (TKI) that is in phase 1 clinical trial for chronic myeloid leukemia (CML), a form of cancer that starts in bone marrow.

Featured Articles

Before you consider Terns Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Terns Pharmaceuticals wasn't on the list.

While Terns Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.