Dollarama Inc. (TSE:DOL - Free Report) - Research analysts at National Bank Financial dropped their FY2027 EPS estimates for shares of Dollarama in a report issued on Wednesday, December 4th. National Bank Financial analyst V. Shreedhar now expects that the company will post earnings per share of $4.95 for the year, down from their prior estimate of $4.96. National Bank Financial currently has a "Hold" rating on the stock. The consensus estimate for Dollarama's current full-year earnings is $5.33 per share.

Other research analysts have also recently issued reports about the stock. Desjardins raised their price objective on shares of Dollarama from C$147.00 to C$150.00 and gave the stock a "buy" rating in a research note on Tuesday, December 3rd. Royal Bank of Canada dropped their price objective on shares of Dollarama from C$160.00 to C$159.00 in a research note on Thursday. National Bankshares cut shares of Dollarama from an "outperform" rating to a "sector perform" rating in a research note on Thursday. TD Securities lifted their target price on shares of Dollarama from C$154.00 to C$160.00 in a research note on Thursday. Finally, Canaccord Genuity Group lifted their target price on shares of Dollarama from C$138.00 to C$140.00 and gave the stock a "hold" rating in a research note on Thursday, November 28th. Seven equities research analysts have rated the stock with a hold rating and five have assigned a buy rating to the company's stock. According to data from MarketBeat, the company has an average rating of "Hold" and an average price target of C$145.00.

Get Our Latest Analysis on DOL

Dollarama Price Performance

Shares of DOL traded down C$1.91 during mid-day trading on Monday, reaching C$140.13. 1,032,557 shares of the company's stock were exchanged, compared to its average volume of 581,951. The company has a quick ratio of 0.08, a current ratio of 1.99 and a debt-to-equity ratio of 391.24. The company has a 50-day simple moving average of C$144.14 and a two-hundred day simple moving average of C$134.49. Dollarama has a 52-week low of C$89.93 and a 52-week high of C$152.97. The company has a market cap of C$39.49 billion, a price-to-earnings ratio of 36.80, a PEG ratio of 1.93 and a beta of 0.56.

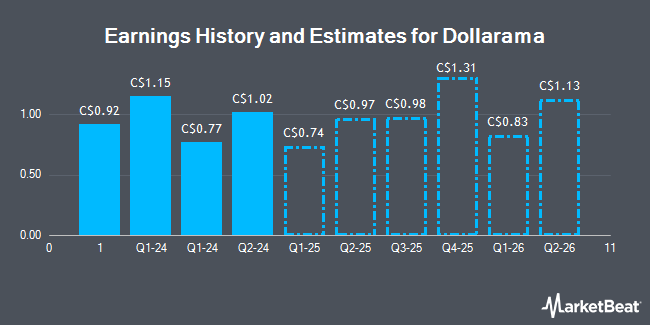

Dollarama (TSE:DOL - Get Free Report) last issued its quarterly earnings data on Wednesday, September 11th. The company reported C$1.02 earnings per share for the quarter, topping analysts' consensus estimates of C$0.96 by C$0.06. Dollarama had a net margin of 17.85% and a return on equity of 156.46%. The business had revenue of C$1.56 billion during the quarter, compared to analysts' expectations of C$1.57 billion.

Insider Buying and Selling

In related news, Senior Officer Mark Di Pesa sold 530 shares of the company's stock in a transaction on Friday, October 11th. The shares were sold at an average price of C$143.47, for a total transaction of C$76,039.10. Also, Director Nicolas Hien sold 5,167 shares of the company's stock in a transaction on Tuesday, September 17th. The stock was sold at an average price of C$135.18, for a total transaction of C$698,490.04. In the last ninety days, insiders have sold 7,697 shares of company stock valued at $1,049,979. 2.23% of the stock is currently owned by company insiders.

Dollarama Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, November 1st. Investors of record on Friday, November 1st were given a $0.092 dividend. This represents a $0.37 annualized dividend and a dividend yield of 0.26%. The ex-dividend date of this dividend was Friday, October 4th. Dollarama's dividend payout ratio (DPR) is currently 9.59%.

Dollarama Company Profile

(

Get Free Report)

Dollarama Inc operates a chain of dollar stores in Canada. Its stores offer general merchandise, consumables, and seasonal products. It also sells its products through online store. The company was formerly known as Dollarama Capital Corporation and changed its name to Dollarama Inc in September 2009.

Featured Articles

Before you consider Dollarama, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dollarama wasn't on the list.

While Dollarama currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.