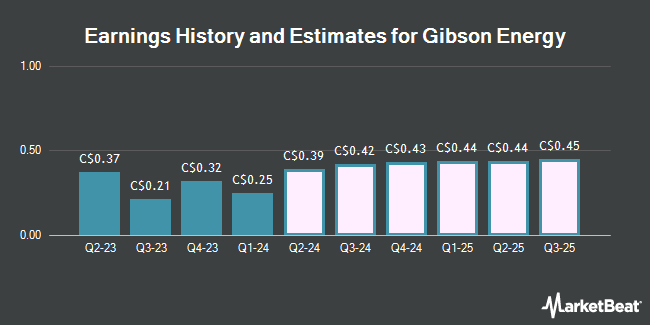

Gibson Energy Inc. (TSE:GEI - Free Report) - Investment analysts at Atb Cap Markets decreased their FY2024 earnings estimates for shares of Gibson Energy in a research note issued to investors on Thursday, February 6th. Atb Cap Markets analyst N. Heywood now anticipates that the company will earn $1.29 per share for the year, down from their prior forecast of $1.30. Atb Cap Markets also issued estimates for Gibson Energy's Q4 2024 earnings at $0.33 EPS.

A number of other equities analysts have also weighed in on GEI. Raymond James upped their target price on shares of Gibson Energy from C$28.50 to C$30.00 in a research note on Thursday, December 5th. CIBC increased their price target on shares of Gibson Energy from C$27.00 to C$29.00 in a report on Thursday, December 5th. BMO Capital Markets raised shares of Gibson Energy from a "market perform" rating to an "outperform" rating and increased their price target for the company from C$25.50 to C$28.00 in a report on Thursday, December 5th. Scotiabank increased their price target on shares of Gibson Energy from C$26.00 to C$27.00 and gave the company an "outperform" rating in a report on Thursday. Finally, Jefferies Financial Group cut shares of Gibson Energy from a "buy" rating to a "hold" rating in a report on Thursday, January 30th. Three equities research analysts have rated the stock with a hold rating, six have given a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of C$27.00.

Check Out Our Latest Stock Analysis on GEI

Gibson Energy Trading Up 0.3 %

Shares of GEI traded up C$0.08 during trading hours on Monday, reaching C$23.95. The stock had a trading volume of 489,506 shares, compared to its average volume of 646,579. The company has a quick ratio of 0.87, a current ratio of 0.70 and a debt-to-equity ratio of 278.33. Gibson Energy has a 52 week low of C$20.42 and a 52 week high of C$26.10. The firm has a 50-day moving average of C$24.87 and a 200 day moving average of C$23.41. The company has a market cap of C$3.91 billion, a P/E ratio of 18.47, a P/E/G ratio of 1.85 and a beta of 1.25.

Insider Transactions at Gibson Energy

In other news, Director Curtis Philippon purchased 40,000 shares of the business's stock in a transaction that occurred on Monday, December 9th. The shares were acquired at an average cost of C$25.46 per share, for a total transaction of C$1,018,400.00. Also, Senior Officer Kelly Holtby bought 2,010 shares of the company's stock in a transaction on Monday, December 30th. The stock was bought at an average price of C$24.85 per share, for a total transaction of C$49,948.50. 0.85% of the stock is owned by company insiders.

About Gibson Energy

(

Get Free Report)

Gibson Energy Inc, together with its subsidiaries, engages in the gathering, storage, optimization, processing, and marketing of liquids and refined products in Canada and the United States. It operates through Infrastructure and Marketing segments. The Infrastructure segment operates a network of liquid infrastructure assets that include oil terminals, rail loading and unloading facilities, gathering pipelines, a crude oil processing facility, and other terminals.

Recommended Stories

Before you consider Gibson Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gibson Energy wasn't on the list.

While Gibson Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.